Edelweiss Turns Nido, Turns Rogue

• NBFC Scam Leaves Family Homeless

• Loan Fraud, Forgery, and a Stolen Home

• Nido Finance Exposed: A House of Lies

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

A certified wellness expert, Mrs. Daljeet Kaur, has accused Edelweiss/Nido Home Finance of orchestrating loan fraud, document forgery, and illegal home seizure. Despite complaints to top authorities, no action has been taken. Sprouts SIT reveals a wider pattern of NBFC exploitation, misuse of SARFAESI Act, and regulatory silence across India.

Wellness Expert Exposes Edelweiss-Nido Housing Scam

In a disturbing case of alleged corporate fraud and systemic abuse, Mrs. Daljeet Kaur, a certified wellness expert and seasoned professional, has come forward with explosive allegations against Edelweiss Housing Finance Ltd., now rebranded as Nido Home Finance Ltd.

Her story paints a chilling picture of financial deception, document forgery, and illegal property takeover—facilitated by regulatory gaps and alleged judicial misrepresentation. The Sprouts News Investigation Team (SIT) has verified multiple documents and timelines, lending significant weight to Kaur’s claims.

Click Here To Download the News Attachment

Contents

Edelweiss Turns Nido, Turns Rogue• NBFC Scam Leaves Family Homeless• Loan Fraud, Forgery, and a Stolen Home• Nido Finance Exposed: A House of LiesWellness Expert Exposes Edelweiss-Nido Housing ScamClick Here To Download the News AttachmentEMI Deductions Without Consent; Loan Disbursed IllegallyForged Relationships and Blank Signatures ExploitedMisuse of SARFAESI Act to Seize Disputed PropertyIntimidation, Obstruction, and Legal HarassmentA Pattern of Exploitation Across IndiaVictim Demands Accountability, Systemic ReformWhy Is the System Still Silent?The Bigger Crisis: When Financial Institutions Turn PredatorsA Trusted Brand Now Under Scrutiny1. Loan Disbursal Irregularities: Disbursed Without Borrower Consent2. Forgery & Falsification of Legal Documents3. Misuse of SARFAESI Act to Grab Properties4. Mental Harassment and Threatening Recovery Tactics5. Regulatory Silence and Legal Manipulation6. Involvement of Senior Management and FoundersAlso Read: Porn Content Ban Hits Ullu, ALTT, Hulchul as OTT Oversight Tightens.Related Article: The Dark Side of Edelweiss/Nido: Financial Exploitation.7. Recurring National Pattern: Not an Isolated Incident8. Delayed Justice and Ongoing TraumaTime for RBI and NHB to Act

EMI Deductions Without Consent; Loan Disbursed Illegally

The saga began in October 2021, when Mrs. Kaur applied for a housing loan with Edelweiss. However, without any disbursal kit, or signed agreement in hand, EMI deductions were initiated unilaterally from her account.

Shockingly, insurance policies worth ₹5 lakh were also created in her name without consent, and forged documents were used to debit premiums. Repeated requests for clarification went unanswered. This opaque and aggressive financial maneuvering laid the groundwork for what followed.

Forged Relationships and Blank Signatures Exploited

In her complaint, Kaur reveals that critical documentation was forged. A co-borrower (her son) was falsely listed as her spouse to manipulate legal standing. Under the pretext of procedural formalities, she was coerced into signing blank documents—later used to prepare falsified paperwork.

These forgery allegations align with patterns seen in other Edelweiss/Nido complaints, where borrowers were misled or bullied into surrendering control over financial documentation.

Misuse of SARFAESI Act to Seize Disputed Property

Perhaps the most serious charge is the alleged misuse of the SARFAESI Act. Despite timely EMI payments and the matter being sub judice before the Debt Recovery Tribunal (DRT), Nido’s legal team submitted false affidavits and manipulated loan history to obtain physical possession orders through a local magistrate’s court.

The property—Mrs. Kaur’s legally owned home—was then sold at a distressed value, reportedly incurring a ₹70 lakh loss, and allegedly transferred to an insider network in a pre-arranged sale.

