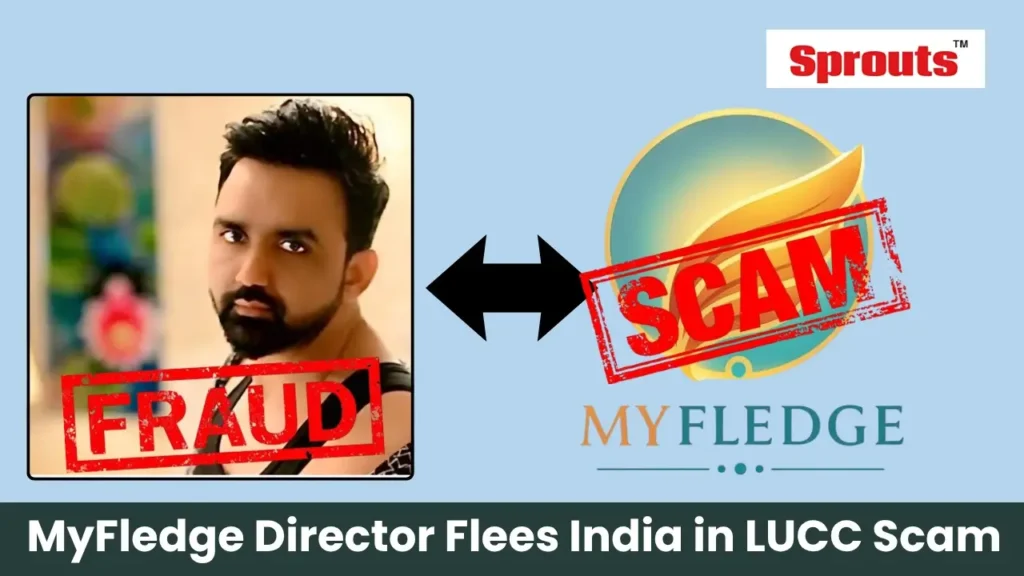

MyFledge Director Flees India in LUCC Scam

• Uttarakhand Police Intensifies Global Manhunt for Scam Accused

• Key Accused, Including Shabab Hussain, Suspected to Have Fled Abroad

• High-Level Review Directs Accelerated Multi-Agency Probe

Uttarakhand Police are pursuing a global manhunt after MyFledge director Shabab Hussain allegedly fled India in connection with the multi-crore LUCC scam. Authorities suspect he escaped abroad to evade arrest. ADG V. Murugeshan has directed the issuance of an Interpol Red Corner Notice against the accused. A high-level review has intensified the investigation, with multiple FIRs filed against LUCC directors for financial fraud and investor deception.

- MyFledge Director Flees India in LUCC Scam

- • Uttarakhand Police Intensifies Global Manhunt for Scam Accused

- • Key Accused, Including Shabab Hussain, Suspected to Have Fled Abroad

- • High-Level Review Directs Accelerated Multi-Agency Probe

- MyFledge Director Flees Abroad in Multi-Crore LUCC Scam; Interpol Red Corner Notice Sought

- Expedited Investigation and International Manhunt

- Asset Seizure and Multi-Agency Coordination

- Invocation of Stringent Financial Laws

- The MyFledge Connection: A ₹4.44 Crore Mumbai Fraud

- High-Level Review Escalates LUCC Scam Crackdown

- International Manhunt for Key Accused

- Asset Seizure and Multi-Agency Coordination

- Invoking Stringent Laws for Investor Restitution

Click Here To Download the News Attachment

MyFledge Director Flees Abroad in Multi-Crore LUCC Scam; Interpol Red Corner Notice Sought

Uttarakhand Police intensifies its crackdown on the Loni Urban Cooperative Society (LUCC) scam. Key accused, including MyFledge director Shabab Hussain, are suspected to have fled the country, prompting a global manhunt.

Senior police officials are pursuing Interpol Red Corner Notices against the prime accused. This major development was confirmed during a high-level review led by ADG V. Murugeshan.

