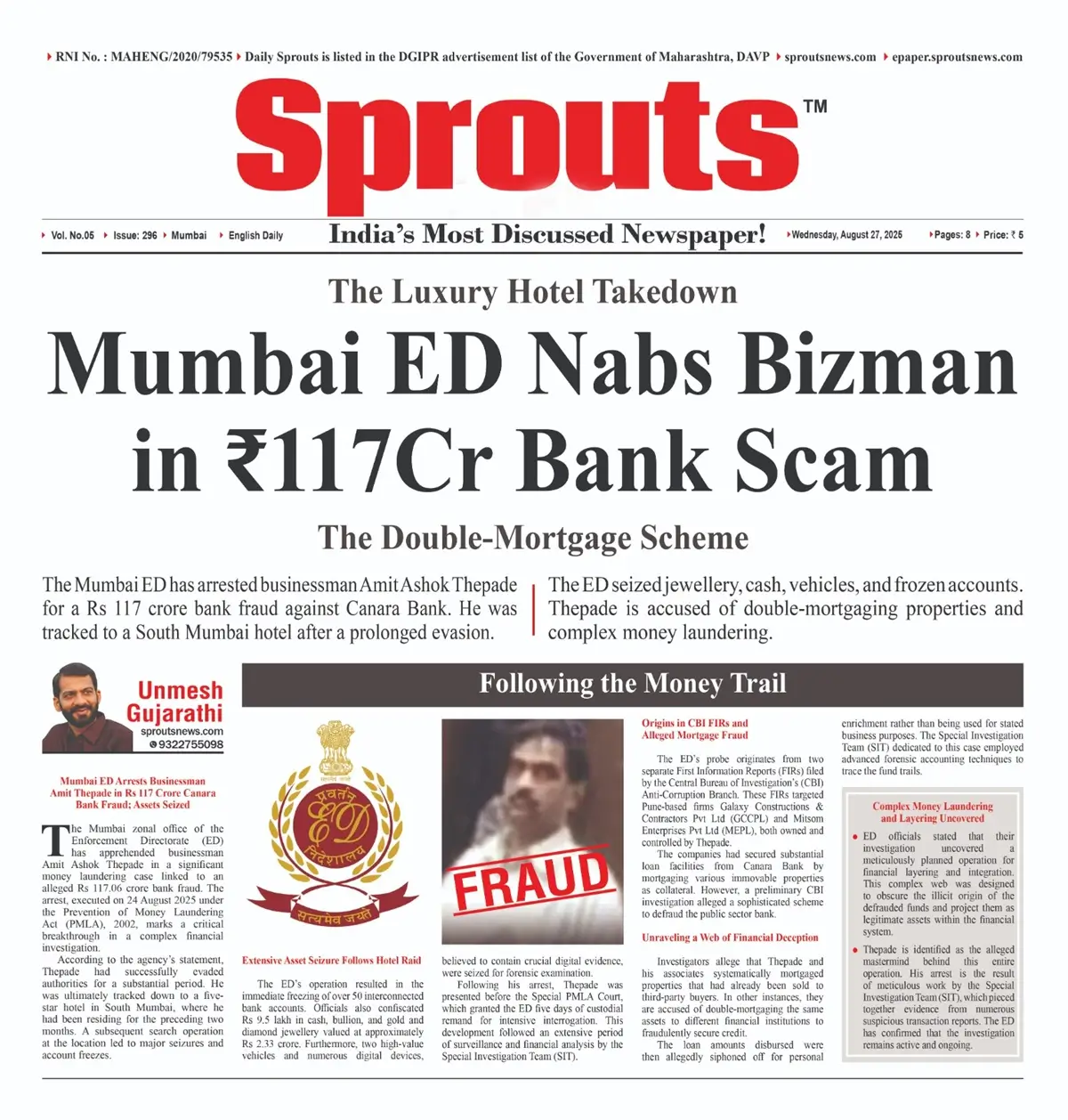

Mumbai ED Nabs Bizman in ₹117Cr Bank Scam

• The Luxury Hotel Takedown

• The Double-Mortgage Scheme

• Following the Money Trail

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

- Mumbai ED Nabs Bizman in ₹117Cr Bank Scam

- Mumbai ED Arrests Businessman Amit Thepade in Rs 117 Crore Canara Bank Fraud; Assets Seized

