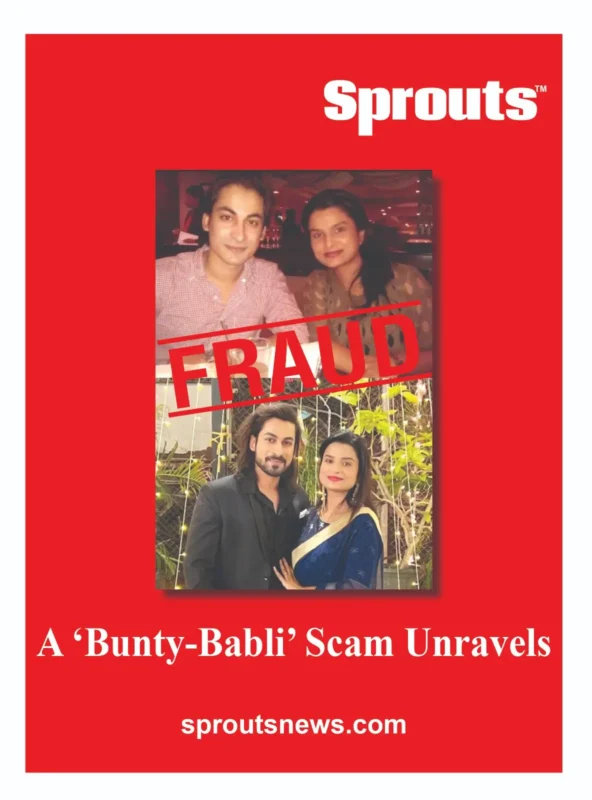

Mahabharat Actor Aayush Shah Files Cheating, Forgery Case in MyFledge ₹4.44 Crore Investment Scam

• A ‘Bunty-Babli’ Scam Unravels: Mahabharat Actor Aayush Shah Files ₹4.44 Crore MyFledge Fraud Case

• The Anatomy of the MyFledge Investment Fraud Scheme

• From Collaboration to Court: How the Alleged Scam Unfolded

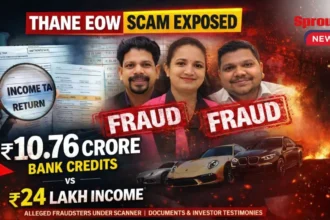

Mahabharat actor Aayush Shah has filed a cheating and forgery case in Mumbai against MyFledge Private Limited’s directors and family members over a ₹4.44 crore investment fraud. The complaint alleges cheating, forgery, and criminal conspiracy involving forged ICICI bank statements, fake property papers, and bounced cheques. Filed under multiple sections of the Bharatiya Nyaya Sanhita, the case intensifies scrutiny on the accused, who reportedly face similar FIRs across India for financial misconduct.

- Mahabharat Actor Aayush Shah Files Cheating, Forgery Case in MyFledge ₹4.44 Crore Investment Scam

- • A ‘Bunty-Babli’ Scam Unravels: Mahabharat Actor Aayush Shah Files ₹4.44 Crore MyFledge Fraud Case

- • The Anatomy of the MyFledge Investment Fraud Scheme

- • From Collaboration to Court: How the Alleged Scam Unfolded

- Mahabharat Actor Aayush Shah Files Multi-Crore Cheating Case Against MyFledge Directors in Mumbai

- The Anatomy of an Alleged Investment Fraud Scheme

- From Professional Projects to Financial Fraud Allegations

- MyFledge’s Nationwide Operation and Fabricated Credentials

- Cheque Bounce Revelations and Document Forgery

- MyFledge Directors Face Multiple Legal Battles Across India

- Intimidation Tactics and Media Threats Alleged

- Broader Implications for Education and Investment Sectors

- Legal Proceedings and Future Developments

Click Here To Download the News Attachment

Mahabharat Actor Aayush Shah Files Multi-Crore Cheating Case Against MyFledge Directors in Mumbai

Mahabharat television series actor Aayush Shah has filed a comprehensive criminal case against MyFledge Private Limited directors and their family members. The case alleges systematic cheating, forgery, and criminal breach of trust involving fabricated bank statements and false property documents.

