₹12 Lakh Crore Written Off by PSBs in a Decade

• Wilful Defaults Soar, Banks Bleed

• Public Banks, Private Losses: Loan Crisis Deepens

• Sprouts SIT Exposes Loan Write-Off Reality

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

India’s public sector banks have written off ₹12.08 lakh crore in bad loans over the past decade, with 1,629 wilful defaulters owing ₹1.63 lakh crore. Despite continued recovery efforts, actual recoveries remain low. Sprouts News Investigation Team (SIT) highlights growing concerns over credit risk, transparency, and weak enforcement in PSB lending.

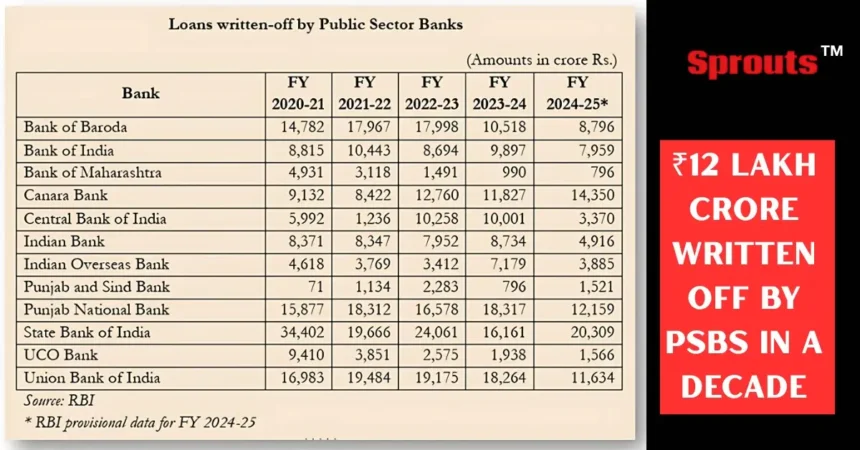

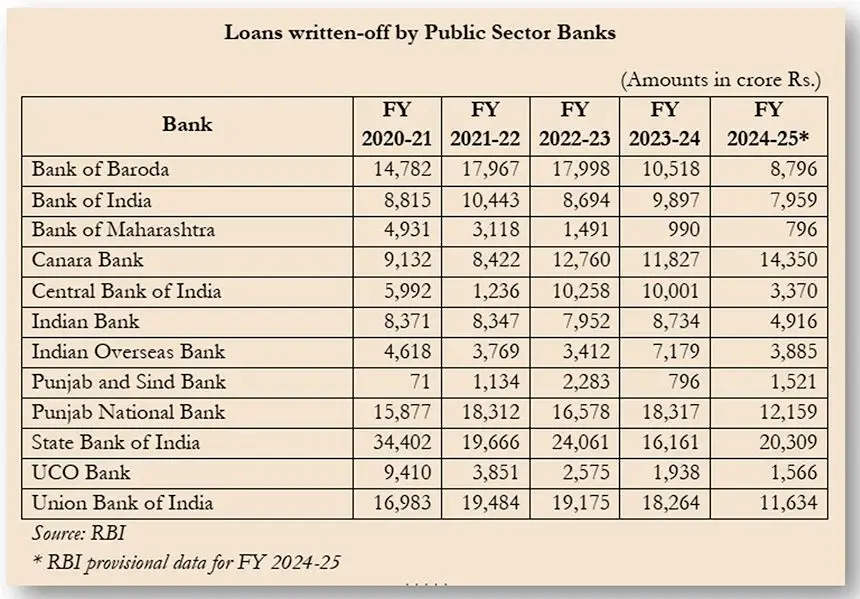

Public Sector Banks Wipe Out ₹12.08 Lakh Crore in Bad Loans Over 10 Years

India’s 12 public sector banks (PSBs) have written off an astonishing ₹12.08 lakh crore in bad loans between FY2015–16 and FY2024–25. This was revealed in a written reply by Minister of State for Finance Pankaj Chaudhary in the Rajya Sabha, responding to a question raised by MP Ritabrata Banerjee. The revelation highlights a decade-long pattern of large-scale loan write-offs by the country’s largest State-owned lenders.

Alongside this, data tabled in Parliament confirmed that 1,629 wilful defaulters, as identified by PSBs, collectively owe ₹1.63 lakh crore as of 31 March 2025. These figures offer a stark snapshot of India’s mounting challenge with bad loans, raising urgent concerns about the effectiveness of recovery frameworks and the credibility of credit risk assessments.

