Infamous DY Patil Pune Under Income Tax Scanner

• 50+ Shell Firms, ₹200 Crore MBBS Fee Scam & ₹25 Crore Grant Diversion Exposed

• Grant Misuse at D.Y. Patil Medical College

• Students Cheated, Funds Siphoned

• CBI ED investigation DY Patil

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

The infamous DY Patil Pune empire is under the Income Tax Department’s scanner after SIT exposed 50+ shell firms at Koregaon Park. Linked to a ₹200 crore MBBS fee scam and ₹25 crore grant diversion, the case—flagged by Cabinet Secretariat—now demands urgent CBI–ED intervention.

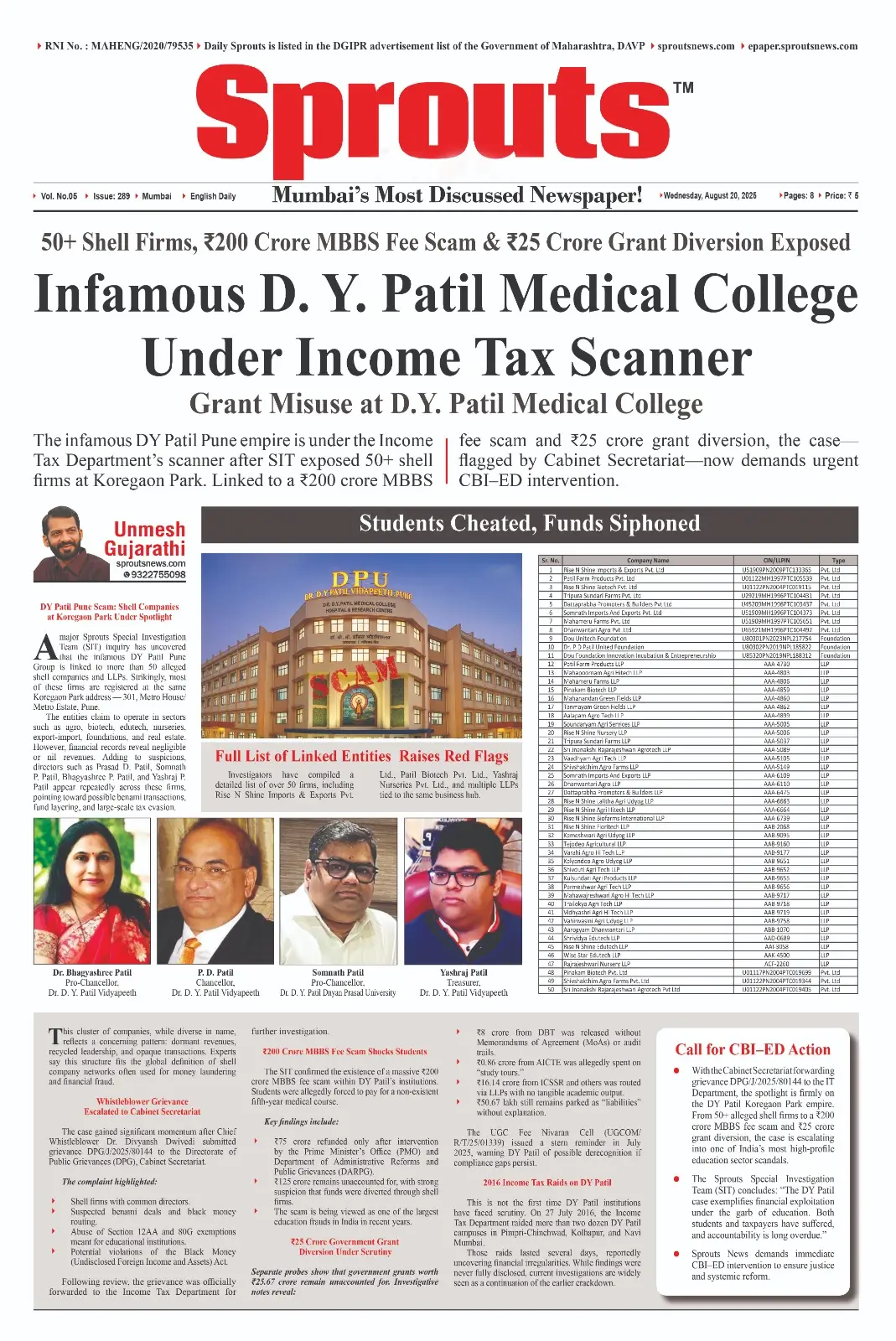

DY Patil Pune Scam: Shell Companies at Koregaon Park Under Spotlight

A major Sprouts Special Investigation Team (SIT) inquiry has uncovered that the infamous DY Patil Pune Group is linked to more than 50 alleged shell companies and LLPs. Strikingly, most of these firms are registered at the same Koregaon Park address — 301, Metro House/Metro Estate, Pune.

