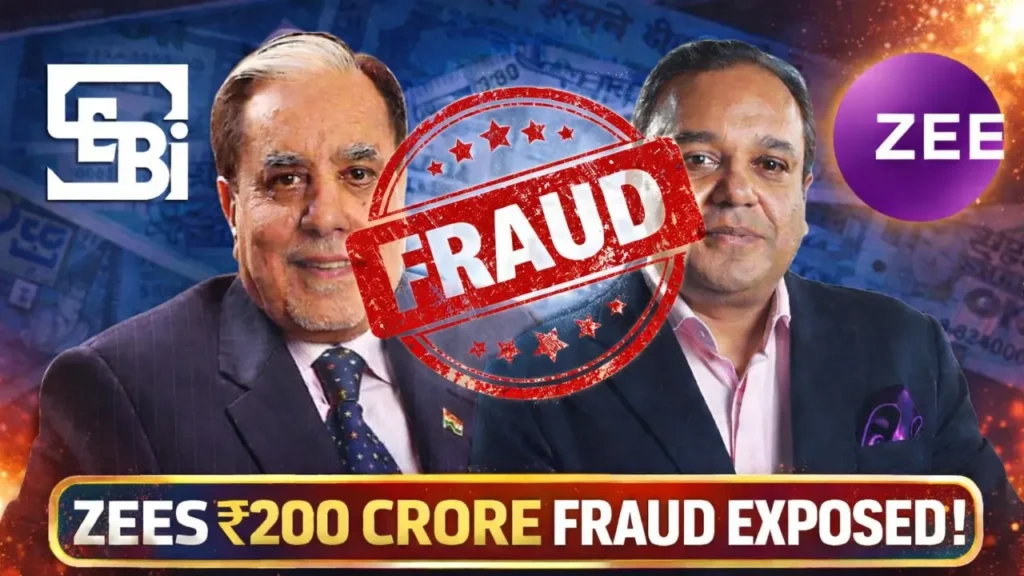

SEBI has issued a show cause notice to Zee Entertainment Enterprises Ltd, questioning alleged fund diversion and corporate governance lapses. The notice also names chairman emeritus Subhash Chandra, CEO Punit Goenka and several related entities. The case relates to fixed deposit adjustments involving Yes Bank and transactions linked to group companies. Zee has denied wrongdoing and said it will respond legally. The matter is now under regulatory examination, with potential implications for disclosure norms, related party transactions and investor confidence in India’s listed media sector.

SEBI Show Cause Notice to Zee Entertainment: Fund Diversion and Corporate Governance Under Scanner

SEBI show cause notice to Zee Entertainment has intensified regulatory scrutiny around one of India’s largest media companies. The market regulator has questioned alleged fund diversion and governance failures at Zee Entertainment Enterprises Ltd.

The notice, dated 12 February 2026, also names chairman emeritus Subhash Chandra, chief executive officer Punit Goenka, and 84 other entities and individuals.

According to regulatory sources, the action stems from long standing concerns over related party transactions, fixed deposit adjustments, and internal approvals that allegedly bypassed standard corporate governance protocols.

Zee Entertainment has denied the allegations. In a statement to media outlets, the company said it will file an appropriate response and remains confident of a fair and objective examination.

The broadcaster also stated that it would take necessary legal steps to safeguard shareholder interests, signalling a possible prolonged legal and regulatory battle.

Yes Bank Fixed Deposit Adjustment and Essel Group Linkages Explained

The controversy traces back to events beginning in 2018 and resurfacing publicly in 2019 when independent directors flagged concerns regarding financial decisions involving group entities.

In November 2019, two independent directors resigned after raising issues linked to the adjustment of fixed deposits held by Zee Entertainment with Yes Bank.

The core issue centred on a letter of comfort issued on 4 September 2018 by Subhash Chandra, then chairman of both Zee Entertainment and the Essel Group.

This letter supported credit facilities availed by certain group companies from Yes Bank, without, according to regulatory findings, full disclosure to the entire board of Zee Entertainment.