The Anatomy of an Alleged Investment Fraud Scheme

The legal criminal complaint names directors Badal Chandra Ghosh, Bijoya Subratkumar Das, Piyalee Shyamlendu Chatterjee, and Bishwajit Badal Chandra Ghosh as primary accused. Advocate Govind Ghogre filed the case at Andheri court under Bharatiya Nyaya Sanhita sections.

It specifically cites sections 316 (Criminal Breach of Trust), 318 (Cheating), and 336 (Forgery). The case also includes Section 335 for creating false documents and Section 61 for criminal conspiracy. These charges follow discovery of forged ICICI Bank statements shared via WhatsApp.

From Professional Projects to Financial Fraud Allegations

The controversy began when Bishwajit Ghosh, a self-described struggling singer, approached Shah for entertainment collaborations. Ghosh and his wife Piyalee gradually built personal rapport with Shah and his sister Mausam Shah.

They leveraged the siblings’ PR agency expertise for their business promotions. Initial interactions featured prompt returns on investments to establish credibility, investigators claim. The accused then presented fabricated financial documents as proof of company stability.

MyFledge’s Nationwide Operation and Fabricated Credentials

MyFledge Private Limited operates as an aviation and vocational training institute with claimed centres across India. Their website listed facilities in Bengaluru, Lucknow, Bhopal, Guwahati, and Raipur. Additional centres were advertised in Mangaluru, Siliguri, Surat, and Mumbai locations.

The company used these nationwide operations to reinforce their legitimacy to potential investors. However, subsequent investigations revealed multiple discrepancies in their claims. The Sprouts News Special Investigation Team found similar patterns in other education fraud cases.

Also Read: ARMIET Construction Scam: Illegal Floors & Crores Lost.

Related Article: Court Acts in ₹4.44 Cr Fraud on Actor Aayush Shah.

Cheque Bounce Revelations and Document Forgery

The accused issued thirty-two cheques totalling ₹4.44 crore against the loans extended by Shah. All these cheques bounced upon deposit, unveiling the alleged financial fraud. This prompted deeper investigation into the company’s financial documentation.

Forensic analysis revealed the ICICI Bank statements shared via WhatsApp were completely forged. Property ownership documents presented as collateral were also fabricated. Initial returns appeared strategically paid to build trust for larger investments.

MyFledge Directors Face Multiple Legal Battles Across India

MyFledge directors now confront eight FIRs across India and seven criminal cases in Mumbai alone. A recent Baghpat, Uttar Pradesh FIR involves ₹5 crore fraud allegations. This indicates a nationwide pattern of alleged financial misconduct by the company.

The company faces allegations of misleading students with guaranteed placement promises. Former employees accuse them of salary non-payment and coercive practices. Technicians from Bishwajit’s music projects also allege payment defaults.

Intimidation Tactics and Media Threats Alleged

Bishwajit Ghosh has allegedly threatened media houses covering cases against him. He reportedly fabricated narratives about FIRs being filed against journalists. WhatsApp texts and voice recordings substantiate these intimidation claims.

This development raises serious concerns about press freedom in financial fraud reporting. The accused used multiple tactics to suppress media coverage of their activities. These allegations form part of the broader criminal conspiracy charges.

Broader Implications for Education and Investment Sectors

The MyFledge case highlights vulnerabilities in India’s education and investment sectors. Students reportedly received fabricated success stories and false placement guarantees. This follows patterns seen in other educational institution scams across Maharashtra.

Investors face significant risks from sophisticated document forgery operations. The case underscores the need for enhanced due diligence processes. Financial regulators may need to strengthen verification mechanisms for such institutions.

Legal Proceedings and Future Developments

Andheri court will hear the case under the new Bharatiya Nyaya Sanhita provisions. This represents one of early high-profile cases under India’s updated legal framework. Legal experts anticipate closely watching the proceedings and their outcomes.

The multiple FIRs across states may lead to coordinated investigation efforts. Central agencies could potentially enter the case given its interstate ramifications. MyFledge directors face potentially severe consequences if convictions occur.

This case serves as a crucial reminder about verifying investment opportunities thoroughly. Both celebrities and common investors must exercise enhanced due diligence. The outcome could influence how similar financial fraud cases are handled nationwide.