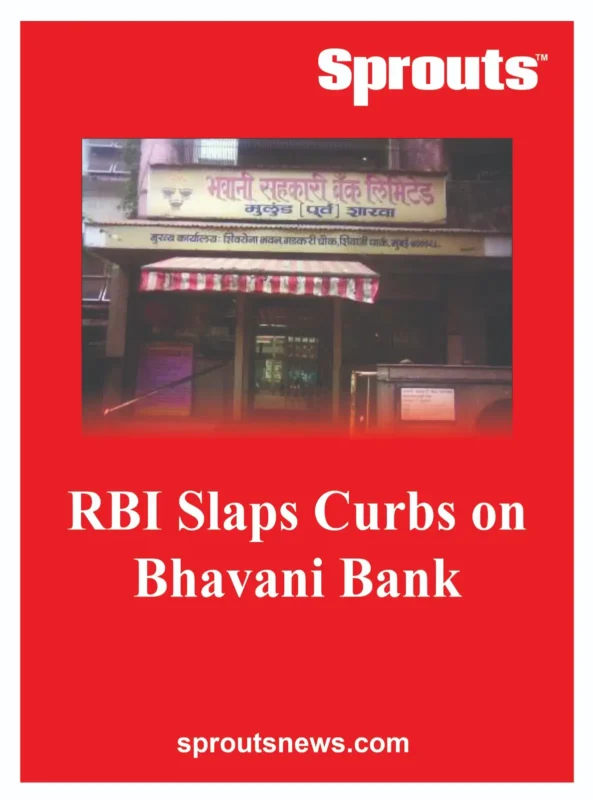

RBI Slaps Curbs on Bhavani Bank

• Founded by Balasaheb Thackeray, the bank now faces restrictions

• Bhavani Bank Faces RBI Heat

• Loan Defaults Hit Thackeray’s Bank

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

The Reserve Bank of India has imposed strict restrictions on Bhavani Sahakari Bank, founded by Balasaheb Thackeray, over poor loan recovery. Citing Section 35A of the Banking Regulation Act, the RBI has barred the bank from issuing loans or making investments. Merger talks and political fallout are now anticipated.

Contents

The Reserve Bank of India (RBI) has imposed strict regulatory restrictions on Bhavani Sahakari Bank Limited, a cooperative bank founded by Shiv Sena supremo Balasaheb Thackeray to support Marathi entrepreneurs. The action comes after serious concerns over the bank’s deteriorating loan recovery performance and financial mismanagement.

On July 4, 2025, the RBI issued a notice under Section 35A of the Banking Regulation Act, 1949, directing the bank to immediately halt key operations including sanctioning loans, investing funds, opening new branches, or disbursing deposits—unless pre-approved by the regulator.

Depositors in Panic as RBI Order Hits Bank’s Core Operations

Bhavani Bank, which has a significant depositor base among auto-rickshaw drivers and small-scale entrepreneurs in Mumbai, is now under scrutiny for failing to recover outstanding loans. The RBI notice has created an atmosphere of uncertainty, especially as a large portion of the bank’s depositors are Shiv Sena loyalists.

The Sprouts News Investigation Team (SIT) has reviewed RBI’s regulatory correspondence and confirmed that the Section 35A order will remain effective for six months, subject to review. As per RBI’s directive, a copy of the restrictions must be publicly displayed on the bank’s premises and website.

Bank insiders say that a series of high-risk unsecured loans and politically driven disbursements were among the key reasons for financial stress. The current directive halts all new loan approvals, investments, and branch expansions, and prohibits any transfer or sale of assets.

Bhavani Bank’s Political Roots and Rapid Urban Expansion

Bhavani Cooperative Bank was founded with the intent to provide accessible financing to the Marathi-speaking population in Mumbai. Initially headquartered at the iconic Shiv Sena Bhavan in Dadar, the bank later expanded operations across the city, establishing over 10 branches including in Ghatkopar, Chembur, and Borivali.

According to documents accessed by the Sprouts News Investigation Team (SIT), the bank had extended loans to several informal-sector workers and small vendors, but a lack of robust recovery mechanisms has led to rising NPAs (Non-Performing Assets). The situation has now escalated to the level of regulatory intervention.

Sources within the bank reveal that many of the board members are office-bearers affiliated with Shiv Sena factions, raising questions over political interference in credit disbursal and debt recovery processes.

Emergency Board Meeting Held, Merger Talks Underway

In response to the RBI action, Bhavani Bank’s Board of Directors convened an emergency meeting on Saturday. According to sources, the agenda included deliberations on RBI’s notice, potential compliance actions, and early-stage merger discussions with Vishweshwar Sahakari Bank Limited, another Maharashtra-based cooperative institution.

Insiders suggest that while a merger remains speculative, it could be a viable path to protect depositors and preserve the bank’s legacy, especially given the political weight behind its foundation.

Key RBI Restrictions Under Section 35A Explained

As per the RBI’s July 4 directive, the following restrictions apply to Bhavani Cooperative Bank:

•No new loans or advances without prior RBI approval

•No fresh investments or opening of new branches

•No payment or contractual commitment without clearance

•No sale or transfer of bank property or assets

These measures are aimed at preventing further financial deterioration while allowing time for restructuring or possible regulatory reconciliation.

Also Read: Tirupati Temple Board Firm on ‘Hindu Staff‑Only’ Stand Amid Suspensions.

Regulatory and Political Fallout Expected

The RBI’s action is likely to spark political debate across Maharashtra, especially within Shiv Sena factions and cooperative banking circles. Questions are being raised about regulatory oversight, management accountability, and the politicization of cooperative finance institutions.

The Sprouts News Investigation Team (SIT) has learned that while the RBI has so far avoided recommending a forensic audit, it may consider such steps if compliance reports remain unsatisfactory or if depositors begin withdrawing en masse.

Experts warn that this incident underlines the fragile health of several politically managed cooperative banks in Maharashtra. With upcoming local body elections, Bhavani Bank’s regulatory crisis may become a flashpoint in political discourse over economic governance.

A Legacy at Risk

Once envisioned by Balasaheb Thackeray as a financial pillar for Mumbai’s Marathi-speaking entrepreneurs, Bhavani Sahakari Bank now stands at a crossroads. Regulatory scrutiny, financial mismanagement, and political pressures have put its credibility and survival in jeopardy.

As the RBI monitors compliance and the board explores restructuring or merger options, the immediate concern remains the safety of public deposits and restoring stakeholder trust.