The ADG Crime and Law and Order chaired a critical video conference on Wednesday. He reviewed seven separate cases filed against LUCC directors for alleged fraud. Murugeshan issued strict directives for a accelerated, multi-agency investigation.

Expedited Investigation and International Manhunt

ADG Murugeshan instructed officials to fast-track all ongoing probes. He emphasized immediate FIR registration based on victim complaints. The focus is on swift and strict legal action against the operators.

Authorities fear key figures have fled or may attempt to escape India. Specific mention was made of Shabab Hussain, a resident of Uttar Pradesh. Look Out Circulars (LOCs) and Interpol Red Corner Notices are now being processed.

This action aims to prevent their escape through international borders. The Uttarakhand Police will formally seek Interpol’s assistance. This coordination is crucial for international legal action and extradition.

Asset Seizure and Multi-Agency Coordination

Police were directed to identify and seize all illegally acquired properties. These assets will be used to recover the lost funds of thousands of investors. The goal is maximum restitution for those affected by the alleged Ponzi scheme.

In a significant move, the ADG ordered close coordination with national agencies. Detailed case reports will be sent to the Enforcement Directorate (ED). The Income Tax Department will also be looped in for a comprehensive financial probe.

Investigators will freeze bank accounts linked to the accused. This action is based on following the complex money trail. The Registrar of Companies (ROC) records will also be scrutinized for evidence.

Invocation of Stringent Financial Laws

The investigation will leverage powerful state and national laws. Cases will be registered under the UPID Act, 2005. The Banning of Unregulated Deposit Schemes (BUDS) Act, 2019 will also be invoked.

These laws provide a strong framework for attaching properties. They are essential for securing the refunds for duped depositors. This legal strategy underscores the seriousness of the crackdown.

Also Read: 10 Bangladeshi Nationals Held with Forged IDs in Navi Mumbai.

The MyFledge Connection: A ₹4.44 Crore Mumbai Fraud

In a related development, a Mumbai court has taken cognizance of a separate fraud case. This case involves MyFledge Pvt. Ltd. and its directors, with damages worth ₹4.44 crore.

The accused directors named are Bishwajit Badal Ghosh, Piyalee Shyamlendu Chatterjee, and Shabab Hussain (aka Shabab Hashim). This directly links the key LUCC accused to another major financial scandal.

The Sprouts News Special Investigation Team (SIT) highlights the interlinked nature of these financial crimes. The pursuit of a Red Corner Notice marks a critical escalation in this multi-state cooperative society scam.

Sprouts News Editorial Note: This report is based on an official police release and court records.

High-Level Review Escalates LUCC Scam Crackdown

In a high-level video conference held on March 2025, Uttarakhand’s ADG Crime, V. Murugeshan, significantly escalated the state’s crackdown on the multi-state LUCC cooperative scam. Reviewing a total of seven registered cases, he issued directives for expedited investigations, the immediate registration of FIRs based on victim complaints, and stringent legal action against all accused.

International Manhunt for Key Accused

Authorities are actively pursuing an international manhunt over concerns that the key accused—including Sameer Agarwal, Pankaj Agarwal, and Shabab Hussain, a director of MyFledge Private Limited—may attempt to flee abroad. To prevent their escape and ensure international legal action, police are processing Look Out Circulars (LOCs) and seeking Interpol Red Corner Notices.

Asset Seizure and Multi-Agency Coordination

The crackdown includes a major financial component, with directives to seize illicit properties and freeze the bank accounts of the accused based on the money trail. Furthermore, the investigation will be a coordinated effort, with detailed reports being shared with central agencies like the Enforcement Directorate (ED) and the Income Tax Department for a comprehensive probe.

Invoking Stringent Laws for Investor Restitution

To strengthen the legal framework and facilitate investor restitution, the probe will leverage powerful financial laws. Cases will be registered under the stringent Uttarakhand Protection of Interests of Depositors (UPID) Act, 2005, and the Banning of Unregulated Deposit Schemes (BUDS) Act, 2019, to formally begin the process of returning funds to the victims.