Gold prices have reached record levels in India. Delhi and Lucknow markets show 24K gold trading at ₹12,589 per gram. The precious metal’s value has surged nationwide, and Mumbai’s market reflects this trend with 24K gold at ₹₹11,869 per gram. Delhi and Lucknow’s 22K gold trades at ₹11,540 per gram, while Mumbai reports slightly lower rates at ₹11,500 per gram.

- Gold Prices Hit Record High Across India

- Gold Prices Hit Record High Across Every states of India

- 24K gold price in India crosses ₹12,589 per gram

- 22K gold rate today sees sharp rise in major cities

- Gold rate today in Delhi, Mumbai, and Lucknow compared

- What is Driving the Surge in Gold Prices?

- Global economic uncertainty boosts gold demand

- Rupee depreciation affects gold imports

- Increased investor interest in safe-haven assets

- How Do 24K, 22K, and 18K Gold Rates Differ Today?

- Today gold rate (24 carat) vs 22 carat vs 18kt gold rate today

- Why 24K gold commands a premium

- Usage and durability differences by purity

- How Are Gold Prices Calculated in India?

- Role of IBJA and bullion associations

- Impact of GST, import duty, and making charges

- How jewelers arrive at final price per gram

- How Can You Invest in Gold Amid Rising Prices?

- Physical gold: coins, bars, and jewelry

- Digital gold and gold ETFs

- Sovereign Gold Bonds and their tax benefits

- What Should Buyers Consider Before Purchasing Gold?

- Check BIS hallmark and purity

- Compare gold rate live across platforms

- Understand making charges and tax implications

- Conclusion

- FAQs

The market for 18K gold has shown most important increases too. Buyers in Delhi and Lucknow will find rates at ₹8,668 per gram, and Mumbai’s prices stand at ₹8,653 per gram. Local market conditions create these small price variations between cities. The market has responded strongly to the 3% GST on gold jewelry and coins, combined with the 15% customs duty on imported gold bars. These price levels represent one of the strongest rallies in recent history, and buyers and investors should monitor these market conditions carefully.

Let’s get into what’s behind this gold price surge and see how rates differ among Indian cities. You’ll learn about how these changes might affect your buying or investment plans. The current gold rate patterns matter a lot if you plan to buy jewelry or want to use gold as a safe-haven asset.

Gold Prices Hit Record High Across India

The Indian gold market has seen wild swings in September 2025. The 24-carat gold prices have broken all previous records. Gold prices have shot up all month, with the last week showing the most dramatic changes.

Gold Prices Hit Record High Across Every states of India

24K gold price in India crosses ₹12,589 per gram

Gold prices in India have made history. The 24-carat gold has firmly crossed the ₹12,589 per gram mark. Right now, on September 24, 2025, you’ll pay ₹12,589 for a gram of 24-carat gold. Some sources say prices have gone even higher – up to ₹12,879 per gram. These numbers are staggering compared to last year’s price of ₹7,633 per gram.

The recent price surge tells quite a story. Between September 19-23, 24-carat gold prices jumped by almost ₹29,000 per 100 grams. The MCX Spot gold price has skyrocketed from ₹73,000 in September 2024 to a whopping ₹1,09,388 for 10 grams of 24-carat gold. That’s a 50% jump in just one year.

22K gold rate today sees sharp rise in major cities

The 22-carat gold market hasn’t been quiet either. Mumbai’s trading shows 22-carat gold at ₹10,575 per gram. These prices have climbed sharply from previous months.

The last five days of trading have been intense for 22-carat gold. September 23 saw prices jump by ₹1,150 per 10 grams, reaching ₹104,800. The market’s momentum is clear – in just four days (September 19-23), prices went up by ₹11,500 per 100 grams.

Daily price changes have become more dramatic. The numbers show that 22-carat gold prices jumped 1.74% on September 23 alone. This shows just how active the gold investment market has become.

