Wine Business to Web of Fraud: Thane Family’s ₹19.46 Crore Battle Reaches Police

• FIR Reveals Massive Fraud: Thane Family Accused of Siphoning ₹19.46 Crore

• Partnership Deeds to Police Case: The Unraveling of a Thane Family’s Business Empire

• The Core Allegation: A Three-Decade Partnership Sours

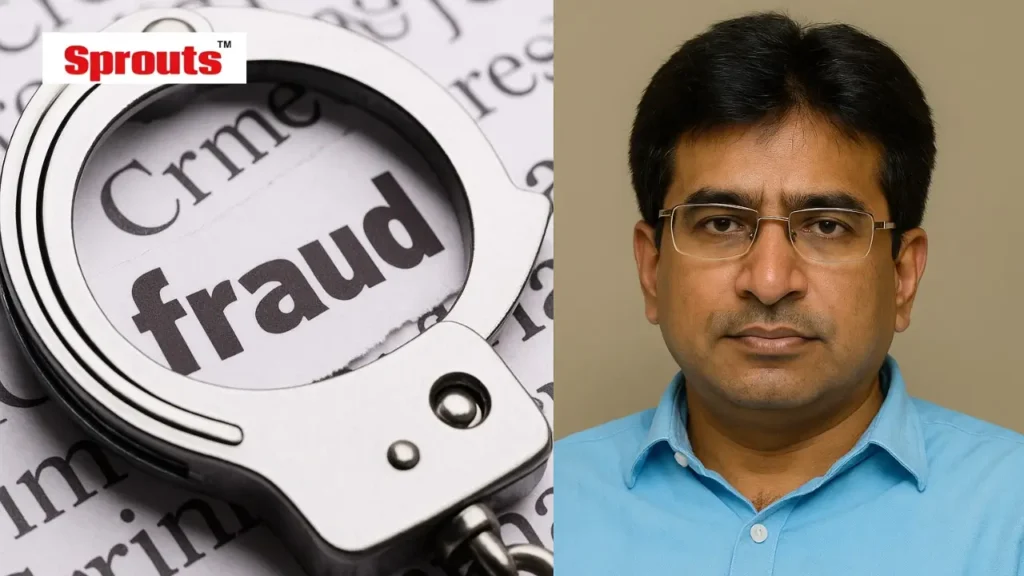

A three-decade-old Thane wine business has spiralled into a ₹19.46 crore financial fraud case, now under active police investigation. Ramesh Vasu Kishnani has filed an FIR accusing Pradeep Vashumal Kishnani and Neha Pradeep Kishnani of siphoning funds, forging partnership deeds, and manipulating accounts over years. Registered at Ulhasnagar police station on November 12, 2025, the complaint cites multiple serious BNS sections, exposing a deep rupture in the family’s long-standing business empire.

- Wine Business to Web of Fraud: Thane Family’s ₹19.46 Crore Battle Reaches Police

- • FIR Reveals Massive Fraud: Thane Family Accused of Siphoning ₹19.46 Crore

- • Partnership Deeds to Police Case: The Unraveling of a Thane Family’s Business Empire

- • The Core Allegation: A Three-Decade Partnership Sours

- Thane Family Business Erupts in Massive ₹19.46 Crore Financial Fraud Case

- The Heart of the Partnership Dispute and Financial Allegations

- Deepening Crisis: Forgery and Police Investigation

- Broader Implications for Family Business Governance

Click Here To Download the News Attachment

Thane Family Business Erupts in Massive ₹19.46 Crore Financial Fraud Case

A three-decade-old Thane family dispute has exploded into a major financial fraud case. Ramesh Vasu Kishnani filed an FIR alleging massive financial manipulation within the family’s wine business. The complaint targets fraud Pradeep Vashumal Kishnani and Neha Pradeep Kishnani as the primary accused. This Sprouts News investigation delves into the intricate details of this complex partnership dispute.

The First Information Report was registered at Ulhasnagar police station on November 12, 2025. It invokes serious sections of the Bharatiya Nyaya Sanhita (BNS). These include sections 318, 316, 338, 340, and 5(5). The allegations range from theft and dishonesty to document forgery.

To view the FIR copy – click here

The Heart of the Partnership Dispute and Financial Allegations

The core of this financial fraud case revolves around M/s Pinkku Traders. This entity operated the retail outlet Best Wine Seller since 1995-96. The business represented a long-standing family enterprise now mired in controversy.

Partnership deeds were repeatedly reconstituted over two decades. Key changes occurred in 1998, 2012, 2014, 2016, and 2019. The complainant alleges his share was altered without his knowledge or consent. This pattern suggests a systematic dilution of his financial stake.

Substantial financial transactions are now under police scrutiny. The FIR specifically mentions transactions worth ₹50 lakh and ₹1 crore. It also details larger transfers of ₹2 crore and ₹2.5 crore. These funds moved through Punjab National Bank and Syndicate Bank accounts.

The most staggering allegation involves a massive missing share. The complainant claims ₹19.46 crore of his capital and profit share is unaccounted for. This forms the central financial fraud accusation in this complex case.

Also Read: Maharashtra Land Grab: Mumbai’s Public Assets Under Threat.

Deepening Crisis: Forgery and Police Investigation

The situation intensified after a key partner’s demise in 2019. Vashumal Narayandas Kishnani’s death preceded major partnership changes. The complainant alleges these post-2019 adjustments were completely unauthorized.

Further accusations include creating fake partnership deeds. The complainant’s name was allegedly removed from official documents. Profit statements were also allegedly manipulated to hide financial discrepancies.

Ulhasnagar police have launched a comprehensive investigation under PI Shankar Waman Avatade. The probe will examine financial records dating back to 1995. This includes all partnership documents and bank statements from involved banks.

Broader Implications for Family Business Governance

This Thane financial fraud case highlights critical vulnerabilities. Family-run businesses often lack transparent financial governance. This case demonstrates how informal agreements can fuel major disputes.

The allegations of fake deeds and fund diversion serve as a cautionary tale. Proper audits and professional management are essential, even within families. This case could inspire stricter financial oversight in similar businesses.

The Kishnani family dispute shows how partnerships can evolve into serious financial crimes. It underscores that trust cannot replace transparent business practices. The Ulhasnagar police investigation will be complex and document-heavy.

Legal experts suggest the BNS sections applied indicate a strong case. The outcome will depend on forensic accounting and documentary evidence. This financial fraud case could set precedents for similar partnership disputes.

Sprouts News will continue to monitor the police investigation’s progress. We will provide updates on any arrests or major developments in this case. The spotlight remains on Thane’s unfolding financial and legal drama.