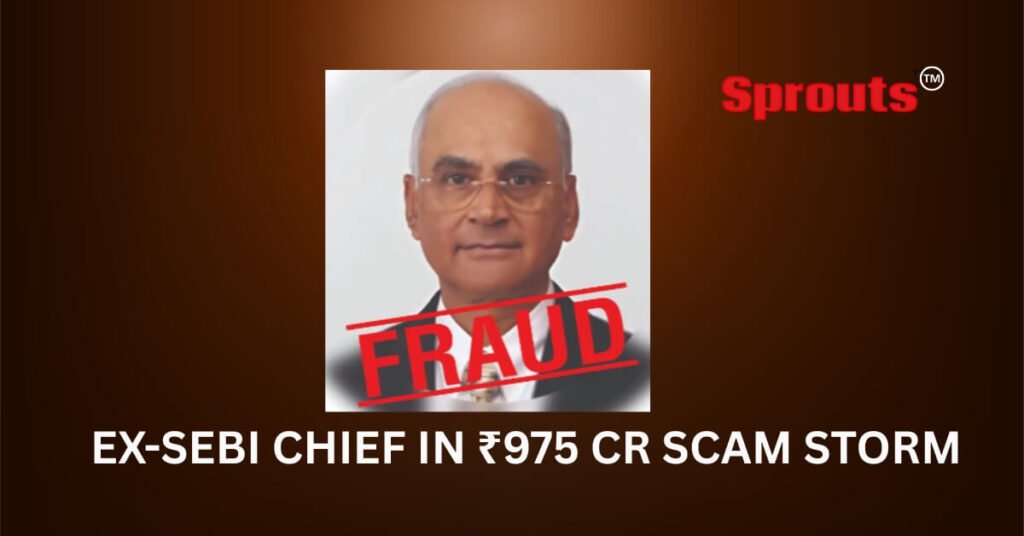

Ex-SEBI Chief in ₹975 Cr Scam Storm

• Bajpai Under Fire in GB Global Fraud

• SEBI Targets Its Former Boss in Mega Fraud

• Audit Lapses Haunt Ex-SEBI Head Bajpai

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

SEBI has issued a show-cause notice to former SEBI chief GN Bajpai and other directors for failing to detect a ₹975 crore fraud at GB Global Ltd. Investigations by SEBI, ED, and Sprouts SIT revealed circular trading, fund diversion, and audit failures. Penalties and market bans are under consideration.

Contents

- Ex-SEBI Chief in ₹975 Cr Scam Storm

- • Bajpai Under Fire in GB Global Fraud

- • SEBI Targets Its Former Boss in Mega Fraud

- • Audit Lapses Haunt Ex-SEBI Head Bajpai

- ₹975 Crore Bank Fraud Puts Spotlight on Former SEBI Chairman GN Bajpai

- Click Here To Download the News Attachment

- Circular Trading, Dummy Firms, and Lavish Lifestyles: Anatomy of the Fraud

- SEBI Holds Bajpai and Directors Liable Under LODR Norms

- ED’s Raids Reveal Assets, Lockers, and Luxury Purchases

- Insolvency Proceedings and a Tarnished Legacy

- Also Read: Delhi High Court Orders Amazon, Flipkart to Delist Jio Trademark Listings.

- Show-Cause Notices and Possible Market Ban

₹975 Crore Bank Fraud Puts Spotlight on Former SEBI Chairman GN Bajpai

In a development shaking the foundations of India’s financial regulatory system, SEBI has issued a show-cause notice to its former chairman Ghyanendra Nath Bajpai in connection with a massive ₹975.08 crore bank fraud involving GB Global Limited (formerly Mandhana Industries Limited). Bajpai, along with independent directors Khurshed Thanawalla, Sanjay K. Asher, Dilip G. Karnik, and Prashant K. Asher, stands accused of failing to exercise adequate oversight of questionable transactions during his tenure on the company’s audit committee.

The fraud, investigated by both SEBI and the Enforcement Directorate (ED), involves suspicious related-party transactions, circular trading, and deliberate financial misreporting between FY 2014–17. A forensic audit conducted by T R Chadha & Co. LLP, alongside inputs from the Sprouts News Investigation Team (SIT), uncovered serious corporate governance lapses that allegedly went unchallenged by the company’s independent directors.