The entities claim to operate in sectors such as agro, biotech, edutech, nurseries, export-import, foundations, and real estate. However, financial records reveal negligible or nil revenues. Adding to suspicions, directors such as Prasad D. Patil, Somnath P. Patil, Bhagyashree P. Patil, and Yashraj P. Patil appear repeatedly across these firms, pointing toward possible benami transactions, fund layering, and large-scale tax evasion.

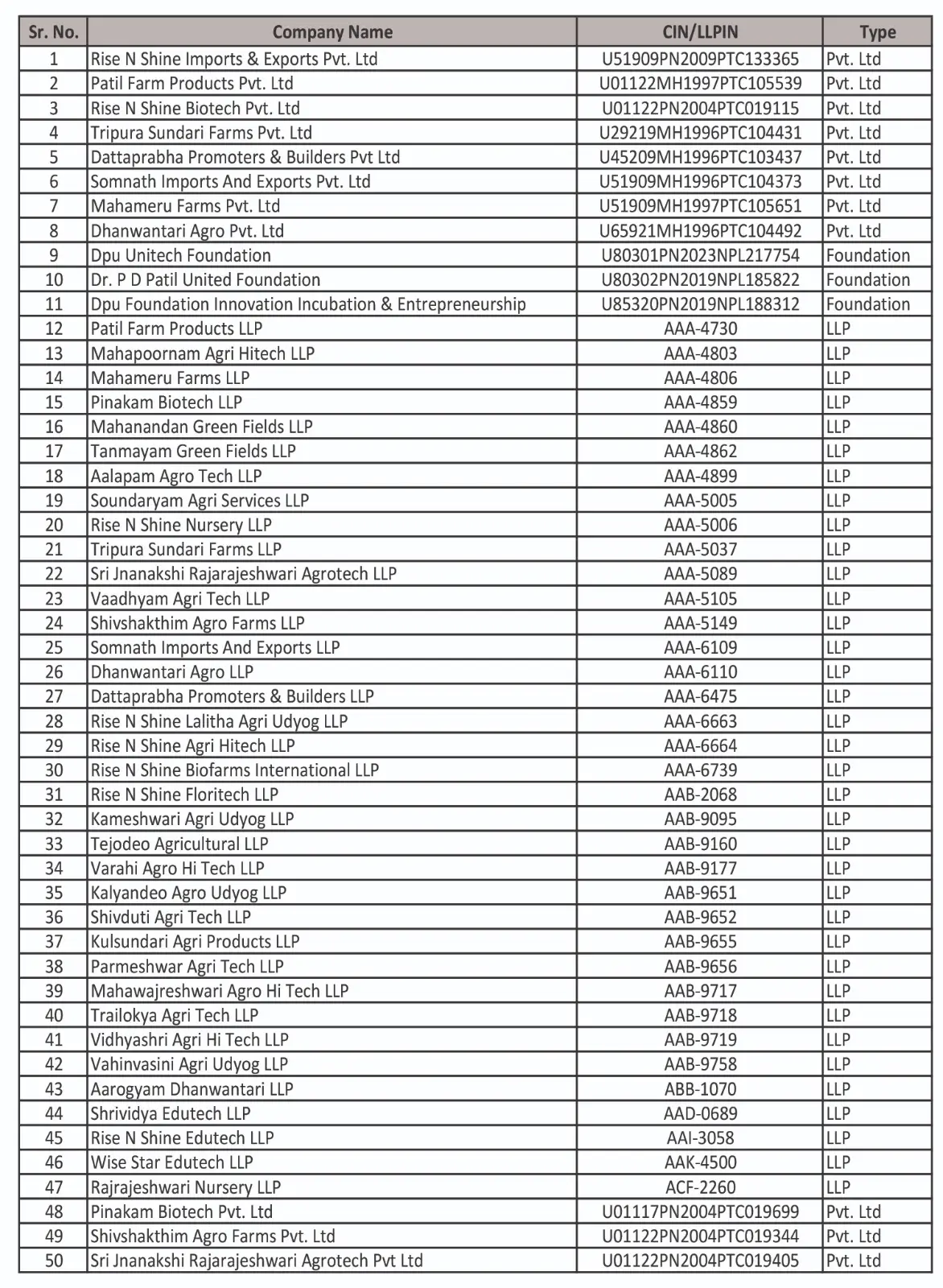

Full List of Linked Entities Raises Red Flags

Investigators have compiled a detailed list of over 50 firms, including Rise N Shine Imports & Exports Pvt. Ltd., Patil Biotech Pvt. Ltd., Yashraj Nurseries Pvt. Ltd., and multiple LLPs tied to the same business hub.(Attached at the bottom)

This cluster of companies, while diverse in name, reflects a concerning pattern: dormant revenues, recycled leadership, and opaque transactions. Experts say this structure fits the global definition of shell company networks often used for money laundering and financial fraud.

