NRI Investment Fraud Exposed: The ₹20,000 Crore Corporate Scam

• Unmesh Gujarathi Exposes Devang Patel’s Multi-State Corporate Fraud

• TechCloud ERP Fraud: Inside the ₹20,000 Crore Fake IPO Scandal

• The Human Cost: Unpaid Salaries and Nationwide Office Closures

A ₹20,000 crore NRI investment scam has been uncovered by Sprouts News, led by journalist Unmesh Gujarathi. Fraudster Devang Hasmukh Patel is accused of orchestrating fake IPO schemes, inflating company valuations, and running illegal hazardous waste import operations. The scam spans multiple states in India and extends into the US, leaving investors, employees, and partner media organisations deceived. The investigation highlights a dangerous blend of financial manipulation, corporate fraud, and cross-border criminal activity.

- NRI Investment Fraud Exposed: The ₹20,000 Crore Corporate Scam

- • Unmesh Gujarathi Exposes Devang Patel’s Multi-State Corporate Fraud

- • TechCloud ERP Fraud: Inside the ₹20,000 Crore Fake IPO Scandal

- • The Human Cost: Unpaid Salaries and Nationwide Office Closures

- NRI Investment Fraud Exposed: ₹20,000 Crore Corporate Scam Rocks India’s Business Landscape

- NRI Businessman’s Corporate Empire Under Scanner

- TechCloud ERP: Digital Innovation or Investment Illusion?

- Fake Valuation Reports and Reverse Merger Scheme

- Times Network Fraud: Media Exploitation Allegations

- Unauthorised Media Venture: INN Channel Launch

- Hazardous Waste Import Scandal

- Corporate Structure Reveals Systematic Fraud

- Political Photo-Ops and Investment Claims

- Regulatory Action and Investigation Demands

- Indore Operations: Empty Promises and Unpaid Salaries

- Office Closures Across India

- Economic Conspiracy and Investor Warning

- Journalist Safety Concerns

- Whistleblower Collaboration Strengthens Investigation

Click Here To Download the News Attachment

NRI Investment Fraud Exposed: ₹20,000 Crore Corporate Scam Rocks India’s Business Landscape

