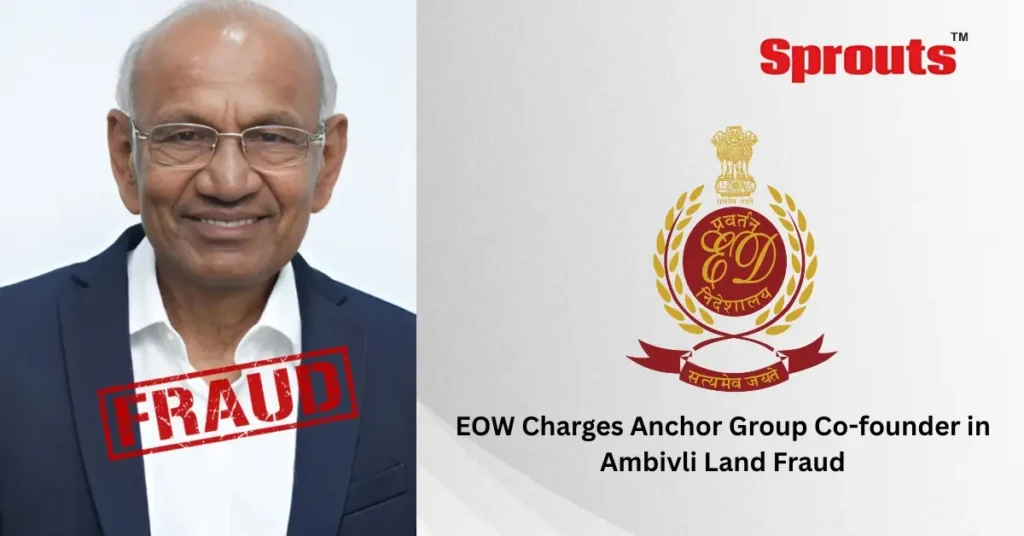

EOW Charges Anchor Group Co-founder in Ambivli Land Fraud

• From Trust to Fraud: ₹51 Cr Misused in Land Deal

• Anchor Director’s Ambivli Land Deal Under EOW Scanner

• Sheth Developers Cheated? EOW Files Fraud Charges

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Mumbai Police’s Economic Offences Wing has chargesheeted Anchor Group co-founder Jadavji Lalji Shah for misappropriating ₹51 crore from developer Ashwin Sheth. The funds, meant for a 70-acre Ambivli land project, were illegally diverted. Shah allegedly concealed land ownership facts, misused funds via Anchor Leasing, and breached trust, triggering serious fraud charges.

₹3,000 Crore Dream Turns into ₹51 Crore Fraud

In a major real estate fraud case, the Economic Offences Wing (EOW) of Mumbai Police has filed a chargesheet against Jadavji Lalji Shah, the 85-year-old co-founder of Anchor Group and Director of Shah Construction Company Ltd. He is accused of criminal breach of trust and cheating involving a ₹51 crore real estate transaction gone awry.

The case, rooted in a 2008 agreement, alleges that Shah misappropriated ₹51 crore transferred by Ashwin Sheth, the founder of Sheth Developers. The funds were provided as an advance to jointly develop a 70-acre land parcel in Ambivli, located in Andheri (West). The ambitious project was projected to generate over ₹3,000 crore in returns. However, the venture never materialized, and the land remained undeveloped.

Anchor Leasing Used to Divert Trust Funds

Sprouts News Investigation Team (SIT) has reviewed the EOW chargesheet, which reveals that Shah rerouted ₹40 crore from the deal to the Gala family, with an additional ₹10 crore invested in mutual funds. The remaining amount reportedly earned over ₹1.06 crore in personal interest, indicating the misuse of funds meant to be held in trust.

All transactions were allegedly channeled through Anchor Leasing, a company where Shah held a directorial role. This deliberate rerouting raised multiple red flags, showing a clear conflict of interest and abuse of fiduciary responsibility.

Click Here To Download the News Attachment

Misrepresentation of Land Ownership and Nature

According to the police chargesheet, Shah was well aware of the land’s legal limitations. The Ambivli land was classified as Class 2, designated for industrial and labour housing purposes. Additionally, it was not solely owned by Shah, but jointly held by his family and other shareholders.

Despite this, Shah is said to have misrepresented the land’s title, ownership structure, and permissible usage, to gain Sheth’s confidence and secure the ₹51 crore advance. The EOW states this concealment was intentional, forming the basis of the cheating allegation.

Case Registered After 16 Years

The matter came to light officially in November 2024, when Ashwin Sheth approached the EOW with a complaint. Sheth claims that his team was initially assured development within six years, but the project faced repeated delays. Shah’s group blamed tax disputes and a High Court case, but no real development took place.

Sprouts News Investigation Team (SIT) found that the land was never eligible for immediate residential development—contradicting what was promised. This delay strategy, according to investigators, was a part of the alleged deception.

Also Read: Exclusive: BJP’s Prafulla Lodha Arrested Under POCSO in Honey Trap Case.

Sprouts SIT Calls for Regulatory Overhaul

This case once again highlights the regulatory grey zones in real estate trust funding, especially when Special Purpose Vehicles (SPVs) are promised but never constituted. The Sprouts News Investigation Team (SIT) urges authorities like Maharashtra RERA, SEBI, and the Registrar of Companies to tighten due diligence norms for such large-scale property development deals.

Industry experts believe this case could set a critical precedent in identifying intermediary-led fund misappropriation, especially where elder business figures exploit legal complexity and decades-old corporate structures to evade scrutiny.

• What’s Next?

While Shah, now in his late 80s, has not been arrested yet, the chargesheet paves the way for a possible trial. The EOW may seek to attach properties linked to Anchor Leasing to recover funds. If convicted, Shah could face rigorous imprisonment under IPC Sections 420 (cheating) and 409 (criminal breach of trust).

Sprouts SIT will continue tracking the case to ensure corporate accountability, transparency in land deals, and justice for the defrauded investor.