Koti Vidya Charitable Trust Fraud Exposed: Chairman, Trustee Face ₹120 Crore Scam Allegations

• Fraudsters Alamuri Venkateshwara Gupta and Dr. Lavendra Bothra Accused in Multi-Crore Education Fraud

• The Core Allegation: A ₹120 Crore Web of Deceit

• Legal Reckoning: FIR, Charges, and the Court’s Stance

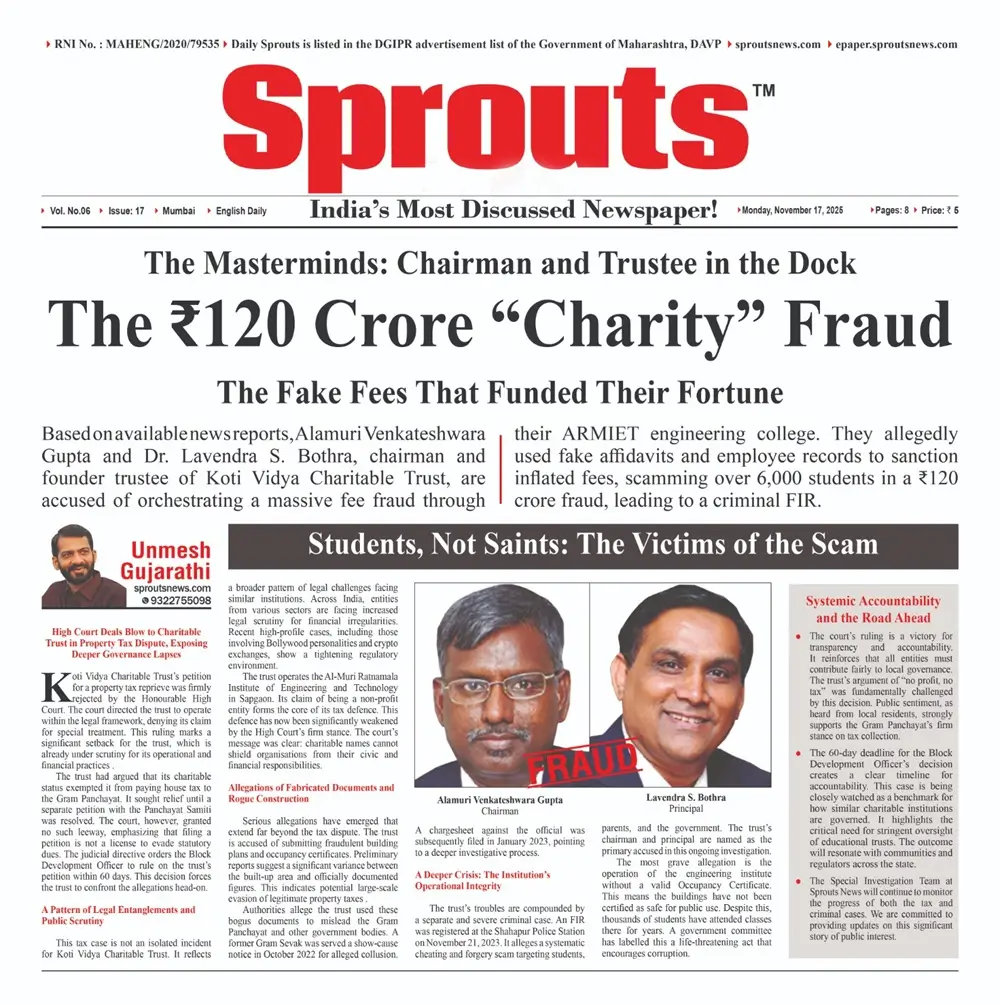

A massive ₹120 crore fraud has been uncovered at the Koti Vidya Charitable Trust, where Chairman Alamuri Venkateshwara Gupta and trustee Dr. Lavendra S. Bothra allegedly used fake affidavits, fabricated employee records, and inflated fees through ARMIET engineering college. Over 6,000 students were reportedly cheated. In a parallel setback, the High Court rejected the trust’s plea for property tax exemption, citing governance lapses and ordering a ruling within 60 days, deepening the trust’s legal troubles.

