Motilal Oswal: The King of Frauds

• Exposed in NSEL Scam: Mis-selling and Benami Deals

• SFIO & EOW Nail MOFSL in Multi-Crore Fraud

• SEBI Declares Motilal Oswal ‘Not Fit and Proper’

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

- Motilal Oswal: The King of Frauds

- • Exposed in NSEL Scam: Mis-selling and Benami Deals

- • SFIO & EOW Nail MOFSL in Multi-Crore Fraud

- • SEBI Declares Motilal Oswal ‘Not Fit and Proper’

- SEBI Declares MOFSL Not ‘Fit and Proper’ to Act as Commodity Broker

- ₹25 Lakh Fine for Misuse of Client Funds

- Whistleblower Allegations and Internal Governance Red Flags

- Also Read: Electoral Bond Donor MEIL Accused in Mongol Refinery Project Scam.

- Related Article: Motilal Oswal Faces Backlash Over Alleged Mismanagement.

- Mutual Funds Under Scanner: Mis-selling to Seniors & NRIs

- Sprouts SIT Calls for White Paper on Broker Malpractices

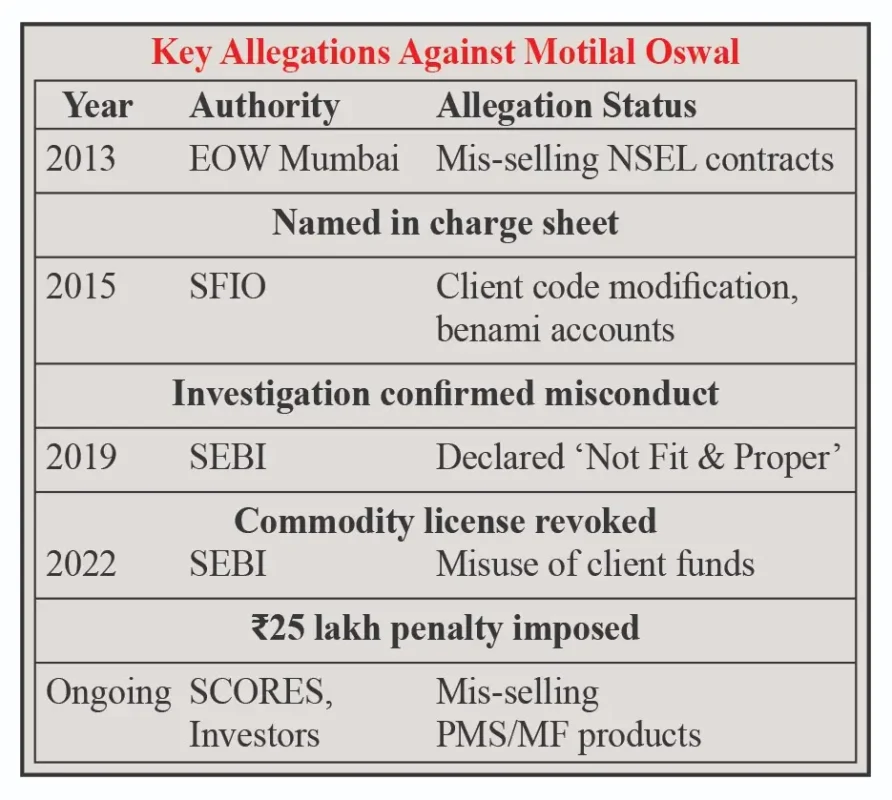

- Key Allegations Against Motilal Oswal

- Despite Regulatory Heat, Motilal Oswal Thrives — Sprouts SIT Calls for Judicial Probe into Broker Malpractices and Regulatory Arbitrage

Motilal Oswal Financial Services Ltd. has faced multiple regulatory actions for mis-selling, KYC manipulation, and misuse of client funds, especially in the ₹5,600 crore NSEL scam. Declared ‘not fit and proper’ by SEBI in 2019, MOFSL continues to operate despite SFIO, EOW, and SEBI findings exposing serious governance and compliance failures.