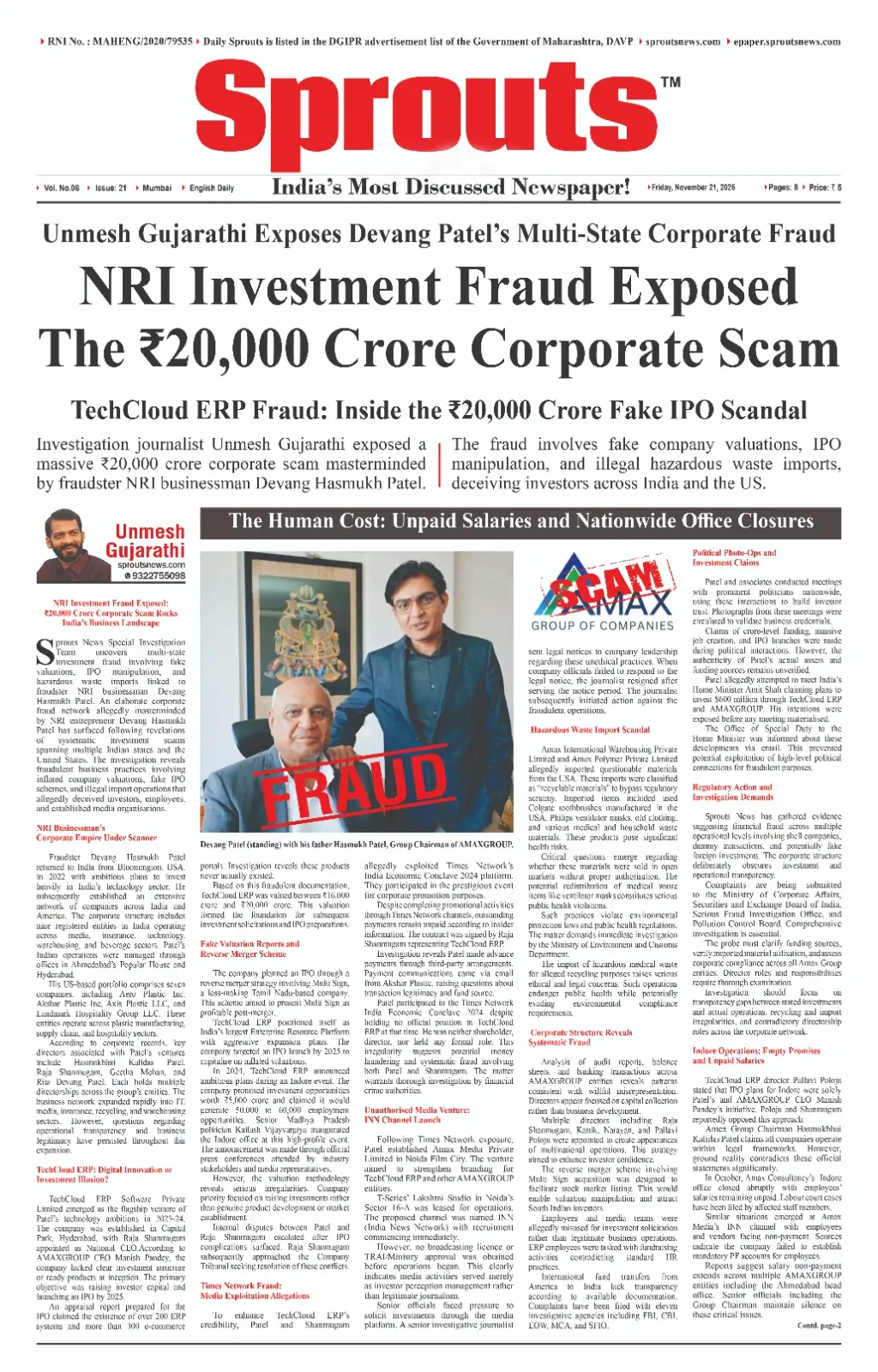

Sprouts News Special Investigation Team uncovers multi-state investment fraud involving fake valuations, IPO manipulation, and hazardous waste imports linked to fraudster NRI businessman Devang Hasmukh Patel

An elaborate corporate fraud network allegedly masterminded by NRI entrepreneur Devang Hasmukh Patel has surfaced following revelations of systematic investment scams spanning multiple Indian states and the United States.

The investigation reveals fraudulent business practices involving inflated company valuations, fake IPO schemes, and illegal import operations that allegedly deceived investors, employees, and established media organisations.

NRI Businessman’s Corporate Empire Under Scanner

Fraudster Devang Hasmukh Patel returned to India from Bloomington, USA, in 2022 with ambitious plans to invest heavily in India’s technology sector. He subsequently established an extensive network of companies across India and America.

The corporate structure includes nine registered entities in India operating across media, insurance, technology, warehousing, and beverage sectors. Patel’s Indian operations were managed through offices in Ahmedabad’s Popular House and Hyderabad.

His US-based portfolio comprises seven companies, including Aero Plastic Inc, Akshar Plastic Inc, Axis Plastic LLC, and Landmark Hospitality Group LLC. These entities operate across plastic manufacturing, supply chain, and hospitality sectors.

According to corporate records, key directors associated with Patel’s ventures include Hasmukbhai Kalidas Patel, Raja Shanmugam, Geetha Mohan, and Rita Devang Patel. Each holds multiple directorships across the group’s entities.

The business network expanded rapidly into IT, media, insurance, recycling, and warehousing sectors. However, questions regarding operational transparency and business legitimacy have persisted throughout this expansion.

TechCloud ERP: Digital Innovation or Investment Illusion?

TechCloud ERP Software Private Limited emerged as the flagship venture of Patel’s technology ambitions in 2023-24. The company was established in Capital Park, Hyderabad, with Raja Shanmugam appointed as National CEO.

According to AMAXGROUP CEO Manish Pandey, the company lacked clear investment structure or ready products at inception. The primary objective was raising investor capital and launching an IPO by 2025.

An appraisal report prepared for the IPO claimed the existence of over 200 ERP systems and more than 300 e-commerce portals. Investigation reveals these products never actually existed.

Based on this fraudulent documentation, TechCloud ERP was valued between ₹16,000 crore and ₹20,000 crore. This valuation formed the foundation for subsequent investment solicitations and IPO preparations.

Fake Valuation Reports and Reverse Merger Scheme

The company planned an IPO through a reverse merger strategy involving Multi Sign, a loss-making Tamil Nadu-based company. This scheme aimed to present Multi Sign as profitable post-merger.

