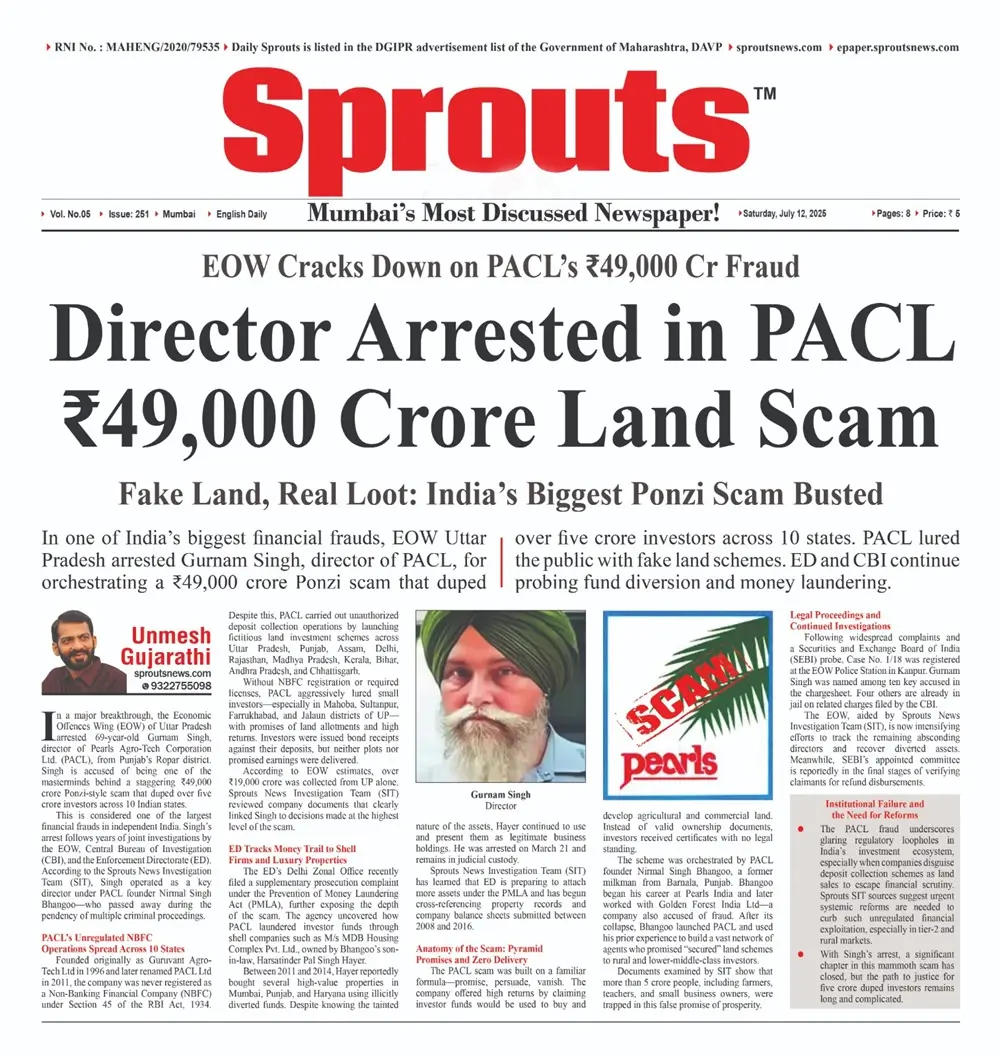

Director Arrested in PACL ₹49,000 Crore Land Scam

• EOW Cracks Down on PACL’s ₹49,000 Cr Fraud

• Fake Land, Real Loot: India’s Biggest Ponzi Scam Busted

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

In one of India’s biggest financial frauds, EOW Uttar Pradesh arrested Gurnam Singh, director of PACL, for orchestrating a ₹49,000 crore Ponzi scam that duped over five crore investors across 10 states. PACL lured the public with fake land schemes. ED and CBI continue probing fund diversion and money laundering.

In a major breakthrough, the Economic Offences Wing (EOW) of Uttar Pradesh arrested 69-year-old Gurnam Singh, director of Pearls Agro-Tech Corporation Ltd. (PACL), from Punjab’s Ropar district. Singh is accused of being one of the masterminds behind a staggering ₹49,000 crore Ponzi-style scam that duped over five crore investors across 10 Indian states.

This is considered one of the largest financial frauds in independent India. Singh’s arrest follows years of joint investigations by the EOW, Central Bureau of Investigation (CBI), and the Enforcement Directorate (ED). According to the Sprouts News Investigation Team (SIT), Singh operated as a key director under PACL founder Nirmal Singh Bhangoo—who passed away during the pendency of multiple criminal proceedings.