Motilal Oswal Financial Services Ltd. (MOFSL), once perceived as a trusted name in financial services, has been repeatedly embroiled in high-profile scams and regulatory breaches. Among the most damaging controversies is its involvement in the ₹5,600 crore National Spot Exchange Ltd. (NSEL) scam.

Investigations by the Economic Offences Wing (EOW) of Mumbai Police and the Serious Fraud Investigation Office (SFIO) revealed that MOFSL played a pivotal role in misleading investors by aggressively mis-selling NSEL contracts to clients under the guise of risk-free arbitrage opportunities. These contracts were in fact unregulated forward contracts, completely violating norms.

SFIO’s findings, along with client testimonies and forensic audits, indicated that Know Your Customer (KYC) manipulations, client code modifications, and benami transactions were common practices used by MOFSL to circumvent regulatory oversight. Moreover, black money infusion via its NBFC arm was reportedly routed through the NSEL platform to conceal the source of funds.

SEBI Declares MOFSL Not ‘Fit and Proper’ to Act as Commodity Broker

In February 2019, following repeated recommendations from the SFIO and EOW, the Securities and Exchange Board of India (SEBI) declared Motilal Oswal “not fit and proper” to function as a commodity derivatives broker. This was a major reputational blow for the group, which had long positioned itself as a key market participant in equity and derivatives.

SEBI, in its order, cited MOFSL’s systemic lapses and breach of client trust in dealing with NSEL contracts. The regulator noted that MOFSL had intentionally misled clients, failed to conduct due diligence, and displayed a “wilful disregard” for investor interest. The declaration meant MOFSL could no longer operate in commodity derivative segments regulated by SEBI.

Notably, IIFL, Anand Rathi, Geojit, and other major brokerages were also implicated, but MOFSL’s involvement was termed as “organised and active,” meriting stricter action.

₹25 Lakh Fine for Misuse of Client Funds

In May 2022, SEBI further penalized Motilal Oswal with a ₹25 lakh fine for misutilization of client funds and inaccurate margin reporting. The regulator found that MOFSL had violated multiple provisions of the SEBI Stock Brokers Regulations, 1992, and SEBI Circulars on Client Money.

According to SEBI’s investigation, the brokerage had used client funds for proprietary trading and had failed to segregate client assets from its own. This was in clear contravention of regulatory mandates that seek to protect retail investors from systemic risk.

Such practices not only undermine market stability but also place lakhs of retail investors at potential financial risk—especially when conducted by large institutions like MOFSL.

Whistleblower Allegations and Internal Governance Red Flags

Multiple whistleblower complaints have surfaced over the years, alleging deep-rooted corporate governance failures within MOFSL. Anonymous letters sent to SEBI and the Ministry of Corporate Affairs (MCA) have alleged insider trading, manipulation of profit figures, and conflict of interest in fund management operations.

In one instance, it was alleged that Motilal Oswal’s portfolio management schemes (PMS) misrepresented historical returns and risk factors. While SEBI initiated informal inquiries, no formal penalty has yet been issued. However, the recurrence of such complaints signals persistent opacity in internal governance.

Sprouts News Investigation Team (SIT) reached out to former employees, many of whom described the internal environment as “compliance-averse” and “target-driven to the point of breaking norms.”

Also Read: Electoral Bond Donor MEIL Accused in Mongol Refinery Project Scam.

Related Article: Motilal Oswal Faces Backlash Over Alleged Mismanagement.

Mutual Funds Under Scanner: Mis-selling to Seniors & NRIs

Motilal Oswal’s mutual fund arm has also not remained untouched by controversy. There have been credible complaints of mis-selling of thematic funds and aggressive equity-linked products to senior citizens and NRIs, without adequate risk disclosures.

In one case from 2021, an NRI investor based in Dubai alleged that he was sold a high-risk, small-cap fund under the pretense of a fixed-return product. The complaint was escalated to SEBI’s SCORES portal, where the matter is reportedly still under review.

