Exclusive: Mumbai Businessman Loses ₹27 Lakh in Sophisticated UAE Police Impersonation Scam; HSBC Accounts Drained

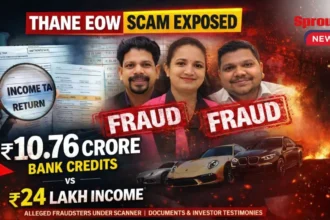

A Mumbai-based businessman has lost over ₹27 lakh in a sophisticated UAE Police impersonation scam, investigated by the Sprouts News SIT. Fraudsters posing as officers of the Dubai Police contacted the victim via video call, shared forged identity documents, and claimed a joint India–UAE probe into his finances. Using fear, isolation tactics, and insider knowledge of his HSBC accounts, the scammers coerced transfers, draining his funds.

- Exclusive: Mumbai Businessman Loses ₹27 Lakh in Sophisticated UAE Police Impersonation Scam; HSBC Accounts Drained

- HSBC Bank Accounts Targeted in Elaborate Video Call Scam

- Fraudsters Use Forged Dubai Police ID to Gain Trust

- Pressure Tactics Employed: Victim Threatened with Legal Action

- OTPs Shared Under Duress, Leading to Massive Financial Drain

- ₹27.36 Lakh Siphoned Off to Untraceable Accounts in Minutes

- Fraud Discovered After Friend Recognises

- FIR Registered at Cyber Police Station Under IT Act Sections

- Official Complaint Also Lodged on National Cyber Crime Portal

- Modus Operandi Reflects Rising Trend in Cross-Border Cyber Fraud

- HSBC Bank’s Response and Investigation Awaited

- Mumbai Cyber Police Launch Manhunt for International Syndicate

- Public Advisory Issued by Police on Government Impersonation

- Expert Analysis: How to Protect Yourself from Similar Scams

- The Human Cost: Beyond the Financial Loss for Victims

- Sprouts News Investigation Reveals Systemic Challenges

- Swift Police Action and Syndicate Uncovered

- International Cybercrime Network Exposed

- Community Awareness Initiative Launched

HSBC Bank Accounts Targeted in Elaborate Video Call Scam

The victim, Nitin Krushnrao Nandekar, was targeted on November 8, 2025. He received a video call from a number impersonating UAE authorities. The fraudster claimed to be an officer named ‘Ahmed Riffat Abdulla’. They alleged a joint India-UAE probe into his financial activities.

Fraudsters Use Forged Dubai Police ID to Gain Trust

To establish credibility, the scammer sent a forged Dubai Police identity card. The fake ID was shared via WhatsApp during the video call. This convinced Nandekar of the caller’s official status. The fraudster then asserted knowledge of his HSBC bank account details.

Pressure Tactics Employed: Victim Threatened with Legal Action

The impostor claimed Nandekar had received a “Golden Visa” improperly. They insisted his Indian bank accounts were under scrutiny. The caller pressured him to stay in his room for a so-called investigation. He was told to cooperate or face severe legal consequences.

OTPs Shared Under Duress, Leading to Massive Financial Drain

The scammer demanded One-Time Passwords (OTPs) for “verification.” These OTPs were linked to his HSBC savings and credit cards. Under threat, Nandekar shared the codes from his mobile. This access led to immediate, unauthorized transfers from his accounts.

₹27.36 Lakh Siphoned Off to Untraceable Accounts in Minutes

A total of ₹27,36,123.94 was transferred fraudulently. The money was moved from his NRE and NRO accounts. Transfers also occurred from his MasterCard credit cards. The funds were sent to unknown, untraceable bank accounts within India.

Fraud Discovered After Friend Recognises

Cybercrime Pattern

Nandekar realized the fraud only after consulting a friend. His friend identified the scam as a classic impersonation tactic. Attempts to call back the scammer’s number failed immediately. The contact number and email address were swiftly deactivated.

FIR Registered at Cyber Police Station Under IT Act Sections

An FIR has been formally registered by the victim’s brother. Padmakar Krushnrao Nandekar filed the complaint on his brother’s behalf. The case is filed under relevant sections of the IT Act. It includes charges of cheating, impersonation, and cyber fraud.

