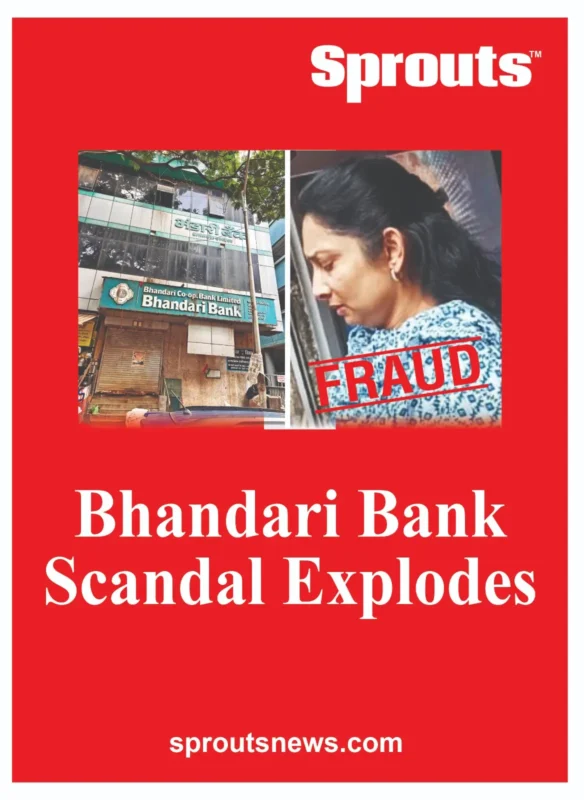

Bhandari Bank Scandal Explodes

• ₹12 Crore Recovery Ignored?

• SIT Probes Co-op Bank Corruption

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

The Bhandari Shareholders Forum has accused administrator Rakhi Gawde of serious financial mismanagement at the Bhandari Co-op Bank. Allegations include ₹12 crore recovery delays, audit report suppression, and misleading reports to authorities. The Sprouts News Investigation Team (SIT) highlights growing demands for her removal and a transparent revival of the bank.

Contents

- Bhandari Bank Scandal Explodes

- Bhandari Bank Administrator Under Fire for Financial Irregularities

- Bhandari Bank Scandal: ₹12 Crore Recovery Ignored, Legal Tactics Questioned

- Audit Reports Withheld, False Report Sent to Commissioner

- Resistance to Revival Efforts Raises Red Flags

- Bhandari Bank Scandal: Forum Demands Government Intervention and Transparency

- Also Read: Malnutrition Crisis Grips Maharashtra: 39 % Kids Stunted, Tribal Areas Worst Hit.

- Bhandari Community Rallies for Justice and Bank Revival

Bhandari Bank Administrator Under Fire for Financial Irregularities

In a new wave of allegations, the Bhandari Shareholders Forum has raised serious concerns over the conduct of Rakhi Gawde, the current administrator (Avsāyak) of the financially troubled Bhandari Co-operative Bank Ltd.. Accusations include deliberate neglect in recovery efforts, questionable legal representation, concealment of audit reports, and misinformation submitted to authorities. The Sprouts News Investigation Team (SIT) has reviewed documents and stakeholder complaints that indicate potential mismanagement at multiple levels.

The Forum has urged the Maharashtra Cooperative Commissioner and concerned ministries to initiate immediate inquiry and remove Gawde and her team from their posts. This is not the first time the Bhandari Co-op Bank has been under scrutiny; however, these new allegations suggest a deeper institutional rot.

Bhandari Bank Scandal: ₹12 Crore Recovery Ignored, Legal Tactics Questioned

According to the Forum, approximately ₹12 crore in recoverable dues from defaulters was deliberately left uncollected. Properties attached against bad loans were not put up for sale, and recovery processes stagnated under Gawde’s tenure.

Adding to the concerns, Gawde allegedly appointed underqualified and inactive lawyers for key cases in the Bombay High Court. These appointments, perceived to be personally motivated, resulted in the bank’s legal stance being weakly presented—causing adverse outcomes, including the setting aside of favourable court orders.

These decisions, the Forum argues, have directly harmed the bank’s recovery and restructuring prospects.

Audit Reports Withheld, False Report Sent to Commissioner

The Sprouts SIT has accessed internal communications that suggest three years’ worth of audit reports were not disclosed to stakeholders, nor were their compliance responses shared with regulators. This suppression is being viewed as a deliberate attempt to cover up financial irregularities.

Furthermore, a misleading report was submitted to the Cooperative Commissioner, claiming that recoveries were impossible without property liquidation. The Forum states this statement misrepresented the bank’s true recovery potential and risks misleading top-level policy decisions.

Resistance to Revival Efforts Raises Red Flags

Community-led efforts to revive the bank at state and central levels were reportedly stonewalled by the current administrator. The Forum alleges that Rakhi Gawde displayed obstructive behaviour instead of supporting the bank’s rehabilitation process. Her lack of engagement is being interpreted as indirect resistance to transparency and accountability, further undermining depositor confidence.

The Sprouts News Investigation Team (SIT) finds that the cumulative effect of administrative indifference, poor legal strategy, and financial opacity could endanger the survival of the bank if not addressed swiftly.

Bhandari Bank Scandal: Forum Demands Government Intervention and Transparency

In its memorandum, the Bhandari Shareholders Forum has outlined specific demands:

•Immediate suspension of Rakhi Gawde, Nazim Virani, Shubhangi Hirlekar, and Netaji Desai from their current roles.

•Appointment of an independent government panel to investigate the alleged mismanagement.

•Recovery of any misused funds or losses incurred due to negligence from the responsible parties.

•Induction of a new, professional administrator with a proven track record in cooperative banking.

•A joint stakeholders meeting chaired by the Cooperation Minister to discuss the bank’s future.

Also Read: Malnutrition Crisis Grips Maharashtra: 39 % Kids Stunted, Tribal Areas Worst Hit.

Bhandari Community Rallies for Justice and Bank Revival

The Bhandari Co-operative Bank, once a symbol of trust and pride for the community, now finds itself mired in administrative controversy and financial uncertainty. The Forum emphasized that the community stands united in its mission to protect the bank’s interests.

“Our bank’s future is non-negotiable. The guilty must be held accountable, and the institution must be rebuilt with transparency,” stated a Forum representative.

The Sprouts News Investigation Team (SIT) will continue monitoring developments in this case, particularly the responses from the Maharashtra Cooperation Department and state-level political leadership. The case could become a landmark in enforcing accountability in cooperative banking.

• Key Allegations Against Administrator Rakhi Gawde

•₹12 crore recoverable loans left uncollected.

•Favoritism in appointing weak legal counsel in High Court cases.

•Non-disclosure of three years’ audit and compliance reports.

•Misleading financial report submitted to Cooperative Commissioner.

•Zero cooperation in community-led bank revival plans.