Sprouts SIT Calls for White Paper on Broker Malpractices

In light of repeated violations and regulatory censure, the Sprouts News Investigation Team (SIT) strongly advocates for the Finance Ministry and SEBI to issue a white paper on broker malpractices, specifically calling out repeat offenders like Motilal Oswal.

It is imperative that client awareness, corporate disclosures, and stringent accountability become the norm in financial markets—especially when large retail pools are involved.

MOFSL’s repeated infractions raise serious concerns about the integrity of India’s capital markets ecosystem and the effectiveness of current enforcement mechanisms.

Key Allegations Against Motilal Oswal

Despite Regulatory Heat, Motilal Oswal Thrives — Sprouts SIT Calls for Judicial Probe into Broker Malpractices and Regulatory Arbitrage

Motilal Oswal Financial Services Ltd. continues to operate across various segments—retail broking, asset management, private equity, and lending—despite being under the scanner of multiple regulatory and investigative agencies. The firm’s ability to withstand reputational damage, and retain licenses in other segments, raises concerns about regulatory arbitrage.

For the sake of investor trust and capital market health, Sprouts News Investigation Team (SIT) reiterates its call for a judicial or parliamentary probe into multi-layered malpractices by brokers like MOFSL, whose financial clout has too often shielded them from meaningful accountability.

O was also cheated by over 20 lakhs my Motilal Oswal forex trading desk in buying n selling of USD N UKL 5 years back.They will call n buy n call n sell and in one month I lost over 20 lakhs as they promised they will recover the losses.I stopped putting more money in them after that.They call me every week when market falls or goes up to put more funds but I refused.Now we know the facts with proof

I can’t but agree with the title of this article! MOFSL is not only “unfit” but they should be taken to the “slaughter house” for manipulation and cheating the Indian Public / investor. It’s sad that the Watchdog only is “watching”. Soon the matter will be settled and hidden under cover and forgotten!!! This is Indian judicial system! Corrupt. It starts from the bottom at NSE……. I’m an investor who was cheated and NSE 2nd Arbitatrial was openly in favour of MOFSL. And I’m not surprised after seeing the poor character of the 2nd set of Arbitrators! Greased palms! !Ahhh, here we come! Sad. Pathetic. Are not Arbitrators to have a clean record of monitoring justice, and independent views without pressure from the top? SAD. PATHETIC. MOSL matters are always closed. Is it difficult to Wonder why?

Sir , I had my Demat account at HDFC since 1990 to 2019. I had very good stocks of leading companies. In 2019 my close relative pressurisd to to shift entire Demat account total value of 1.56 crores from HDFC Bank to Motilal Oswal securities at Prabhadevi office, Mumbai on assuring that:

1. Providing Free service as my assets are more than 50 lakhs.

2. Minimum 25 % growth per year.

3. Relationship Manager would take appropriate decison to do daily transactions . They had opened two SB account at HDFC Bank, Fort branch in my name to assist their Day today grading etc etc. Entire operation was controlled by RM of Motilal Oswal securities.

4. Periodical/ Quarterly report with Hard copies of my assets .

In 2023, I noticed all their promises were false.

In 2023, I started doubting their activities, this I enquired in HDFC Bank Branch where I have my own account about two additional SB accounts which Motilal Oswal securities had opened in my name. They started cautioning me that it is not required. My RM Mr Shinde was asking me to provide OTP regularly for about 3 years. Then I demanded from Shinde that he must send me a email stating for what reason he wants OTP from me. Then he stopped sending OTP request. I doubt my RM Mr Shinde must have moved my Bank balance from my two SB accounts to some where else. Which could be a huge amount.

My learned friends asked me to lodge complaint to Authorities about this scandals . , like Cyber Crime police, SEBI, NSE etc.

Can you please give me an opportunity to meet you personally to submit my complaint against Motilal Oswal securities and hoping to receive necessary

guidance to Book the culprits…

Regards

Charles DSa

8169795479

charlesdsa58@gmail.com