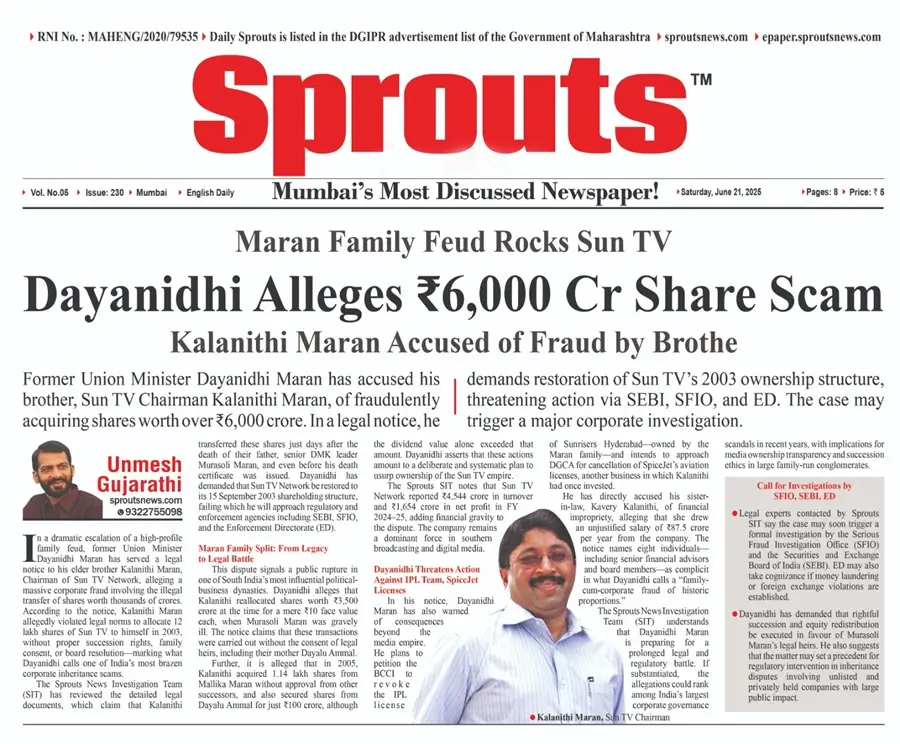

Dayanidhi Alleges ₹6,000 Cr Share Scam

• Maran Family Feud Rocks Sun TV

• Kalanithi Maran Accused of Fraud by Brother

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

- Dayanidhi Alleges ₹6,000 Cr Share Scam

- • Maran Family Feud Rocks Sun TV

- • Kalanithi Maran Accused of Fraud by Brother

- Maran Family Split: From Legacy to Legal Battle

- Also Read: Forgery, Fraud and Force: Ulhasnagar Family Feud Exposes Shocking Real Estate Conspiracy.

- Dayanidhi Threatens Action Against IPL Team, SpiceJet Licenses

- Call for Investigations by SFIO, SEBI, ED

Former Union Minister Dayanidhi Maran has accused his brother, Sun TV Chairman Kalanithi Maran, of fraudulently acquiring shares worth over ₹6,000 crore. In a legal notice, he demands restoration of Sun TV’s 2003 ownership structure, threatening action via SEBI, SFIO, and ED. The case may trigger a major corporate investigation.

In a dramatic escalation of a high-profile family feud, former Union Minister Dayanidhi Maran has served a legal notice to his elder brother Kalanithi Maran, Chairman of Sun TV Network, alleging a massive corporate fraud involving the illegal transfer of shares worth thousands of crores. According to the notice, Kalanithi Maran allegedly violated legal norms to allocate 12 lakh shares of Sun TV to himself in 2003, without proper succession rights, family consent, or board resolution—marking what Dayanidhi calls one of India’s most brazen corporate inheritance scams.

The Sprouts News Investigation Team (SIT) has reviewed the detailed legal documents, which claim that Kalanithi transferred these shares just days after the death of their father, senior DMK leader Murasoli Maran, and even before his death certificate was issued. Dayanidhi has demanded that Sun TV Network be restored to its 15 September 2003 shareholding structure, failing which he will approach regulatory and enforcement agencies including SEBI, SFIO, and the Enforcement Directorate (ED).

Maran Family Split: From Legacy to Legal Battle

This dispute signals a public rupture in one of South India’s most influential political-business dynasties. Dayanidhi alleges that Kalanithi reallocated shares worth ₹3,500 crore at the time for a mere ₹10 face value each, when Murasoli Maran was gravely ill. The notice claims that these transactions were carried out without the consent of legal heirs, including their mother Dayalu Ammal.

Further, it is alleged that in 2005, Kalanithi acquired 1.14 lakh shares from Mallika Maran without approval from other successors, and also secured shares from Dayalu Ammal for just ₹100 crore, although the dividend value alone exceeded that amount. Dayanidhi asserts that these actions amount to a deliberate and systematic plan to usurp ownership of the Sun TV empire.

The Sprouts SIT notes that Sun TV Network reported ₹4,544 crore in turnover and ₹1,654 crore in net profit in FY 2024–25, adding financial gravity to the dispute. The company remains a dominant force in southern broadcasting and digital media.

Also Read: Forgery, Fraud and Force: Ulhasnagar Family Feud Exposes Shocking Real Estate Conspiracy.

Dayanidhi Threatens Action Against IPL Team, SpiceJet Licenses

In his notice, Dayanidhi Maran has also warned of consequences beyond the media empire. He plans to petition the BCCI to revoke the IPL license of Sunrisers Hyderabad—owned by the Maran family—and intends to approach DGCA for cancellation of SpiceJet’s aviation licenses, another business in which Kalanithi had once invested.

He has directly accused his sister-in-law, Kavery Kalanithi, of financial impropriety, alleging that she drew an unjustified salary of ₹87.5 crore per year from the company. The notice names eight individuals—including senior financial advisors and board members—as complicit in what Dayanidhi calls a “family-cum-corporate fraud of historic proportions.”

The Sprouts News Investigation Team (SIT) understands that Dayanidhi Maran is preparing for a prolonged legal and regulatory battle. If substantiated, the allegations could rank among India’s largest corporate governance scandals in recent years, with implications for media ownership transparency and succession ethics in large family-run conglomerates.

Call for Investigations by SFIO, SEBI, ED

Legal experts contacted by Sprouts SIT say the case may soon trigger a formal investigation by the Serious Fraud Investigation Office (SFIO) and the Securities and Exchange Board of India (SEBI). ED may also take cognizance if money laundering or foreign exchange violations are established.

Dayanidhi has demanded that rightful succession and equity redistribution be executed in favour of Murasoli Maran’s legal heirs. He also suggests that the matter may set a precedent for regulatory intervention in inheritance disputes involving unlisted and privately held companies with large public impact.