Click Here To Download the News Attachment

State Bank of India Tops Write-Off List; Others Trail Closely

According to Reserve Bank of India (RBI) data annexed to the response, ₹2.9 lakh crore was written off in just the last five financial years. State Bank of India (SBI) alone accounted for ₹1.14 lakh crore of this, including a provisional ₹20,309 crore in FY24–25. Other top contributors include Union Bank of India (₹85,540 crore), Punjab National Bank (₹81,243 crore), and Bank of Baroda (₹70,061 crore).

Canara Bank’s rising trend is notable—its write-offs increased from ₹8,422 crore in FY21–22 to ₹14,350 crore in FY24–25. While these numbers are book-cleansing exercises, their sheer volume has triggered significant scrutiny from oversight bodies, civil society, and independent watchdogs like the Sprouts News Investigation Team (SIT).

Write-Offs Legal but Recovery Remains Sluggish

The Finance Ministry clarified that loan write-offs follow RBI guidelines, which allow banks to remove non-performing assets (NPAs) from their balance sheets after full provisioning—typically after four years of default. Minister Chaudhary emphasized that this does not imply a waiver of borrower obligations, and that recovery efforts remain in motion.

PSBs are said to be pursuing legal recovery through civil courts, Debt Recovery Tribunals (DRTs), SARFAESI Act, and the Insolvency and Bankruptcy Code (IBC). However, Sprouts SIT finds that actual recovery of written-off loans remains abysmally low, and that the opacity in recovery data fuels public distrust.

Despite official statements, the Ministry’s reply did not provide a granular breakup of recovered amounts, further complicating transparency efforts. Experts argue that this lack of disclosure enables continued inaction against large, politically connected defaulters.

Concerns Over Moral Hazard and Repeat Offenders

The overuse of loan write-offs has once again sparked debate on moral hazard—the tendency of habitual defaulters to assume they’ll face no real consequence. While write-offs help banks meet regulatory norms and improve balance sheets, they also reduce accountability for well-connected borrowers.

This raises questions about the integrity of the 4R strategy (Recognition, Resolution, Recapitalisation, and Reform) repeatedly cited by the government as a systemic solution. The Sprouts News Investigation Team (SIT) notes that when the cumulative loan write-off reaches ₹12 lakh crore in under a decade, the effectiveness of this framework demands serious re-evaluation.

₹1.63 Lakh Crore Owed by 1,629 Wilful Defaulters

In a separate query by MP Sagarika Ghose, the Finance Ministry confirmed that as of 31 March 2025, 1,629 borrowers—excluding overseas individuals—have been declared wilful defaulters by PSBs, with a combined outstanding of ₹1,62,961 crore. These individuals have been reported to Credit Information Companies (CICs) as mandated by RBI regulations.

Such defaulters face multiple deterrents: a five-year ban from accessing fresh credit and capital markets, ineligibility for loan restructuring, and potential criminal prosecution in severe cases. In cases involving absconders, the Fugitive Economic Offenders Act (FEOA), 2018, has been invoked.

According to the government, nine individuals have so far been declared fugitive economic offenders, and assets worth over ₹25,806 crore have been seized and restituted to banks, including ₹16,000 crore under the Prevention of Money Laundering Act (PMLA) and FEOA.

Also Read: Edelweiss Turns Nido, Turns Rogue — Loan Fraud, Forgery & Stolen Home Exposed.

Systemic Gaps and Public Sector Lending Challenges Persist

The alarming figures reinforce the long-standing concern that recovery mechanisms remain structurally weak. The Sprouts SIT observes that despite multiple regulatory reforms, actual enforcement and penal action against top-tier defaulters remains slow and fragmented.

While the government emphasizes the need for a healthy write-off process to unlock fresh capital, the disconnect between write-off and recovery undermines public trust in PSBs. Stakeholders are now demanding greater accountability, improved loan appraisal systems, and real-time transparency in post-write-off recoveries.

Time for a Policy Reset

India’s public banking system is at an inflection point. The sheer volume of loan write-offs, coupled with poor recovery, suggests that systemic loopholes are being exploited. Until enforcement agencies and PSBs align with efficiency and integrity, write-offs will continue to function more as an escape route for defaulters than a solution for lenders.

Sprouts News Investigation Team (SIT) calls for immediate reforms in credit risk governance, mandatory public disclosure of recovery performance, and a watchdog mechanism independent of internal bank audits to restore balance in India’s banking ecosystem.