Gold rate today in Delhi, Mumbai, and Lucknow compared

Gold prices vary slightly across India’s major cities:

- Delhi: 24-carat costs ₹11,552 per gram, 22-carat at ₹10,590 per gram

- Mumbai: 24-carat sits at ₹11,537 per gram, 22-carat at ₹10,575 per gram

- Lucknow: Matches Delhi’s prices exactly – 24-carat at ₹11,552 per gram and 22-carat at ₹10,590 per gram

Chennai tops the list with the highest prices – 24-carat gold sells for ₹11,564 per gram. That’s ₹27 more per gram than Mumbai. Bangalore, Hyderabad, and Kolkata all have the same price: ₹11,537 per gram for 24-carat gold.

These price differences come from local taxes, transport costs, and how much people want to buy in each area. Yet all major Indian cities now sell 24-carat gold above ₹11,500 per gram.

The latest market update shows a small dip on September 24. The 24-carat gold price dropped by ₹32 per gram from September 23. This looks like a tiny correction after the big price rally.

Market experts still see prices going up as festival season gets closer. With Diwali and wedding season around the corner, more people will want to buy gold. This could push prices even higher in the next few weeks.

What is Driving the Surge in Gold Prices?

Gold prices are hitting new records in India and around the world. Many factors work together to push these prices up. Let’s look at what’s behind today’s gold rate surge and how economic signs, world events, and market thinking all play a part.

Global economic uncertainty boosts gold demand

The world’s economy has become harder to predict, which sets the stage for gold’s rise. We mainly see this in how conflicts in Europe and the Middle East have made markets nervous. These tensions have led central banks worldwide to buy more gold this year.

This goes beyond just regional conflicts. Recent market data shows investors worry about policy changes and recession risks. They see gold as protection against both slow growth and inflation that markets might face in 2025-2026. Gold’s role as a safe place to invest has grown stronger as markets become shakier.

Central banks buying gold is a big deal right now. The World Gold Council’s 2025 Central Bank Gold Reserves Survey shows 95% of central bankers think global gold reserves will grow this year. Even more telling is that 43% say their own bank will buy more gold – that’s a record high.

Rupee depreciation affects gold imports

A weaker Indian rupee is a vital reason domestic gold rates are up. Gold trades in US dollars worldwide, so a falling rupee makes importing gold more expensive for India. This makes global gold price increases hurt even more.

Money experts think the falling rupee will add about USD 15 billion to India’s import costs. This hits gold imports hard, since gold prices jumped 27% from USD 2,066.26 per ounce in December 2023 to USD 2,617.11 per ounce in December 2024.

This matters a lot for India because we import 70-80% of our gold. So any change in rupee-dollar rates directly changes today’s gold rate. When you combine a weaker rupee with rising global gold prices, Indian buyers feel the pinch twice as much.

Increased investor interest in safe-haven assets

Money has moved toward gold in a big way. Investors are turning to gold as their safe choice when economic and political risks grow. That’s why people buy more gold exactly when they’re selling other investments in panic.

Buying gold is easier than ever before. By early 2025, SPDR Gold Shares ETF (GLD) and its lower-cost version GLDM held over 31.6 million ounces of gold – worth more than INR 7594.24 billion. ETF investments keep growing, with 310 tons added this year, about 10% of all global holdings.

The Federal Reserve’s choice to cut interest rates has made gold more attractive. Lower rates mean there’s less reason to avoid gold just because it doesn’t pay interest. Gold hit an all-time high of INR 312,038.91 per ounce in September 2024, as everyone expected the Federal Reserve to lower rates.

Gold still works well to protect against inflation. It keeps its value over time, which makes it attractive when money loses buying power. This becomes extra important when people worry about currencies getting weaker.

How Do 24K, 22K, and 18K Gold Rates Differ Today?

Gold’s pricing structure changes based on its purity level. You should know these differences to make smart decisions in today’s market, whether you’re buying jewelry or investing.