TechCloud ERP positioned itself as India’s largest Enterprise Resource Platform with aggressive expansion plans. The company targeted an IPO launch by 2025 to capitalise on inflated valuations.

In 2024, TechCloud ERP announced ambitious plans during an Indore event. The company promised investment opportunities worth ₹5,000 crore and claimed it would generate 50,000 to 60,000 employment opportunities.

Senior Madhya Pradesh politician Kailash Vijayvargiya inaugurated the Indore office at this high-profile event. The announcement was made through official press conferences attended by industry stakeholders and media representatives.

However, the valuation methodology reveals serious irregularities. Company priority focused on raising investments rather than genuine product development or market establishment.

Internal disputes between Patel and Raja Shanmugam escalated after IPO complications surfaced. Raja Shanmugam subsequently approached the Company Tribunal seeking resolution of these conflicts.

Times Network Fraud: Media Exploitation Allegations

To enhance TechCloud ERP’s credibility, Patel and Shanmugam allegedly exploited Times Network’s India Economic Conclave 2024 platform. They participated in the prestigious event for corporate promotion purposes.

Despite completing promotional activities through Times Network channels, outstanding payments remain unpaid according to insider information. The contract was signed by Raja Shanmugam representing TechCloud ERP.

Investigation reveals Patel made advance payments through third-party arrangements. Payment communications came via email from Akshar Plastic, raising questions about transaction legitimacy and fund source.

Patel participated in the Times Network India Economic Conclave 2024 despite holding no official position in TechCloud ERP at that time. He was neither shareholder, director, nor held any formal role.

This irregularity suggests potential money laundering and systematic fraud involving both Patel and Shanmugam. The matter warrants thorough investigation by financial crime authorities.

Unauthorised Media Venture: INN Channel Launch

Following Times Network exposure, Patel established Amax Media Private Limited in Noida Film City. The venture aimed to strengthen branding for TechCloud ERP and other AMAXGROUP entities.

T-Series’ Lakshmi Studio in Noida’s Sector 16-A was leased for operations. The proposed channel was named INN (India News Network) with recruitment commencing immediately.

However, no broadcasting licence or TRAI/Ministry approval was obtained before operations began. This clearly indicates media activities served merely as investor perception management rather than legitimate journalism.

Senior officials faced pressure to solicit investments through the media platform. A senior investigative journalist sent legal notices to company leadership regarding these unethical practices.

When company officials failed to respond to the legal notice, the journalist resigned after serving the notice period. The journalist subsequently initiated action against the fraudulent operations.

Hazardous Waste Import Scandal

Amax International Warehousing Private Limited and Amax Polymer Private Limited allegedly imported questionable materials from the USA. These imports were classified as “recyclable materials” to bypass regulatory scrutiny.

Imported items included used Colgate toothbrushes manufactured in the USA, Philips ventilator masks, old clothing, and various medical and household waste materials. These products pose significant health risks.

Critical questions emerge regarding whether these materials were sold in open markets without proper authorisation. The potential redistribution of medical waste items like ventilator masks constitutes serious public health violations.

Such practices violate environmental protection laws and public health regulations. The matter demands immediate investigation by the Ministry of Environment and Customs Department.

The import of hazardous medical waste for alleged recycling purposes raises serious ethical and legal concerns. Such operations endanger public health while potentially evading environmental compliance requirements.

Also Read: Filmmaker Vikram Bhatt Faces ₹30 Crore Fraud Case in Udaipur.

Corporate Structure Reveals Systematic Fraud

Analysis of audit reports, balance sheets, and banking transactions across AMAXGROUP entities reveals patterns consistent with willful misrepresentation. Directors appear focused on capital collection rather than business development.

Multiple directors including Raja Shanmugam, Kartik, Narayan, and Pallavi Poloju were appointed to create appearances of multinational operations. This strategy aimed to enhance investor confidence.

The reverse merger scheme involving Multi Sign acquisition was designed to facilitate stock market listing. This would enable valuation manipulation and attract South Indian investors.

Employees and media teams were allegedly misused for investment solicitation rather than legitimate business operations. ERP employees were tasked with fundraising activities contradicting standard HR practices.

International fund transfers from America to India lack transparency according to available documentation. Complaints have been filed with eleven investigative agencies including FBI, CBI, EOW, MCA, and SFIO.

Political Photo-Ops and Investment Claims

Patel and associates conducted meetings with prominent politicians nationwide, using these interactions to build investor trust. Photographs from these meetings were circulated to validate business credentials.

