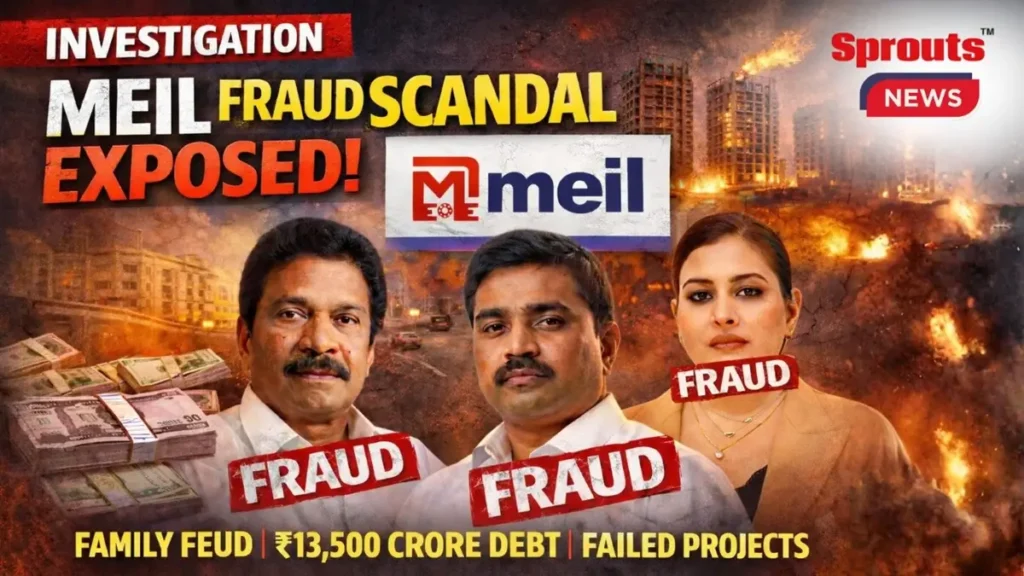

Megha Collapse: India’s Infrastructure Giant Faces Financial Crisis, Political Pushback, and Project Failures

Megha Engineering and Infrastructures Limited, once a rising force in India’s infrastructure sector, is facing a severe financial and operational crisis. Family disputes, high interest borrowing, stalled projects, regulatory bans, and political distancing have pushed the company to the brink, raising serious concerns about governance, accountability, and the future of large infrastructure execution in India.

- Megha Collapse: India’s Infrastructure Giant Faces Financial Crisis, Political Pushback, and Project Failures

- Debt Burden, Family Dispute, and Control Over MEIL

- Regulatory Action, Project Failures, and Political Distance

- International Fallout and Shift Towards Real Estate

- Controversies Surrounding Megha Engineering and Infrastructures Limited

Megha Collapse has emerged as a critical issue within India’s infrastructure sector, signalling deeper structural and governance concerns. Megha Engineering and Infrastructures Limited, once a preferred contractor, now faces mounting financial and operational distress.

Industry analysts note that MEIL’s troubles reflect broader risks in debt driven expansion models. Aggressive borrowing, internal disputes, and delayed execution have combined to weaken confidence among lenders, governments, and project partners.

The Hyderabad based company, led by Megha Krishna Reddy, expanded rapidly across highways, irrigation, oil, and refinery projects. That growth, however, appears increasingly disconnected from consistent project delivery and sustainable financial planning.

Sources familiar with company operations confirm that internal family disputes have sharply impacted strategic decision making. Management bandwidth has shifted from execution to control, slowing approvals and disrupting long term planning across key verticals.

Debt Burden, Family Dispute, and Control Over MEIL

Financial stress intensified after Megha Krishna Reddy raised loans from Oak Tree Capital at an interest rate reportedly near fifteen percent. Such high cost borrowing raised immediate concerns among infrastructure finance experts.

In the previous financial year, Megha Krishna Reddy paid approximately ₹1,500 crore to his uncle, P P Reddy. This payment was part of a larger settlement linked to ownership and control issues.

For the current year, commitments reportedly rise to nearly ₹5,000 crore. The total payout obligation to P P Reddy is estimated at ₹13,500 crore, significantly straining MEIL’s balance sheet.

Market observers believe this settlement aims to consolidate majority ownership within MEIL. However, the scale and timing of payments have sharply reduced working capital available for ongoing projects.

As liquidity tightened, multiple project sites reportedly slowed or stopped operations. Contractors complained of delayed payments, while several employees confirmed that salaries were withheld for extended periods.