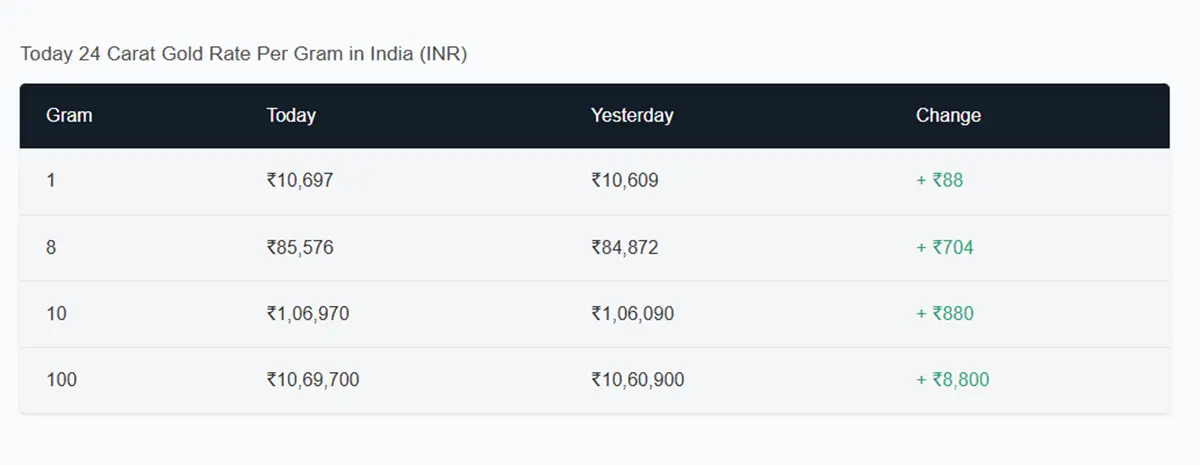

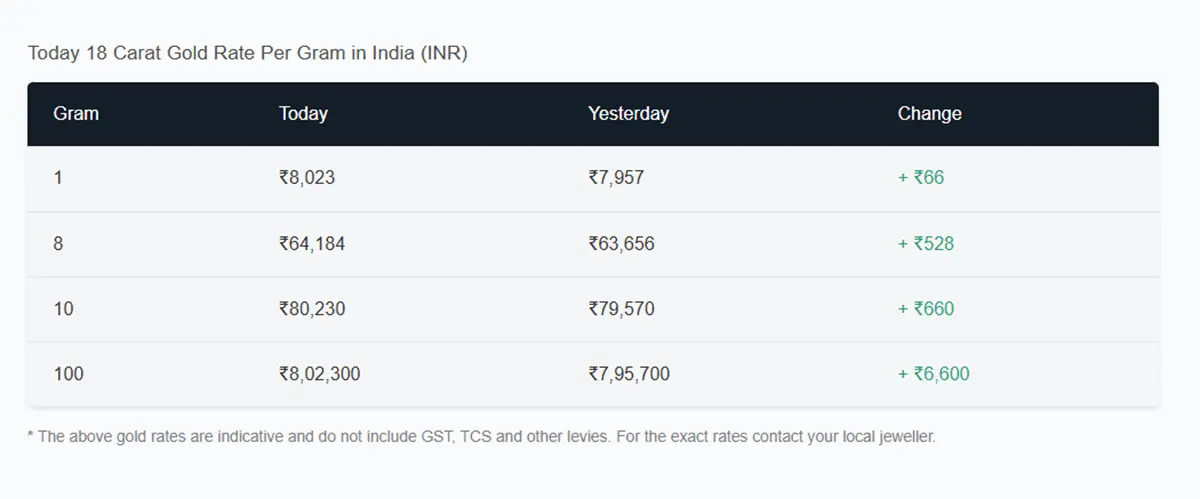

Today gold rate (24 carat) vs 22 carat vs 18kt gold rate today

Gold prices on September 24, 2025, show clear differences between purity levels. A gram of 24-carat gold costs ₹11,648. The price drops to ₹10,677.33 per gram for 22-carat gold. You can get 18-carat gold at ₹8,736 per gram. These prices show how purity directly affects cost.