- Extensive Asset Seizure Follows Hotel Raid

- Origins in CBI FIRs and Alleged Mortgage Fraud

- Unraveling a Web of Financial Deception

- Complex Money Laundering and Layering Uncovered

The Mumbai ED has arrested businessman Amit Ashok Thepade for a Rs 117 crore bank fraud against Canara Bank. He was tracked to a South Mumbai hotel after a prolonged evasion. The ED seized jewellery, cash, vehicles, and frozen accounts. Thepade is accused of double-mortgaging properties and complex money laundering.

Click Here To Download the News Attachment

Mumbai ED Arrests Businessman Amit Thepade in Rs 117 Crore Canara Bank Fraud; Assets Seized

The Mumbai zonal office of the Enforcement Directorate (ED) has apprehended businessman Amit Ashok Thepade in a significant money laundering case linked to an alleged Rs 117.06 crore bank fraud. The arrest, executed on 24 August 2025 under the Prevention of Money Laundering Act (PMLA), 2002, marks a critical breakthrough in a complex financial investigation.

According to the agency’s statement, Thepade had successfully evaded authorities for a substantial period. He was ultimately tracked down to a five-star hotel in South Mumbai, where he had been residing for the preceding two months. A subsequent search operation at the location led to major seizures and account freezes.

Extensive Asset Seizure Follows Hotel Raid

The ED’s operation resulted in the immediate freezing of over 50 interconnected bank accounts. Officials also confiscated Rs 9.5 lakh in cash, bullion, and gold and diamond jewellery valued at approximately Rs 2.33 crore. Furthermore, two high-value vehicles and numerous digital devices, believed to contain crucial digital evidence, were seized for forensic examination.

Following his arrest, Thepade was presented before the Special PMLA Court, which granted the ED five days of custodial remand for intensive interrogation. This development followed an extensive period of surveillance and financial analysis by the Special Investigation Team (SIT).

Origins in CBI FIRs and Alleged Mortgage Fraud

The ED’s probe originates from two separate First Information Reports (FIRs) filed by the Central Bureau of Investigation’s (CBI) Anti-Corruption Branch. These FIRs targeted Pune-based firms Galaxy Constructions & Contractors Pvt Ltd (GCCPL) and Mitsom Enterprises Pvt Ltd (MEPL), both owned and controlled by Thepade.

The companies had secured substantial loan facilities from Canara Bank by mortgaging various immovable properties as collateral. However, a preliminary CBI investigation alleged a sophisticated scheme to defraud the public sector bank.

Also Read: How a Fake IT Firm at Hinjawadi IT Park Duped Job Seekers.

Unraveling a Web of Financial Deception

Investigators allege that Thepade and his associates systematically mortgaged properties that had already been sold to third-party buyers. In other instances, they are accused of double-mortgaging the same assets to different financial institutions to fraudulently secure credit.

The loan amounts disbursed were then allegedly siphoned off for personal enrichment rather than being used for stated business purposes. The Special Investigation Team (SIT) dedicated to this case employed advanced forensic accounting techniques to trace the fund trails.

Complex Money Laundering and Layering Uncovered

ED officials stated that their investigation uncovered a meticulously planned operation for financial layering and integration. This complex web was designed to obscure the illicit origin of the defrauded funds and project them as legitimate assets within the financial system.

Thepade is identified as the alleged mastermind behind this entire operation. His arrest is the result of meticulous work by the Special Investigation Team (SIT), which pieced together evidence from numerous suspicious transaction reports. The ED has confirmed that the investigation remains active and ongoing.