Subsequently, Yes Bank adjusted a fixed deposit of Rs200 crore belonging to Zee Entertainment to settle dues of seven associate entities owned and controlled by promoter family members.

In its response to SEBI, the company maintained that the Rs200 crore was later repaid by the concerned associate entities during September and October 2019.

However, a detailed analysis of bank statements, cited in a June 2023 regulatory order, suggested that much of the funds repaid had indirectly originated from Zee Entertainment or other listed Essel Group companies.

The funds allegedly moved through layered transactions before reaching the associate entities and eventually returning to Zee Entertainment, raising questions over round tripping and disclosure standards.

Corporate Governance, SEBI Investigation and Market Implications

The role of Securities and Exchange Board of India is central in this unfolding matter, as the regulator evaluates whether disclosure norms and fiduciary duties were compromised.

Corporate governance experts note that letters of comfort, while not always illegal, require transparent board level approval and clear shareholder communication, particularly when listed entities are involved.

If proven, the alleged diversion of funds and inadequate disclosure could amount to violations of listing regulations, related party transaction norms, and duties of independent directors.

For investors, the case underscores persistent concerns around promoter driven structures within Indian conglomerates where operational and financing boundaries between listed and unlisted entities often blur.

The timing of the notice is significant, as the media sector faces consolidation pressures, digital transformation challenges, and heightened scrutiny from regulators and institutional investors.

Market analysts believe that regulatory clarity will be crucial for restoring confidence, especially among foreign portfolio investors closely monitoring governance standards in Indian listed companies.

The Sprouts News Special Investigation Team will continue to track official filings, responses submitted to SEBI, and any adjudication orders that may follow in the coming months.

At this stage, a show cause notice represents the beginning of adjudicatory proceedings, not a final finding of guilt. The outcome will depend on documentary evidence and legal submissions.

Nevertheless, the case serves as a critical reminder that corporate governance lapses, even if technical, can escalate into major regulatory crises affecting valuation, reputation, and long term investor trust.

Also Read: Court Grants Bail to Raj Kundra in ₹150 Crore Bitcoin Case.

Controversies:

1. Yes Bank Fixed Deposit Adjustment Case (2018–2019)

In 2018, a letter of comfort was issued by Subhash Chandra to support loans taken by Essel Group entities from Yes Bank.

Subsequently, fixed deposits worth ₹200 crore belonging to Zee Entertainment Enterprises Ltd were adjusted by the bank against dues of related entities.

The matter triggered resignations of independent directors in 2019 and led to a regulatory probe by Securities and Exchange Board of India.

2. SEBI Interim Order and Governance Restrictions (2023)

In June 2023, SEBI passed an interim order restraining Subhash Chandra and Punit Goenka from holding directorial or key managerial positions in listed companies over alleged fund diversion and governance lapses.

SEBI alleged that funds of Zee Entertainment were routed to promoter linked entities. Both denied wrongdoing and challenged the order before the Securities Appellate Tribunal.

3. Essel Group Debt Crisis (2019)

The Essel Group faced a severe liquidity crisis in 2019 after promoter share pledges were invoked by lenders.

The crisis led to large scale debt restructuring efforts, asset sales, and concerns among investors regarding financial transparency and leverage practices.

4. Zee Sony Merger Collapse (2022–2024)

The proposed merger between Zee Entertainment and Sony’s India unit collapsed amid governance disputes and regulatory scrutiny.

Sony reportedly raised concerns regarding ongoing investigations and management continuity issues, which became a significant setback for Zee’s strategic restructuring plans.

5. Corporate Governance and Independent Director Resignations

Over the years, Zee witnessed resignations of independent directors citing governance concerns and disclosure issues.

Such resignations intensified scrutiny from institutional investors and proxy advisory firms over board independence and related party transactions.

Readers’ Appeal:

If you have verified information or documents related to this matter, contact 9322755098.

Unmesh Gujarathi, investigative journalist, welcomes credible leads in the public interest.