- Koti Vidya Charitable Trust Fraud Exposed: Chairman, Trustee Face ₹120 Crore Scam Allegations

- • Fraudsters Alamuri Venkateshwara Gupta and Dr. Lavendra Bothra Accused in Multi-Crore Education Fraud

- • The Core Allegation: A ₹120 Crore Web of Deceit

- • Legal Reckoning: FIR, Charges, and the Court’s Stance

- High Court Deals Blow to Charitable Trust in Property Tax Dispute, Exposing Deeper Governance Lapses

- A Pattern of Legal Entanglements and Public Scrutiny

- Allegations of Fabricated Documents and Rogue Construction

- A Deeper Crisis: The Institution’s Operational Integrity

- Systemic Accountability and the Road Ahead

Click Here To Download the News Attachment

High Court Deals Blow to Charitable Trust in Property Tax Dispute, Exposing Deeper Governance Lapses

Koti Vidya Charitable Trust’s petition for a property tax reprieve was firmly rejected by the Honourable High Court. The court directed the trust to operate within the legal framework, denying its claim for special treatment. This ruling marks a significant setback for the trust, which is already under scrutiny for its operational and financial practices .

The trust had argued that its charitable status exempted it from paying house tax to the Gram Panchayat. It sought relief until a separate petition with the Panchayat Samiti was resolved. The court, however, granted no such leeway, emphasizing that filing a petition is not a license to evade statutory dues. The judicial directive orders the Block Development Officer to rule on the trust’s petition within 60 days. This decision forces the trust to confront the allegations head-on.

A Pattern of Legal Entanglements and Public Scrutiny

This tax case is not an isolated incident for Koti Vidya Charitable Trust. It reflects a broader pattern of legal challenges facing similar institutions. Across India, entities from various sectors are facing increased legal scrutiny for financial irregularities. Recent high-profile cases, including those involving Bollywood personalities and crypto exchanges, show a tightening regulatory environment .

The trust operates the Al-Muri Ratnamala Institute of Engineering and Technology in Sapgaon. Its claim of being a non-profit entity forms the core of its tax defence. This defence has now been significantly weakened by the High Court’s firm stance. The court’s message was clear: charitable names cannot shield organisations from their civic and financial responsibilities.

Also Read: Wine Business to Web Fraud of ₹19.46 Cr: Family Faces FIR.

Related Article: ARMIET Construction Scam: Illegal Floors & Crores Lost.

Related Article: ARMIET College Scandal: Tax Default & Fraud Allegations.

Allegations of Fabricated Documents and Rogue Construction

Serious allegations have emerged that extend far beyond the tax dispute. The trust is accused of submitting fraudulent building plans and occupancy certificates. Preliminary reports suggest a significant variance between the built-up area and officially documented figures. This indicates potential large-scale evasion of legitimate property taxes .

Authorities allege the trust used these bogus documents to mislead the Gram Panchayat and other government bodies. A former Gram Sevak was served a show-cause notice in October 2022 for alleged collusion. A chargesheet against the official was subsequently filed in January 2023, pointing to a deeper investigative process.

A Deeper Crisis: The Institution’s Operational Integrity

The trust’s troubles are compounded by a separate and severe criminal case. An FIR was registered at the Shahapur Police Station on November 21, 2023. It alleges a systematic cheating and forgery scam targeting students, parents, and the government. The trust’s chairman and principal are named as the primary accused in this ongoing investigation .

The most grave allegation is the operation of the engineering institute without a valid Occupancy Certificate. This means the buildings have not been certified as safe for public use. Despite this, thousands of students have attended classes there for years. A government committee has labelled this a life-threatening act that encourages corruption.

Systemic Accountability and the Road Ahead

The court’s ruling is a victory for transparency and accountability. It reinforces that all entities must contribute fairly to local governance. The trust’s argument of “no profit, no tax” was fundamentally challenged by this decision. Public sentiment, as heard from local residents, strongly supports the Gram Panchayat’s firm stance on tax collection.

The 60-day deadline for the Block Development Officer’s decision creates a clear timeline for accountability. This case is being closely watched as a benchmark for how similar charitable institutions are governed. It highlights the critical need for stringent oversight of educational trusts. The outcome will resonate with communities and regulators across the state.

The Special Investigation Team at Sprouts News will continue to monitor the progress of both the tax and criminal cases. We are committed to providing updates on this significant story of public interest.