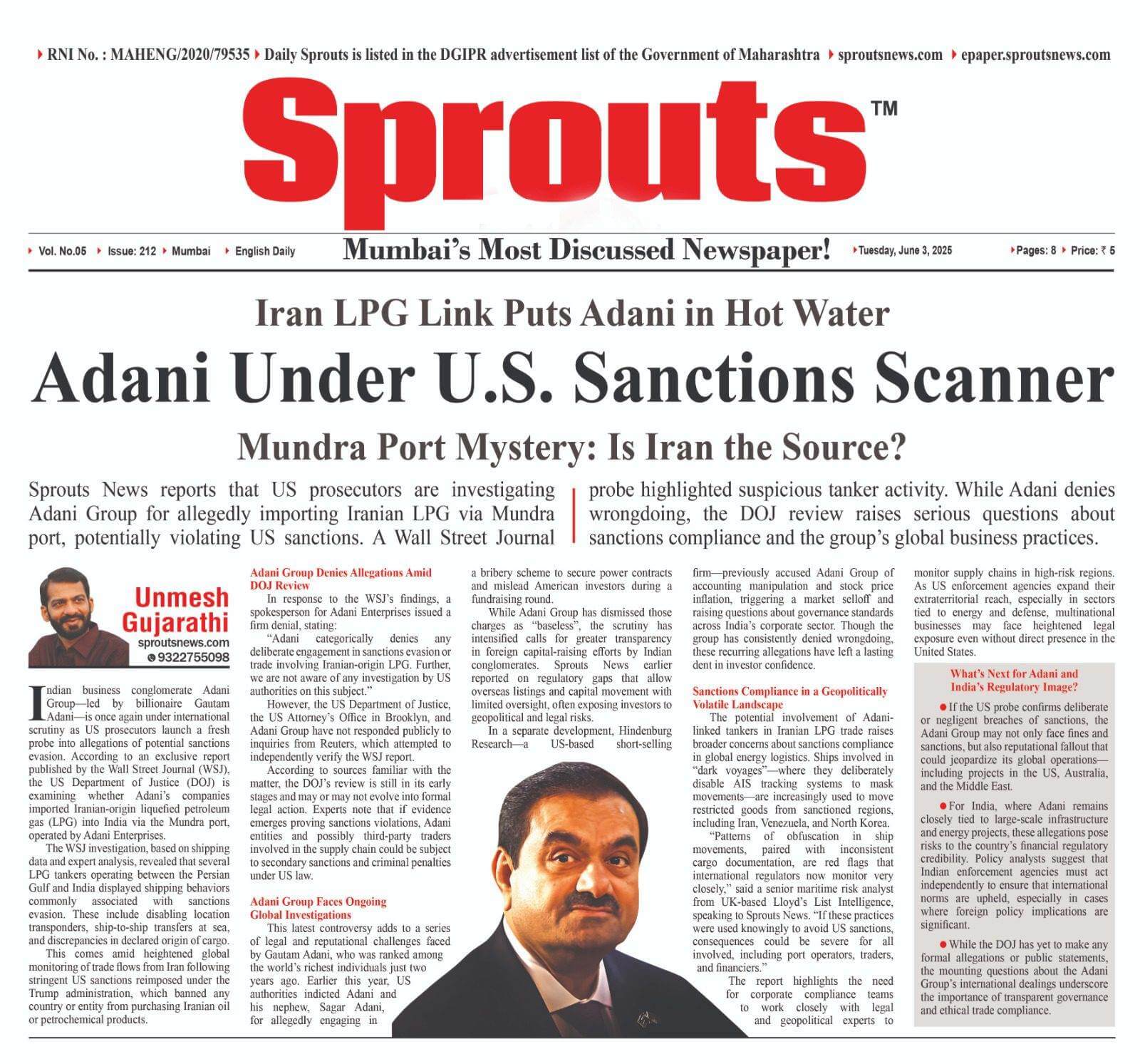

Adani Under U.S. Sanctions Scanner

• Iran LPG Link Puts Adani in Hot Water

• Mundra Port Mystery: Is Iran the Source?

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

- Adani Under U.S. Sanctions Scanner

- • Iran LPG Link Puts Adani in Hot Water

- • Mundra Port Mystery: Is Iran the Source?

- US Prosecutors Probe Adani Group Over Possible Iranian LPG Imports: Report

- Adani Group Denies Allegations Amid DOJ Review

- Adani Group Faces Ongoing Global Investigations

- Sanctions Compliance in a Geopolitically Volatile Landscape

- Also Read: Bhandari Mandal Property Scam: Criminal Nexus Unmasked.

- What’s Next for Adani and India’s Regulatory Image?