The price gap becomes more obvious with larger amounts. Ten grams of 24K gold will cost you ₹1,16,480.01. The same amount of 22K gold sells for ₹1,06,773.34. That’s almost a ₹10,000 difference, which shows how much more people pay for higher purity.

Different Indian cities have their own price points. Kolkata sells 24K gold at ₹11,537 per gram, while 22K costs ₹10,575 and 18K is priced at ₹8,653. Local costs, taxes, and market demand create these price differences.

Why 24K gold commands a premium

24K gold costs more because it’s 99.9% pure gold with almost no other metals mixed in. This makes it perfect for investment purposes.

22K gold contains 91.67% pure gold and 8.33% other metals like copper or silver. Pure gold naturally costs more per gram because of this difference. Each karat represents 1/24th of pure gold by weight, which creates a logical pricing system.

24K gold’s premium price makes sense for several reasons. It gives you the most gold for your money. Lower karats mix in cheap base metals worth just pennies per gram, but 24K gold gives you pure precious metal.

Pure gold never tarnishes, unlike 18K gold that contains metals that can oxidize over time. This helps it keep its value better when gold prices rise.

Usage and durability differences by purity

Each gold purity level works best for different uses. 24K gold’s extreme softness limits its everyday jewelry use. People mostly buy it as gold coins, bars, and digital gold.

22K gold hits the sweet spot for jewelry. It mixes 91.6% gold with silver, copper and sometimes zinc. This blend stays strong enough to hold detailed designs and gemstones. That’s why Indian weddings and festivals feature so much 22K gold jewelry, from bangles to bridal sets.

18K gold, with 75% pure gold, gives you even more durability while looking luxurious. It resists scratches better than purer options, making it great for diamond jewelry and everyday pieces.

These durability differences matter in real life. 24K gold’s softness limits its jewelry use, but people with sensitive skin love it. The metals mixed into 22K and 18K gold make them tough enough for daily wear while keeping that golden look everyone wants.

Today’s gold buyers should look beyond just price per gram. Think about how you’ll use it, how long it needs to last, and what look you want from different purity levels.

How Are Gold Prices Calculated in India?

Gold price calculation in India works through many connected factors that end up setting what you pay at the jewelry counter. The pricing system takes international measures and adds local taxes and charges to reach the final retail price.

Role of IBJA and bullion associations

The India Bullion and Jewelers Association (IBJA), 104 years old, is the apex organization for all bullion and jewelry associations in the country. IBJA plays a vital role in setting daily gold prices through its gold rate fixing process. The association releases daily Gold AM and PM rates that act as measuring figures for the entire industry.

These IBJA-published rates carry official standing. The government uses these rates as measures for Sovereign Gold Bonds issuance, based on Ministry of Finance and Reserve Bank of India notifications. Banks and NBFCs also use these rates to lend against jewelry, as RBI regulations state.

IBJA’s gold price determination looks at international market conditions and local factors. Their calculations take into account global gold prices, currency changes, and local demand patterns. This all-encompassing approach will give an accurate picture of current market value across India.

Impact of GST, import duty, and making charges

The price you pay for gold has several extra components beyond the base rate. GST on gold in India is 3% (split as 1.5% CGST + 1.5% SGST). This rate applies to all forms of gold, including jewelry, coins, and bars.

Imported gold faces customs duties that affect pricing. The current import duty structure has a 6% charge, with 5% basic customs duty plus 1% Agriculture Infrastructure and Development Cess. This duty was higher at 15% earlier but dropped to stop smuggling and line up domestic prices with global rates.

Making charges are another big part of the final price. These charges usually range from 8% to 20% of the base gold value, based on design complexity. Intricate pieces can cost much more because of the craftsmanship involved.