Infrastructure experts warn that such payment disruptions damage execution credibility. Once trust erodes among vendors and labour, restarting stalled projects becomes expensive and operationally risky.

Regulatory Action, Project Failures, and Political Distance

MEIL’s operational challenges soon attracted regulatory scrutiny. Union Minister Nitin Gadkari publicly described the company as a hindrance to India’s infrastructure growth during a contractors’ meeting, an unusually direct rebuke.

The National Highways Authority of India barred MEIL from participating in tenders for a second consecutive year. Officials cited performance concerns and compliance issues linked to ongoing highway projects.

State level actions followed. The Bihar government debarred Megha Engineering from state projects, while the company was removed from the Western Kosi irrigation project due to unsatisfactory execution.

Multiple large projects across states subsequently entered cold storage. Political sources indicate that senior leaders within the Bharatiya Janata Party reduced engagement with the company as delays mounted.

Currently, Megha Krishna Reddy’s active engagements are largely limited to Congress governed states such as Karnataka, Telangana, and his home state Andhra Pradesh, reflecting a narrowed political operating space.

Energy sector setbacks further compounded the crisis. MEIL’s underperformance in oil and petrochemical projects reportedly contributed to significant losses at Oil and Natural Gas Corporation.

The re appointment of retired bureaucrat Arun Kumar Singh as Chairman of ONGC has drawn scrutiny. Critics allege the move shields accountability for contractor underperformance, including MEIL linked projects.

Also Read: How Fake Honorary Doctorate Are Being Sold as Prestige.

International Fallout and Shift Towards Real Estate

MEIL’s failure to complete the ₹17,000 crore Mongolia refinery project raised diplomatic concerns. Funded with Indian government support, the delay reportedly affected India Mongolia bilateral economic cooperation.

Foreign policy experts caution that infrastructure credibility directly influences India’s overseas partnerships. Delays in flagship projects weaken India’s position as a reliable development partner in emerging economies.

Facing shrinking infrastructure opportunities, Megha Krishna Reddy has publicly indicated a strategic pivot. The company is exploring Hyderabad based real estate ventures, particularly in disputed land parcels.

Urban policy specialists warn that such shifts carry reputational and regulatory risks. Moving from nationally strategic infrastructure to contested real estate signals retreat rather than recovery.

Sprouts News Special Investigation Team continues to examine MEIL’s financial arrangements, regulatory actions, and project outcomes. The unfolding Megha Collapse raises fundamental questions about governance, accountability, and sustainable growth in India’s infrastructure ecosystem.

Controversies Surrounding Megha Engineering and Infrastructures Limited

Megha Engineering and Infrastructures Limited has faced sustained controversy despite its rapid rise in India’s infrastructure sector. Allegations range from financial stress and family disputes to repeated project failures across highways, irrigation, and energy sectors.

Family Disputes and Financial Pressure

A major controversy involves promoter Megha Krishna Reddy’s financial settlement with his uncle, P. P. Reddy, reportedly amounting to ₹13,500 crore. High-interest borrowing from Oak Tree Capital has further strained MEIL’s finances and liquidity.

These obligations reportedly triggered payment delays to contractors and employees, disrupting execution and weakening confidence among vendors, lenders, and government agencies.

Also Read: How Fake Honorary Doctorate Are Being Sold as Prestige.

Related Article: MEIL Implodes: Ownership War Shakes Infra Giant.

Related Article: Megha Engineering’s rapid growth has raised new questions.

Regulatory Action and Project Failures

MEIL has faced firm action from authorities. The National Highways Authority of India barred the company from tenders for two consecutive years, citing performance concerns. Bihar also debarred the company from state projects.

MEIL was removed from the Western Kosi irrigation project due to non-performance, raising serious questions about its execution capabilities despite its scale and resources.

Energy Sector and International Setbacks

In the oil and petrochemical sector, MEIL’s alleged underperformance has been linked to losses at Oil and Natural Gas Corporation. Critics have questioned accountability mechanisms within such public-sector projects.

Internationally, delays in the ₹17,000 crore Mongolia refinery project, backed by the Indian government, reportedly affected India–Mongolia economic relations and diplomatic credibility.

Investigative Journalism and Public Accountability

Unmesh Gujarathi, a famous investigative journalist in India, along with the Sprouts News Special Investigation Team (SIT), has consistently exposed MEIL’s irregularities. Their reporting has brought public attention to governance failures, regulatory lapses, and systemic risks.

Why These Controversies Matter?

The MEIL case highlights deeper flaws in infrastructure oversight. It underscores the need for transparency, accountability, and stronger scrutiny where public funds and national credibility are at stake.