Claims of crore-level funding, massive job creation, and IPO launches were made during political interactions. However, the authenticity of Patel’s actual assets and funding sources remains unverified.

Patel allegedly attempted to meet India’s Home Minister Amit Shah claiming plans to invest $600 million through TechCloud ERP and AMAXGROUP. His intentions were exposed before any meeting materialised.

The Office of Special Duty to the Home Minister was informed about these developments via email. This prevented potential exploitation of high-level political connections for fraudulent purposes.

Regulatory Action and Investigation Demands

Sprouts News has gathered evidence suggesting financial fraud across multiple operational levels involving shell companies, dummy transactions, and potentially fake foreign investments. The corporate structure deliberately obscures investment and operational transparency.

Complaints are being submitted to the Ministry of Corporate Affairs, Securities and Exchange Board of India, Serious Fraud Investigation Office, and Pollution Control Board. Comprehensive investigation is essential.

The probe must clarify funding sources, verify imported material utilisation, and assess corporate compliance across all Amax Group entities. Director roles and responsibilities require thorough examination.

Investigation should focus on transparency gaps between stated investments and actual operations, recycling and import irregularities, and contradictory directorship roles across the corporate network.

Indore Operations: Empty Promises and Unpaid Salaries

TechCloud ERP director Pallavi Poloju stated that IPO plans for Indore were solely Patel’s and AMAXGROUP CEO Manish Pandey’s initiative. Poloju and Shanmugam reportedly opposed this approach.

Amex Group Chairman Hasmukbhai Kalidas Patel claims all companies operate within legal frameworks. However, ground reality contradicts these official statements significantly.

In October, Amax Consultancy’s Indore office closed abruptly with employees’ salaries remaining unpaid. Labour court cases have been filed by affected staff members.

Similar situations emerged at Amax Media’s INN channel with employees and vendors facing non-payment. Sources indicate the company failed to establish mandatory PF accounts for employees.

Reports suggest salary non-payment extends across multiple AMAXGROUP entities including the Ahmedabad head office. Senior officials including the Group Chairman maintain silence on these critical issues.

Office Closures Across India

Most AMAXGROUP and TechCloud ERP offices have closed nationwide including locations in Indore, Hyderabad, Coimbatore, Trichy, Kochi, and the Noida media office. This sudden shutdown affects hundreds of employees.

Despite these closures, Patel has reportedly added pharmaceutical and polymer companies to his network. These additions appear designed to facilitate large bank loans.

New entities include Matish Healthcare Private Limited, Metrix Meditech Private Limited, and Vasani Polymers Private Limited. Each features different directors while maintaining connections to Patel’s network.

This expansion during investigation raises concerns about potential asset diversion and continued fraudulent practices. Banking institutions must scrutinise loan applications from these entities carefully.

Economic Conspiracy and Investor Warning

The investigation reveals a planned economic conspiracy with clear objectives including capital collection through false promises, share price manipulation via reverse mergers, and corporate image building through media publicity.

Such activities harm investors and employees whilst damaging India’s business reputation and NRI community credibility. Transparent resource utilisation remains essential for genuine development.

Despite recent regulatory improvements, the system lacks effective mechanisms for preventing planned economic crimes. SEBI has intensified scrutiny of SME sector IPOs to protect small investors.

Investors must exercise caution regarding attractive investment opportunities promising exceptional returns. Thorough due diligence and verification remain essential before committing capital to any venture.

The case demonstrates how business based on deceit rather than trust requires immediate investigation and regulatory action. Multiple investigative agencies must examine every individual, company, document, and transaction thoroughly.

Journalist Safety Concerns

The investigating journalist has received death threats alongside various inducements to suppress this exposé. However, such intimidation tactics cannot silence committed investigative journalism.

Every aspect of this case requires examination in national interest including all connected individuals, companies, documents, and financial transactions. Comprehensive investigation by relevant agencies remains imperative.

The Patel case serves as warning that corporate fraud can operate at massive scale whilst exploiting regulatory gaps and political connections. Systematic enforcement mechanisms must strengthen to prevent similar schemes.

Whistleblower Collaboration Strengthens Investigation

Investigative journalist Unmesh Gujarathi collaborated with senior journalist Ajit Ujjainkar to expose the multi-crore fraud. Their combined efforts documented systematic irregularities within AMAXGROUP operations, strengthening evidence for regulatory agencies investigating the alleged corporate conspiracy and investment scam.