Click Here To Download the News Attachment

PACL’s Unregulated NBFC Operations Spread Across 10 States

Founded originally as Guruvant Agro-Tech Ltd in 1996 and later renamed PACL Ltd in 2011, the company was never registered as a Non-Banking Financial Company (NBFC) under Section 45 of the RBI Act, 1934. Despite this, PACL carried out unauthorized deposit collection operations by launching fictitious land investment schemes across Uttar Pradesh, Punjab, Assam, Delhi, Rajasthan, Madhya Pradesh, Kerala, Bihar, Andhra Pradesh, and Chhattisgarh.

Without NBFC registration or required licenses, PACL aggressively lured small investors—especially in Mahoba, Sultanpur, Farrukhabad, and Jalaun districts of UP—with promises of land allotments and high returns. Investors were issued bond receipts against their deposits, but neither plots nor promised earnings were delivered.

According to EOW estimates, over ₹19,000 crore was collected from UP alone. Sprouts News Investigation Team (SIT) reviewed company documents that clearly linked Singh to decisions made at the highest level of the scam.

ED Tracks Money Trail to Shell Firms and Luxury Properties

The ED’s Delhi Zonal Office recently filed a supplementary prosecution complaint under the Prevention of Money Laundering Act (PMLA), further exposing the depth of the scam. The agency uncovered how PACL laundered investor funds through shell companies such as M/s MDB Housing Complex Pvt. Ltd., owned by Bhangoo’s son-in-law, Harsatinder Pal Singh Hayer.

Between 2011 and 2014, Hayer reportedly bought several high-value properties in Mumbai, Punjab, and Haryana using illicitly diverted funds. Despite knowing the tainted nature of the assets, Hayer continued to use and present them as legitimate business holdings. He was arrested on March 21 and remains in judicial custody.

Sprouts News Investigation Team (SIT) has learned that ED is preparing to attach more assets under the PMLA and has begun cross-referencing property records and company balance sheets submitted between 2008 and 2016.

Also Read: D.Y. Patil Medical College Defies SC Fee Order, ₹200 Cr Scam Emerges.

Anatomy of the Scam: Pyramid Promises and Zero Delivery

The PACL scam was built on a familiar formula—promise, persuade, vanish. The company offered high returns by claiming investor funds would be used to buy and develop agricultural and commercial land. Instead of valid ownership documents, investors received certificates with no legal standing.

The scheme was orchestrated by PACL founder Nirmal Singh Bhangoo, a former milkman from Barnala, Punjab. Bhangoo began his career at Pearls India and later worked with Golden Forest India Ltd—a company also accused of fraud. After its collapse, Bhangoo launched PACL and used his prior experience to build a vast network of agents who promised “secured” land schemes to rural and lower-middle-class investors.

Documents examined by SIT show that more than 5 crore people, including farmers, teachers, and small business owners, were trapped in this false promise of prosperity.

Legal Proceedings and Continued Investigations

Following widespread complaints and a Securities and Exchange Board of India (SEBI) probe, Case No. 1/18 was registered at the EOW Police Station in Kanpur. Gurnam Singh was named among ten key accused in the chargesheet. Four others are already in jail on related charges filed by the CBI.

The EOW, aided by Sprouts News Investigation Team (SIT), is now intensifying efforts to track the remaining absconding directors and recover diverted assets. Meanwhile, SEBI’s appointed committee is reportedly in the final stages of verifying claimants for refund disbursements.

Institutional Failure and the Need for Reforms

The PACL fraud underscores glaring regulatory loopholes in India’s investment ecosystem, especially when companies disguise deposit collection schemes as land sales to escape financial scrutiny. Sprouts SIT sources suggest urgent systemic reforms are needed to curb such unregulated financial exploitation, especially in tier-2 and rural markets.

With Singh’s arrest, a significant chapter in this mammoth scam has closed, but the path to justice for five crore duped investors remains long and complicated.

It’s going to be finish of mine day, except before end I am reading this impressive piece of

writing to improve my knowledge.

Really when someone doesn’t know afterward its up to other users that they

will assist, so here it takes place.

IT’S A BIGGEST MONZI SCAM OF THOSE DAYS.

NOTHING WILL HAPPEN.

IT’S ALMOST MORE THAN 10 YEARS, AND STILL THE INVESTIGATION IS GOING ON.

PLENTY OF ARREST WERE MADE AND LATER WERE RELEASE.

ALWAYS THE PEOPLE’S ARE MADE TO SUFFER AND IT’S THE HISTORY SO FAR THAT ( PONZI SCHEME) THE HARD EARNED MONEY WERE NEVER RETURNED BACK TO THE PEOPLE, WHO ARE VICTIMS OF SUCH A SCAM.

When some one searches for his necessary thing, so he/she wishes to be available that in detail, therefore that thing

is maintained over here.