How jewelers arrive at final price per gram

Jewelers use a standard formula to calculate the final price per gram:

Price of Gold Jewelry = (Gold Rate per Gram × Weight of Gold) + Making Charges + Taxes

They follow these steps:

- Determine base gold price: Multiply current gold rate per gram by the jewelry’s weight

- Add making charges: Use either a percentage of base price or fixed amount per gram

- Calculate GST: Add 3% GST on the total of base gold price and making charges

- Compute final price: Add all components together

Here’s a real example: Take a 10-gram 22K gold item priced at ₹47,300 per 10 grams (or ₹4,730 per gram):

- Base gold price: ₹4,730 × 9 grams = ₹42,570

- Making charges (8%): ₹3,405.60

- Subtotal: ₹45,975.60

- GST (3%): ₹1,379

- Final price: ₹47,354.60

Most jewelers use this simple formula, though there’s no universal invoicing pattern across the sector. Local jewelry associations in each city announce the day’s gold rate every morning for retailers to reference.

Smart buyers should look at all these components carefully. Making charges can vary a lot between retailers, so it’s worth comparing prices across different jewelers.

How Can You Invest in Gold Amid Rising Prices?

Gold prices have hit record highs, and smart investors are now looking at different ways to add this precious metal to their portfolios. You can benefit from gold’s stability during market ups and downs through traditional physical ownership or newer digital options.

Physical gold: coins, bars, and jewelry

Physical gold remains a popular choice among investors, and each form comes with its own benefits. Gold bars give you the best value since they contain 24-karat gold (99.9% purity) without the extra making charges you’d pay for jewelry. Bars work better than jewelry as an investment because you can sell them more easily in international markets.

Gold coins strike a balance—you can buy them in small units (0.5-1 gram) with high purity. These coins are easier to sell than jewelry since their value depends only on weight and purity. Right now, both coins and bars let you own gold directly without worrying about design changes or fashion trends.

Jewelry serves two purposes: you can wear it and invest in it. But its investment value takes a hit from making charges of 15-20%, plus you might lose 10-20% when reselling because of purity issues. These days, buying physical gold means you need to check the source to make sure you’re getting quality gold.

Digital gold and gold ETFs

Gold Exchange-Traded Funds (ETFs) give you a paperless way to own gold. These funds track gold prices and trade just like shares on stock exchanges. Each ETF unit equals one gram of gold and has actual gold backing it up, but you don’t need to worry about storing it.

ETFs beat physical gold in several ways: they’re easy to buy and sell, show live prices, and you don’t need to worry about theft or purity. They’re also budget-friendly with small expense ratios (about 1%) and no entry or exit fees.

ETF taxes follow clear rules: short-term gains (within 12 months) match your income tax bracket, while long-term gains get taxed at 20% with indexation benefits. Unlike physical gold, ETFs skip VAT and Securities Transaction Tax.

Digital gold platforms let you invest smaller amounts with quick access to your money. This option works well if you don’t want to maintain a demat account.

Sovereign Gold Bonds and their tax benefits

Sovereign Gold Bonds (SGBs) stand out because they have backing from the Reserve Bank of India. These bonds track gold prices and pay you 2.5% interest every six months.

You can start with just one gram of gold, though individuals can’t buy more than 4kg, and trusts are limited to 20kg. The best part? You pay no tax on capital gains when the bonds mature after eight years. Just remember that you’ll still pay regular income tax on the interest.

You can cash out these bonds after five years if needed. Banks will also let you use these bonds as collateral for loans. SGBs give you gold’s security with government backing, making them a great choice for long-term investors worried about rising gold prices.

What Should Buyers Consider Before Purchasing Gold?

Before you buy gold when prices are high, you just need to do your homework to get the best value. Understanding a few significant factors will help you make smarter buying decisions.

