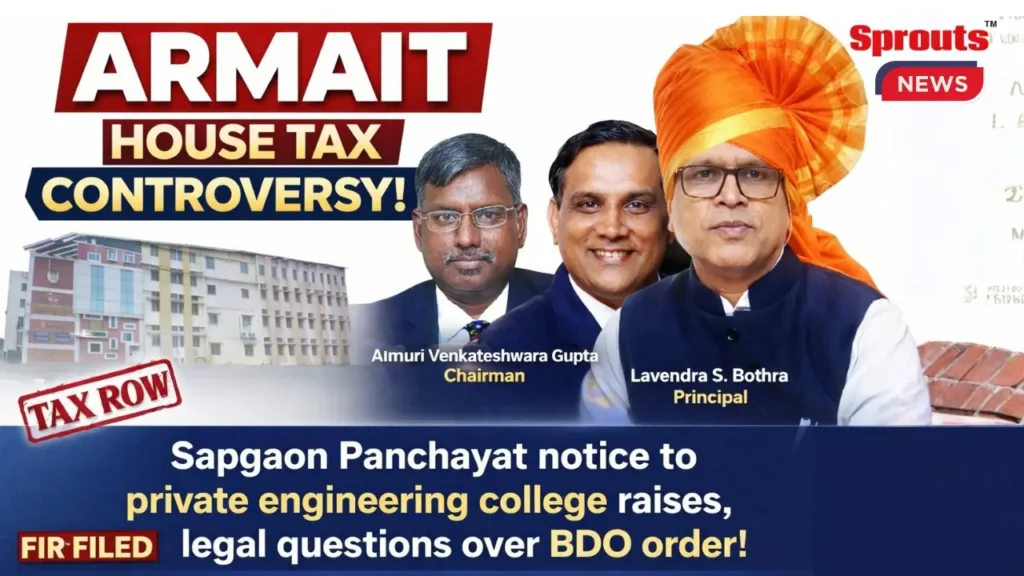

The Armait House Tax controversy in Shahapur has escalated after Sapgaon Gram Panchayat issued a ₹1.50 crore property tax notice to Almuri Ratnamala Institute of Engineering and Technology. The notice challenges a recent Block Development Officer order that interpreted tax exemption provisions differently. Questions have emerged over occupancy certificates, educational use classification, and revenue calculations, raising wider concerns about rural taxation rules and local governance accountability in Maharashtra.

Armait House Tax Controversy: Sapgaon Panchayat Notice Raises Legal Questions Over BDO Order

Sprouts News urges citizens facing injustice to speak out without fear. Editor in Chief Unmesh Gujarathi pledges fearless, independent support for truth and accountability. If you have credible information or grievances, reach out and ensure your voice is heard.

Armait house tax controversy has erupted in Shahapur taluka after Sapgaon Gram Panchayat issued a ₹1.50 crore property tax notice to a private engineering college, questioning the legal validity of a Block Development Officer’s recent order.

The notice demands ₹1,50,46,014 in house tax from Almuri Ratnamala Institute of Engineering and Technology, operated by Koti Vidya Charitable Trust in Sapgaon, Thane district.

Sapgaon Gram Panchayat claims the demand follows official documents and registered records establishing taxable built up area under existing government resolutions governing rural local bodies and property tax assessment norms.

However, on 29 January 2026, the Block Development Officer of the Panchayat Samiti reportedly issued an order that allegedly interpreted government provisions differently, creating a direct administrative conflict.

Local representatives argue that the BDO order avoided explicitly mentioning the total taxable construction area and offered protection under educational use classification without addressing critical compliance gaps.

Property Tax Exemption Debate and Occupancy Certificate Concerns

At the heart of the dispute lies the question of whether a private professional college charging building usage fees qualifies for house tax exemption under rural taxation rules.

Gram Panchayat officials state that the buildings in question allegedly lack a valid occupancy certificate from the competent authority, despite being used for regular academic operations.

Experts in municipal governance point out that occupancy certification is central to lawful building use, safety compliance, and eligibility for tax classification benefits under Maharashtra’s regulatory framework.

Critics further argue that commercial elements exist because the institution collects annual building usage fees from students, potentially altering its classification from purely charitable educational use.

There is reportedly no explicit provision granting blanket property tax exemption to institutions conducting professional education while charging structured fees linked to infrastructure usage.

The Panchayat maintains that ignoring these aspects weakens fiscal discipline and risks setting a precedent that could erode revenue collection powers of local self government institutions.

Discrepancies have also surfaced between construction measurements recorded by the Panchayat Samiti and those registered by the Town Planning Department.

Officials allege that such variations may have affected calculations related to compromise fees, labour welfare cess, and development charges, potentially leading to an estimated ₹3 crore revenue impact.

Also Read: Axis Securities faces FIR over ₹1.70 crore trading loss.

FIR, Financial Irregularities and Wider Institutional Scrutiny

The controversy extends beyond taxation. An FIR numbered 405 of 2023 was registered at Shahapur Police Station on 21 November 2023 against trust officials under several sections of the Indian Penal Code.

The Integrated Tribal Development Project, Shahapur, accused the management of misleading authorities, students, and parents in matters relating to scholarship claims and financial declarations.

The inquiry committee reportedly recommended criminal action for submitting allegedly false affidavits in fee increase proposals and urged deeper police investigation into regulatory compliance.

It also suggested detailed audits by the Charity Commissioner’s office and the Income Tax Department to examine administrative and financial conduct of the trust.

Serious observations were made regarding alleged overcharging of students under multiple charitable trusts, invoking provisions of a Maharashtra Tribal Development Department government resolution dated 17 January 2022.

The committee further recommended scrutiny of regulatory bodies including the All India Council for Technical Education, the Directorate of Technical Education, the University of Mumbai, and the Maharashtra State Board of Technical Education.

Questions were raised about whether inspection reports overlooked deficiencies, enabling continued operations despite alleged non compliance in infrastructure and financial governance.

Allegations also include possible irregularities in employees’ provident fund contributions, prompting calls for comprehensive verification of employment records and statutory deposits.

Against this backdrop, critics contend that the BDO’s order appears legally ambiguous and potentially protective of the institution amid ongoing criminal and administrative scrutiny.

The Sapgaon Gram Panchayat has demanded a high level independent inquiry, emphasising the need to protect local revenue authority and uphold transparency in rural governance.

For fast growing peri urban regions like Shahapur, this case underscores how tax classification disputes intersect with education regulation, fiscal accountability, and public trust in local administration.

Sources allege that due to the collusion between the accused institution operator Almuri Venkatesh Gupta, Principal Lavendra Bothra, and Block Development Officer B. H. Rathod, the government is facing further substantial financial losses.

Sprouts News Special Investigation Team notes that authorities have the opportunity to clarify their positions, while residents await decisive action on property tax recovery and institutional compliance.

Stand Up Against Injustice

“Silence protects the powerful. Courage protects the truth.” If you are facing injustice, do not wait for someone else to speak. Be rebellious. Sprouts News and its Editor-in-Chief, senior journalist Unmesh Gujarathi, are ready to stand with you. Call 9322755098.