List of 50 Alleged Shell Companies of Dr. D. Y. Patil College, Pune.

Whistleblower Grievance Escalated to Cabinet Secretariat

The case gained significant momentum after Chief Whistleblower Dr. Divyansh Dwivedi submitted grievance DPG/J/2025/80144 to the Directorate of Public Grievances (DPG), Cabinet Secretariat.

The complaint highlighted:

•Shell firms with common directors.

•Suspected benami deals and black money routing.

•Abuse of Section 12AA and 80G exemptions meant for educational institutions.

•Potential violations of the Black Money (Undisclosed Foreign Income and Assets) Act.

Following review, the grievance was officially forwarded to the Income Tax Department for further investigation.

₹200 Crore MBBS Fee Scam Shocks Students

The SIT confirmed the existence of a massive ₹200 crore MBBS fee scam within DY Patil’s institutions. Students were allegedly forced to pay for a non-existent fifth-year medical course.

Key findings include:

•₹75 crore refunded only after intervention by the Prime Minister’s Office (PMO) and Department of Administrative Reforms and Public Grievances (DARPG).

•₹125 crore remains unaccounted for, with strong suspicion that funds were diverted through shell firms.

•The scam is being viewed as one of the largest education frauds in India in recent years.

₹25 Crore Government Grant Diversion Under Scrutiny

Separate probes show that government grants worth ₹25.67 crore remain unaccounted for. Investigative notes reveal:

•₹8 crore from DBT was released without Memorandums of Agreement (MoAs) or audit trails.

•₹0.86 crore from AICTE was allegedly spent on “study tours.”

•₹16.14 crore from ICSSR and others was routed via LLPs with no tangible academic output.

•₹50.67 lakh still remains parked as “liabilities” without explanation.

The UGC Fee Nivaran Cell (UGCOM/R/T/25/01339) issued a stern reminder in July 2025, warning DY Patil of possible derecognition if compliance gaps persist.

Also Read: AstroTalk Investigation Exposes Misleading Predictions and Scams.

Contents

- Infamous DY Patil Pune Under Income Tax Scanner

- • 50+ Shell Firms, ₹200 Crore MBBS Fee Scam & ₹25 Crore Grant Diversion Exposed

- • Grant Misuse at D.Y. Patil Medical College

- • Students Cheated, Funds Siphoned

- • CBI ED investigation DY Patil

- DY Patil Pune Scam: Shell Companies at Koregaon Park Under Spotlight

- Full List of Linked Entities Raises Red Flags

- Whistleblower Grievance Escalated to Cabinet Secretariat

- ₹200 Crore MBBS Fee Scam Shocks Students

- ₹25 Crore Government Grant Diversion Under Scrutiny

- 2016 Income Tax Raids on DY Patil

- Call for CBI–ED Action: Income tax raid at DY Patil medical College

Related Article: DY Patil Assistant Dean Faces Academic Fraud Allegations.

2016 Income Tax Raids on DY Patil

This is not the first time DY Patil institutions have faced scrutiny. On 27 July 2016, the Income Tax Department raided more than two dozen DY Patil campuses in Pimpri-Chinchwad, Kolhapur, and Navi Mumbai.

Those raids lasted several days, reportedly uncovering financial irregularities. While findings were never fully disclosed, current investigations are widely seen as a continuation of the earlier crackdown.

Call for CBI–ED Action: Income tax raid at DY Patil medical College

With the Cabinet Secretariat forwarding grievance DPG/J/2025/80144 to the IT Department, the spotlight is firmly on the DY Patil Koregaon Park empire. From 50+ alleged shell firms to a ₹200 crore MBBS fee scam and ₹25 crore grant diversion, the case is escalating into one of India’s most high-profile education sector scandals.

The Sprouts Special Investigation Team (SIT) concludes: “The DY Patil case exemplifies financial exploitation under the garb of education. Both students and taxpayers have suffered, and accountability is long overdue.”

Sprouts News demands immediate CBI–ED intervention to ensure justice and systemic reform.