Click Here To Download the News Attachment

Circular Trading, Dummy Firms, and Lavish Lifestyles: Anatomy of the Fraud

According to the ED, promoters Purushottam Mandhana, Manish Mandhana, and Biharilal Mandhana set up fictitious entities using company employees as proxies, through which they layered funds, siphoned off bank loans, and manipulated accounts. These activities resulted in alleged losses to a consortium of banks, led by Bank of Baroda, to the tune of ₹975.08 crore.

The fraudulent scheme involved third-party transactions via two shell entities—Munirabad Trading Limited (MTL) and Aassem Multitrade Private Limited (AMPL)—with massively overstated receivables and dubious payments. For instance, in FY 2015–16, Mandhana Industries recorded ₹328.65 crore receivables from MTL, whereas MTL acknowledged only ₹37.48 crore. A similar discrepancy appeared in FY 2016–17, pointing to a ₹339.41 crore overstatement.

On the expenditure side, the company paid ₹388.05 crore to AMPL against recorded purchases worth ₹265.01 crore, leading to an excess outflow of ₹123.04 crore. The Sprouts SIT has verified that these transactions were unsupported by basic documentation—including unsigned delivery challans, missing lorry receipts, and unverified invoices—highlighting a deliberate strategy to circulate and disguise funds.

SEBI Holds Bajpai and Directors Liable Under LODR Norms

SEBI’s investigation found that the Audit Committee chaired by Bajpai failed to detect or question these suspicious transactions, nor were concerns raised when stock auditors flagged ₹430 crore in slow-moving inventory during FY 2015–16. Despite these red flags, financial statements were approved without scrutiny.

The regulator has charged Bajpai and other directors under Regulation 18(3) of SEBI’s LODR Regulations, along with Clause 49(III)(D)(1) of the erstwhile listing agreement. Penalties may be imposed under Sections 15HB, 11(4A), and 11B(2) of the SEBI Act, and Section 23E of the Securities Contracts (Regulation) Act (SCRA). The charges reflect SEBI’s stance that independent directors are not mere figureheads but must actively enforce corporate governance.

For Bajpai—who served as SEBI chairman from 2002 to 2005 and was considered an authority on financial regulation—these charges represent a serious reputational setback. His failure to uphold fiduciary responsibility is now under intense scrutiny from both regulators and the market.

ED’s Raids Reveal Assets, Lockers, and Luxury Purchases

The ED’s June 26, 2024 search operation across 12 Mumbai locations unveiled a trail of luxury acquisitions funded by diverted loan proceeds. Investigators seized assets including Rolex and Hublot watches, Lexus and Mercedes-Benz cars, over 140 bank accounts, five lockers, and shares worth ₹5 crore. Property documents and digital evidence seized during the raid have been added to the case file.

The Sprouts News Investigation Team (SIT) has obtained key internal communications and audit records, which support the regulators’ allegations and indicate that senior management was aware of the fraudulent financial engineering. The misuse of public funds, especially those loaned by PSU banks, has raised alarms among policymakers and investors.

Insolvency Proceedings and a Tarnished Legacy

The scandal surfaced in the aftermath of Mandhana Industries’ admission into Corporate Insolvency Resolution Process (CIRP) on September 29, 2017, following a default petition by Bank of Baroda under the Insolvency and Bankruptcy Code (IBC). While Formation Textiles LLC initially took over management, their failure led to a second resolution plan by Dev Land & Housing Pvt. Ltd., approved in 2021.

Despite the ownership changes, the shadow of financial mismanagement continues to linger. SEBI’s current action may set a precedent regarding the accountability of former regulators serving on company boards.

Also Read: Delhi High Court Orders Amazon, Flipkart to Delist Jio Trademark Listings.

Show-Cause Notices and Possible Market Ban

SEBI has demanded that Bajpai and the other notices explain why penalties, including a ban from accessing the securities market, should not be imposed. While the notices may submit replies, legal proceedings are expected to follow. The Central Bureau of Investigation (CBI) is also expected to file a supplementary chargesheet based on the ED’s findings.

This case strikes at the heart of India’s capital market trust. The Sprouts SIT believes this is not just a question of individual liability but a systemic failure of corporate oversight. The outcome will have a lasting impact on how independent directors and former regulators are held accountable in the private sector.

Documents related to this case are under the possession of the Sprouts News Investigation Team (SIT). Further revelations expected.