Check BIS hallmark and purity

BIS hallmarked gold is the foundation of ensuring authenticity. The Bureau of Indian Standards hallmark shows that gold meets national purity standards. Each piece of hallmarked jewelry comes with a unique six-digit alphanumeric HUID code. You can verify this code through the BIS CARE app on Android and iOS platforms. The verification shows vital details like jeweler registration, assaying center, article type, and exact purity level.

Compare gold rate live across platforms

Gold prices change daily based on many factors like demand, supply, import rates, and currency values. Smart buyers should check current rates in their city before making a purchase. Prices differ between cities because of transportation costs, local taxes, and regional demand. Note that gold’s purity doesn’t affect the GST rate—tax applies to the gold’s value whatever its karatage.

Understand making charges and tax implications

Making charges range from 8-20% of the base gold value based on design complexity. Gold jewelry attracts 3% GST on metal value and 5% GST on making charges. Let’s say you buy gold worth ₹50,000 with making charges of ₹5,000. Your total tax would be ₹1,750 (₹1,500 GST on gold + ₹250 GST on making charges).

Conclusion

Gold prices have reached new heights across India. 24K gold now costs more than ₹11,500 per gram, breaking all previous records. This remarkable rise shows how global economic uncertainty, rupee depreciation, and investors’ preference for safe-haven assets work together. Of course, each major city’s different prices show how local market forces shape today’s gold rates.

Pure 24K, 22K, and 18K gold come with different price tags that show how purity affects their value and use. 24K gold stands as the top investment choice because of its pure form. The jewelry market still prefers 22K gold since it lasts longer and works better for detailed designs.

Buyers need to be smart in this expensive market. Getting BIS hallmarks checked, looking up current rates on different platforms, and knowing all costs including making charges and taxes are crucial before buying gold. On top of that, options like Sovereign Gold Bonds are a great way to get tax benefits while gaining from rising gold prices during these peak periods.

Today’s gold market brings both risks and rewards. High prices might scare away casual buyers, but they confirm gold’s strength as a wealth protector during uncertain times. People buying gold for festivals or as investments just need to think over their timing, purpose, and how they want to invest.

Short-term price drops might happen, but the reasons behind gold’s impressive rise seem here to stay. Then, gold will keep its place as the life-blood of Indian financial planning, whatever the short-term price changes. Knowing how gold gets its value and the many ways to invest in it helps buyers make smart choices in this ever-changing market.

FAQs

Q1. What factors are driving the current surge in gold prices?

The surge in gold prices is primarily driven by global economic uncertainty, geopolitical tensions, and increased investor interest in safe-haven assets. Additionally, the depreciation of the Indian rupee has impacted gold imports, further contributing to the price increase.

Q2. How do 24K, 22K, and 18K gold rates differ?

24K gold is the purest form and commands the highest price, currently around ₹11,648 per gram. 22K gold, which is more commonly used in jewelry, is priced at about ₹10,677 per gram. 18K gold, with lower purity, is available at approximately ₹8,736 per gram. The price differences reflect the varying levels of gold content in each type.

Q3. What should buyers consider before purchasing gold?

Buyers should check for the BIS hallmark to ensure authenticity, compare live gold rates across different platforms, and understand the complete cost structure, including making charges and taxes. It’s also important to consider the purpose of the purchase and explore various investment options like physical gold, ETFs, or Sovereign Gold Bonds.

Q4. How are gold prices calculated in India?

Gold prices in India are calculated based on international gold rates, currency exchange rates, and local factors. The India Bullion and Jewelers Association (IBJA) plays a crucial role in determining daily gold prices. Additional components like GST, import duty, and making charges are then added to arrive at the final retail price.

Q5. What are some alternatives to buying physical gold for investment?

Alternatives to physical gold include Gold ETFs (Exchange-Traded Funds), which offer a paperless way to invest in gold, and Sovereign Gold Bonds, which are government-backed instruments that track gold prices while offering additional interest. Digital gold platforms also allow for smaller investments with instant liquidity.