Intimidation, Obstruction, and Legal Harassment

Sprouts SIT has reviewed records suggesting a sustained campaign of intimidation by Nido’s recovery agents. Mrs. Kaur was obstructed from accessing her home, and subjected to verbal threats. Her mental health, finances, and personal dignity were systematically targeted.

Despite submitting complaints to the Prime Minister’s Office (PMOPG/D/2025/0086856), National Housing Bank (NHB Comp/1379/2025), and the Ministry of Finance, no decisive regulatory or judicial intervention has occurred.

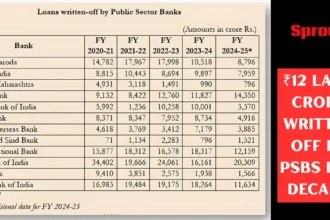

A Pattern of Exploitation Across India

Sprouts News Investigation Team (SIT) has previously uncovered similar tactics used by Edelweiss/Nido against borrowers nationwide:

•Elderly citizens losing life savings,

•EMI schedules falsified to trigger false defaults,

•SARFAESI notices fabricated,

•Recovery agents colluding with property dealers to grab homes at undervalued rates.

These are not isolated lapses but signs of systemic abuse, driven by profit motives, institutional negligence, and regulatory silence.

Victim Demands Accountability, Systemic Reform

“What they did to me was criminal,” says Mrs. Kaur. “But this isn’t just about me—it’s about any Indian citizen who trusted the system. Rashesh Shah and his executives must face justice.”

Her demands include:

•A criminal probe into Edelweiss/Nido’s top brass and recovery staff,

•Cancellation of the fraudulent property transaction,

•Full compensation for financial and emotional damage,

•Executive disqualifications for gross misconduct.

Why Is the System Still Silent?

Despite multiple whistleblower accounts, official complaints, and detailed evidence reported by Sprouts SIT, no visible regulatory crackdown has emerged. Questions remain:

•Why hasn’t the RBI or NHB acted against Nido Home Finance?

•Are NBFCs operating with unchecked powers under SARFAESI?

•How are forged documents making it into court records without challenge?

The continued inaction raises concerns about deep-rooted collusion between financial institutions, legal enablers, and regulatory watchdogs.

The Bigger Crisis: When Financial Institutions Turn Predators

Mrs. Kaur’s story is emblematic of a larger national crisis. When respected NBFCs like Edelweiss rebrand, restructure, and continue operations despite mounting fraud allegations, it indicates a dangerous loophole in India’s financial regulatory framework.

Sprouts News Investigation Team (SIT) is calling for:

•An independent commission to investigate NBFC-level housing frauds,

•Amendments to the SARFAESI Act to protect borrowers in disputed cases,

•Real-time monitoring of property seizures and court proceedings involving financial institutions.

A Trusted Brand Now Under Scrutiny

Once regarded as a prestigious player in India’s financial services sector, Edelweiss Financial Services Ltd.—now operating parts of its business under the name Nido Home Finance Ltd.—is rapidly becoming synonymous with regulatory evasion, loan fraud, and borrower harassment.

What started as isolated customer complaints has now emerged as a nationwide pattern of financial abuse, document forgery, and illegal property acquisition—especially in housing finance operations. The Sprouts News Investigation Team (SIT) has identified multiple cases and testimonies that point toward systemic malpractice involving senior leadership, field agents, and recovery teams.

1. Loan Disbursal Irregularities: Disbursed Without Borrower Consent

Multiple borrowers, including Mrs. Daljeet Kaur, have accused Edelweiss (now Nido) of initiating EMI deductions even before officially disbursing loans. In several cases, customers claim that:

•They never received proper sanction letters or loan agreements.

•They were forced to sign blank documents, later filled with manipulated details.

•Insurance policies worth lakhs were created in their name without their knowledge, and premiums were deducted illegally.

This is a gross violation of RBI guidelines and represents a clear breach of trust and contract law.

