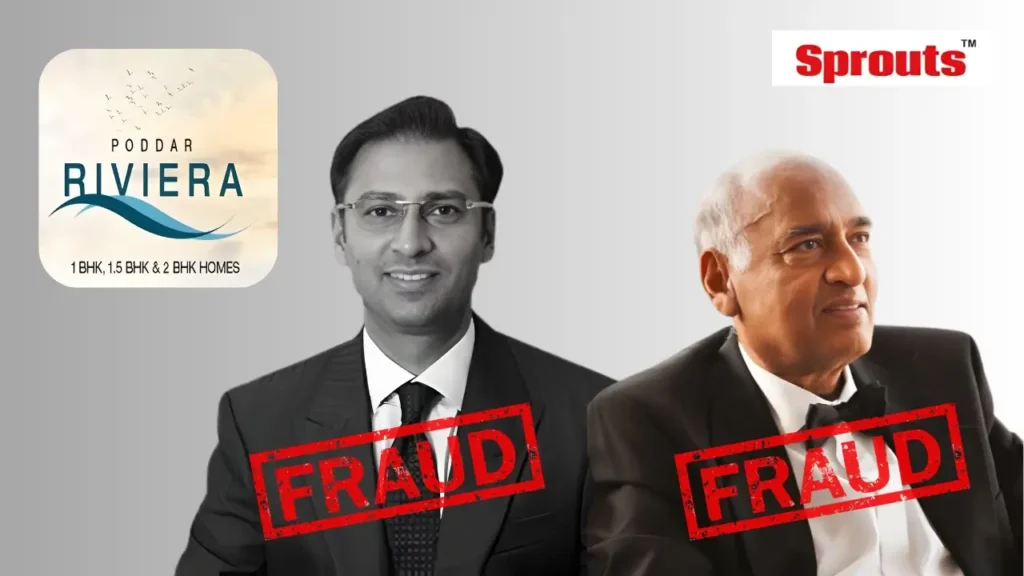

STCI Finance Withdraws IBC Petition Against Poddar Housing Amid Settlement Talks, Exposing Wider Legal and Land Dispute Web

STCI Finance has withdrawn its IBC insolvency petition against Poddar Housing amid advanced settlement talks before the NCLT. However, the withdrawal does not resolve underlying payment defaults or long-standing land and title disputes. Nearly 498 homebuyers remain impacted, while lenders retain the right to revive insolvency proceedings if settlement terms fail. Legal experts warn that such conditional withdrawals often mask deeper structural and regulatory risks in stalled real estate projects.

- STCI Finance Withdraws IBC Petition Against Poddar Housing Amid Settlement Talks, Exposing Wider Legal and Land Dispute Web

- STCI Finance Withdraws IBC Plea Against Poddar Housing

- Section 7 IBC and Continuing Default Exposure

- Parallel Land Disputes Deepen Legal Uncertainty

- Trust Ownership and Procedural Dismissal

- Impact on Lenders, Homebuyers, and Regulators

- What Lies Ahead for Poddar Housing

STCI Finance Withdraws IBC Plea Against Poddar Housing

STCI Finance has withdrawn its insolvency petition against Poddar Housing, triggering renewed scrutiny of settlement talks, unresolved defaults, and legacy land disputes impacting nearly 498 affected homebuyers across Maharashtra.

Investigative journalist Unmesh Gujarathi reported that the withdrawal before the National Company Law Tribunal does not close underlying financial liabilities, as creditors retain the right to revive insolvency proceedings.

The case has gained attention within the real estate and insolvency ecosystem, as settlement-driven withdrawals often signal deeper structural and legal complications rather than resolution of defaults.

STCI Finance filed the petition under Section 7 of the Insolvency and Bankruptcy Code, citing payment defaults by Poddar Housing and Development Limited.

At the request of STCI Finance, the tribunal permitted withdrawal of Company Petition No. 109 of 2024 after advanced settlement discussions, while granting liberty to refile if commitments are breached.

Legal experts note that such conditional withdrawals are increasingly common, especially when asset valuation and land title disputes complicate recovery prospects for lenders.

Click to check the document – In a letter to the Bombay Stock Exchange and NSE, Poddar has stated that he lacks the required funds.

Section 7 IBC and Continuing Default Exposure

Section 7 of the Insolvency and Bankruptcy Code empowers financial creditors to initiate insolvency proceedings upon establishing debt and default before the tribunal.

STCI Finance approached the NCLT as a secured financial creditor, triggering regulatory scrutiny into Poddar Housing’s repayment capacity and corporate financial disclosures.

Counsel for Poddar Housing raised no objection to the withdrawal, formally acknowledging that creditors retain statutory rights to revive insolvency proceedings if settlement terms fail.

Experts caution that settlement negotiations do not extinguish default unless repayment agreements are legally binding, time-bound, and fully honoured.

For affected homebuyers, the withdrawal offers no immediate relief, as project delays, delivery uncertainty, and recovery timelines remain unresolved.

The insolvency pause therefore represents a temporary legal breather rather than closure of financial accountability.

Also Read: Can SevenHills Become Mumbai’s Largest Public Hospital?

Related Article: Poddar Rivera ₹100 Crore Fraud Halts Kalyan Housing Project.

Parallel Land Disputes Deepen Legal Uncertainty

Beyond insolvency proceedings, Poddar-linked entities face long-standing land disputes that continue to cloud asset ownership and enforceability.

Trust Ownership and Procedural Dismissal

During proceedings before the Charity Commissioner Mumbai, the land was found recorded in the name of Shree Radha Damodar Trust, invoking provisions of the Bombay Public Trust Act, 1950.

The court held that possession suits involving public trust properties require prior sanction from the Charity Commissioner.

Since no such permission was obtained,, the question of rights over the land remain unresolved, thus putting in jeopardy the rights of around 400 flat buyers who have booked their apartments in the particular project.

Such matters significantly weaken asset clarity during insolvency or recovery actions.

Impact on Lenders, Homebuyers, and Regulators

Legal analysts emphasise that unresolved land titles, trust restrictions, and historical lease breaches severely reduce asset valuation during insolvency resolution.

For lenders like STCI Finance, negotiated settlements often appear more practical and convenient than prolonged litigation with uncertain recovery outcomes. The moot question is whether lenders exercise due diligence prior to lending and whether such due diligence is to the extent that it safeguards the interests of the lenders as well as the home buyers.

Homebuyers face compounded risk, as insolvency delays intersect with land disputes that can stall project completion indefinitely.

Regulators need to view such cases as indicators of deeper governance gaps within Maharashtra’s real estate and land administration frameworks.

The Poddar Housing episode reinforces the importance of title diligence, verification of trust records, and continuous monitoring of tribunal proceedings.

According to Sprouts News, overlapping insolvency, civil litigation, and trust law issues expose systemic weaknesses requiring coordinated regulatory oversight.

What Lies Ahead for Poddar Housing

As settlement discussions continue, lenders and homebuyers will closely watch whether Poddar Housing honours its repayment commitments.

Failure to comply could trigger fresh insolvency proceedings under Section 7, reopening tribunal scrutiny into finances and land assets.

For now, the withdrawal marks a pause rather than resolution, leaving critical questions around accountability, asset clarity, and buyer protection unanswered.

The case stands as a cautionary example for investors, policymakers, and regulators navigating India’s complex real estate insolvency landscape.

Repeated attempts to contact Rohit Poddar for his comments failed.