Sprouts News reports that US prosecutors are investigating Adani Group for allegedly importing Iranian LPG via Mundra port, potentially violating US sanctions. A Wall Street Journal probe highlighted suspicious tanker activity. While Adani denies wrongdoing, the DOJ review raises serious questions about sanctions compliance and the group’s global business practices.

US Prosecutors Probe Adani Group Over Possible Iranian LPG Imports: Report

Indian business conglomerate Adani Group—led by billionaire Gautam Adani—is once again under international scrutiny as US prosecutors launch a fresh probe into allegations of potential sanctions evasion. According to an exclusive report published by the Wall Street Journal (WSJ), the US Department of Justice (DOJ) is examining whether Adani’s companies imported Iranian-origin liquefied petroleum gas (LPG) into India via the Mundra port, operated by Adani Enterprises.

The WSJ investigation, based on shipping data and expert analysis, revealed that several LPG tankers operating between the Persian Gulf and India displayed shipping behaviors commonly associated with sanctions evasion. These include disabling location transponders, ship-to-ship transfers at sea, and discrepancies in declared origin of cargo.

This comes amid heightened global monitoring of trade flows from Iran following stringent US sanctions reimposed under the Trump administration, which banned any country or entity from purchasing Iranian oil or petrochemical products.

Adani Group Denies Allegations Amid DOJ Review

In response to the WSJ’s findings, a spokesperson for Adani Enterprises issued a firm denial, stating:

“Adani categorically denies any deliberate engagement in sanctions evasion or trade involving Iranian-origin LPG. Further, we are not aware of any investigation by US authorities on this subject.”

However, the US Department of Justice, the US Attorney’s Office in Brooklyn, and Adani Group have not responded publicly to inquiries from Reuters, which attempted to independently verify the WSJ report.

According to sources familiar with the matter, the DOJ’s review is still in its early stages and may or may not evolve into formal legal action. Experts note that if evidence emerges proving sanctions violations, Adani entities and possibly third-party traders involved in the supply chain could be subject to secondary sanctions and criminal penalties under US law.

Adani Group Faces Ongoing Global Investigations

This latest controversy adds to a series of legal and reputational challenges faced by Gautam Adani, who was ranked among the world’s richest individuals just two years ago. Earlier this year, US authorities indicted Adani and his nephew, Sagar Adani, for allegedly engaging in a bribery scheme to secure power contracts and mislead American investors during a fundraising round.

While Adani Group has dismissed those charges as “baseless”, the scrutiny has intensified calls for greater transparency in foreign capital-raising efforts by Indian conglomerates. Sprouts News earlier reported on regulatory gaps that allow overseas listings and capital movement with limited oversight, often exposing investors to geopolitical and legal risks.

In a separate development, Hindenburg Research—a US-based short-selling firm—previously accused Adani Group of accounting manipulation and stock price inflation, triggering a market selloff and raising questions about governance standards across India’s corporate sector. Though the group has consistently denied wrongdoing, these recurring allegations have left a lasting dent in investor confidence.

Sanctions Compliance in a Geopolitically Volatile Landscape

The potential involvement of Adani-linked tankers in Iranian LPG trade raises broader concerns about sanctions compliance in global energy logistics. Ships involved in “dark voyages”—where they deliberately disable AIS tracking systems to mask movements—are increasingly used to move restricted goods from sanctioned regions, including Iran, Venezuela, and North Korea.

“Patterns of obfuscation in ship movements, paired with inconsistent cargo documentation, are red flags that international regulators now monitor very closely,” said a senior maritime risk analyst from UK-based Lloyd’s List Intelligence, speaking to Sprouts News. “If these practices were used knowingly to avoid US sanctions, consequences could be severe for all involved, including port operators, traders, and financiers.”

The report highlights the need for corporate compliance teams to work closely with legal and geopolitical experts to monitor supply chains in high-risk regions. As US enforcement agencies expand their extraterritorial reach, especially in sectors tied to energy and defense, multinational businesses may face heightened legal exposure even without direct presence in the United States.

Also Read: Bhandari Mandal Property Scam: Criminal Nexus Unmasked.

What’s Next for Adani and India’s Regulatory Image?

If the US probe confirms deliberate or negligent breaches of sanctions, the Adani Group may not only face fines and sanctions, but also reputational fallout that could jeopardize its global operations—including projects in the US, Australia, and the Middle East.

For India, where Adani remains closely tied to large-scale infrastructure and energy projects, these allegations pose risks to the country’s financial regulatory credibility. Policy analysts suggest that Indian enforcement agencies must act independently to ensure that international norms are upheld, especially in cases where foreign policy implications are significant.

While the DOJ has yet to make any formal allegations or public statements, the mounting questions about the Adani Group’s international dealings underscore the importance of transparent governance and ethical trade compliance.