2. Forgery & Falsification of Legal Documents

One of the most alarming aspects of Edelweiss’s operation is the alleged use of forged documents:

•Fake relationships were declared (e.g., son shown as spouse) to legally manipulate co-borrower roles.

•Customer signatures were misused on loan-related affidavits and SARFAESI declarations.

•False KYC documents were attached without customer verification.

Such actions indicate a deep-rooted internal nexus, possibly involving employees at multiple levels who facilitate documentation fraud.

3. Misuse of SARFAESI Act to Grab Properties

Under the pretext of loan default—even in disputed or partially paid accounts—Edelweiss/Nido has reportedly invoked SARFAESI proceedings to seize homes. However, Sprouts SIT investigations reveal:

•Symbolic possession was taken without due process.

•Affidavits with forged loan histories were submitted in local magistrate courts to gain physical possession orders.

•Properties were sold at throwaway prices, often to insiders or pre-arranged buyers.

This is a blatant misuse of a law originally intended to protect creditors in genuine default cases, not to empower corporate land grabs.

4. Mental Harassment and Threatening Recovery Tactics

Victims have described Edelweiss/Nido recovery agents as aggressive, intrusive, and intimidating. Common harassment tactics include:

•Verbal abuse and home visits without legal authority.

•Obstruction from entering or staying in their own properties.

•Coercion to accept “settlements” under duress.

Such practices violate the Fair Practices Code and bring into question the company’s ethical standards.

5. Regulatory Silence and Legal Manipulation

Despite mounting evidence and complaints to:

•PMO (e.g., PMOPG/D/2025/0086856),

•National Housing Bank (NHB),

•Reserve Bank of India (RBI),

•Ministry of Finance,

there has been no effective regulatory action. This raises questions about possible regulatory capture, legal loopholes, or deep-rooted collusion protecting NBFCs like Edelweiss.

In several cases, courts were misled with false affidavits and non-disclosure of pending litigation, especially where DRT cases were already in motion.

6. Involvement of Senior Management and Founders

One of the most controversial allegations is the direct or indirect involvement of Rashesh Shah, the founder and former chairman of Edelweiss Group. Victims allege:

•Shah had knowledge of unethical housing loan practices.

•The rebranding to Nido was a strategic move to avoid public scrutiny.

•Legal and recovery teams operated with near impunity, hiding behind corporate structures and shell entities.

While Rashesh Shah has publicly denied personal involvement, Sprouts SIT has access to testimonies and timelines that suggest executive complicity or gross negligence.

Also Read: Porn Content Ban Hits Ullu, ALTT, Hulchul as OTT Oversight Tightens.

Related Article: The Dark Side of Edelweiss/Nido: Financial Exploitation.

7. Recurring National Pattern: Not an Isolated Incident

Sprouts SIT and several regional media have documented multiple similar incidents in:

•Maharashtra – Seniors and widows losing homes to SARFAESI misuse.

•Delhi-NCR – Borrowers receiving pre-filled documents and fake foreclosure letters.

•South India – NBFCs selling properties to known insiders at a fraction of market rates.

This points to a structured fraud model rather than operational errors.

8. Delayed Justice and Ongoing Trauma

Despite DRT petitions, multiple FIRs, media coverage, and mounting public outcry, borrowers continue to fight protracted legal battles for properties that were wrongfully seized or fraudulently sold.

Victims like Mrs. Kaur have not only lost their homes, but also face:

•Emotional trauma and mental health breakdowns,

•Reputational damage in their professional circles,

•Endless legal costs without timely redressal.

Time for RBI and NHB to Act

The growing list of controversies around Edelweiss/Nido Home Finance demands immediate regulatory and criminal scrutiny. Sprouts News Investigation Team (SIT) urges:

•A high-level forensic audit of all SARFAESI-based property disposals done by Edelweiss/Nido in the last 5 years.

•Disqualification of executives found complicit in document forgery or harassment.

•Formation of a borrower grievance redressal commission specific to NBFCs.