Official Complaint Also Lodged on National Cyber Crime Portal

A separate complaint was lodged on the government’s www.cybercrime.gov.in portal. This national portal acknowledges cybercrime reports for central tracking. The acknowledgment numbers are 21911250125523 and 21911250125565. This initiates a parallel investigative process by federal agencies.

Modus Operandi Reflects Rising Trend in Cross-Border Cyber Fraud

Cybersecurity experts note a rise in such cross-border scams. Fraudsters exploit victims’ fear of international legal authorities. The use of video calls and fake IDs makes the scam highly convincing. These tactics represent a new evolution in social engineering attacks.

HSBC Bank’s Response and Investigation Awaited

The victim has officially informed HSBC Bank about the fraudulent transactions. Standard bank protocols for such cyber fraud cases are now underway. The bank’s internal security team is tracing the transaction trail. Recovery of funds depends on the speed of account freezing requests.

Mumbai Cyber Police Launch Manhunt for International Syndicate

The Mumbai Cyber Crime Cell has taken up the investigation. Preliminary evidence points to operators based outside India. International cooperation with UAE authorities may be sought. The police are analyzing the digital footprints from the communication.

Public Advisory Issued by Police on Government Impersonation

Authorities reiterate that no police official will demand OTPs. Legitimate investigations never require sharing passwords over calls. Citizens are urged to verify directly with local police stations. Official communication always follows proper written channels, not video calls.

Expert Analysis: How to Protect Yourself from Similar Scams

Cybersecurity analysts advise immediate disconnection on such calls. Verify any claim by contacting the agency directly via official numbers. Never share personal identification documents digitally with unknown callers. Enable two-factor authentication using authenticator apps, not SMS OTPs.

The Human Cost: Beyond the Financial Loss for Victims

Beyond the ₹27 lakh loss, victims suffer significant psychological distress. The feeling of violation and fear persists long after the incident. This case highlights the urgent need for robust public cyber awareness. Legal frameworks must evolve to combat these international criminal networks.

Sprouts News Investigation Reveals Systemic Challenges

Our investigation finds such scams are often underreported due to embarrassment. The complex international jurisdiction hinders swift action and recovery. There is a pressing need for faster inter-bank alert systems to block transactions. Public-private partnership is crucial to combat this financial terrorism.

Swift Police Action and Syndicate Uncovered

The Cuffe Parade police station acted promptly by registering an FIR and cooperating with Dr. Padmakar Nandekar, who filed a detailed report on the official cybercrime portal. This action was initiated following a video call with Nitinchandra Nandekar, and the entire process of documentation and registration was completed within three hours. The efficient response marked a critical first step in investigating the sophisticated fraud attempt.

International Cybercrime Network Exposed

During the investigation, the cyber division revealed the extensive reach of the criminal operation. They identified that these gangs have a domestic footprint within India, particularly operating from villages in former Naxal-affected areas where they source account access packs and disposable SIM cards. Furthermore, the syndicate has significant international links, with call centers located in far-flung regions of Cambodia and Vietnam. Indian nationals are often lured to these locations for jobs, only to have their passports confiscated and be placed under tight security in a state of effective house arrest, from where they are forced to operate the fraud calls. This highlights the operation as a major international racket of financial cyber crime.

Community Awareness Initiative Launched

In response to this threat, the Cuffe Parade police have decided to proactively educate the community. They plan to organize a comprehensive financial cyber crime awareness campaign across all residential buildings in collaboration with the Cuffe Parade Residents’ Association (CPRA). This initiative will include detailed presentations and lectures, delivered both in person and via call. Dr. Padmakar Nandekar, Vice President of CPRA, has assured full support for the drive. The police station’s goal is to ensure every resident is informed, vigilant, and ready to report any suspicious communication, leveraging their dedicated special cyber cell for immediate action.

Article is well researched to create awareness among subscribers not to fall in international trap of criminals of cyber financial fraud