PMLA Action Begins in Karnala Bank Case

• Panvel Land, Sports Academy Face Auction

• Karnala Bank Collapse Hits Depositors Hard

• Scam Tainted Builder Jailed for 4 Years

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

In the ₹500 crore Karnala Bank scam, the ED’s PMLA court has ordered the auction of former MLA Vivek Patil’s 102-acre land and Karnala Sports Academy. The funds will repay defrauded depositors and companies. Patil, jailed since 2019, is accused of large-scale embezzlement and banking fraud.

Karnala Chairman’s Assets Face Liquidation

In a major development in the ₹500 crore Karnala Bank scam, the Enforcement Directorate’s (ED) special PMLA court has ordered the auction of assets belonging to former MLA and Karnala Nagari Sahakari Bank Chairman Vivek Patil. The move aims to recover funds owed to depositors, insurance companies, and financial institutions impacted by the multi-crore financial fraud.

Click Here To Download the News Attachment

Contents

PMLA Action Begins in Karnala Bank Case• Panvel Land, Sports Academy Face Auction• Karnala Bank Collapse Hits Depositors Hard• Scam Tainted Builder Jailed for 4 YearsKarnala Chairman’s Assets Face LiquidationClick Here To Download the News AttachmentED Court Orders Auction of Karnala Sports Academy and 102 Acres in PosariFraud Breakdown: Depositor, Insurer, and Employee Funds EmbezzledKarnala Bank Scam: Timeline and Legal StatusDeeper Systemic Issues: More Than One Bank, One FraudAlso Read: ₹12 Lakh Crore Written Off by PSBs in a Decade: Wilful Defaults Soar, Banks Bleed.What Next? Funds Recovery and AccountabilityKey Facts:

ED Court Orders Auction of Karnala Sports Academy and 102 Acres in Posari

As per official documents reviewed by the Sprouts News Investigation Team (SIT), the court has approved the liquidation of Karnala Sports Academy in Panvel and 102 acres of agricultural land in Posari village, Khalapur Taluka. These properties are part of the 87 assets declared by Vivek Patil, currently in Taloja Jail for the past four years.

The auction is being carried out under the Prevention of Money Laundering Act (PMLA) to return the dues of depositors and financial entities. Posari’s land will be the first to go under the hammer, followed by the prime academy land in Panvel.

Fraud Breakdown: Depositor, Insurer, and Employee Funds Embezzled

According to financial investigation records, the scam involves the misappropriation of ₹500 crore, including:

•₹380 crore owed to a private insurance company

•₹178 crore in fixed deposits and savings accounts of common depositors

•Unpaid dues to employees, Income Tax, and other statutory bodies

The Sprouts SIT has further learned that fake loan approvals, manipulation of bank books, and use of forged documents were some of the techniques allegedly used to siphon off funds.

Karnala Bank Scam: Timeline and Legal Status

The scam, which first came to light in 2019, revealed a systemic misuse of depositors’ money by the management of Karnala Bank. Vivek Patil, who served both as bank chairman and political representative, was arrested and remanded under PMLA provisions. He remains incarcerated at Taloja Central Jail.

Facing mounting pressure from regulators and victims, Patil submitted a plea in PMLA court allowing for the voluntary auction of some of his declared properties to partially compensate affected parties.

Deeper Systemic Issues: More Than One Bank, One Fraud

The Sprouts News Investigation Team (SIT) points to a broader pattern in the cooperative banking sector where similar frauds—ranging from dubious loans to benami transactions—are common. This case mirrors financial irregularities seen in PMC Bank, Seva Vikas Bank, and others across Maharashtra.

Experts say cooperative banks, often run by politically connected individuals, lack rigorous oversight, making them prone to abuse.

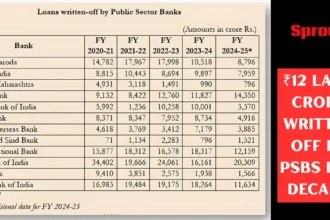

Also Read: ₹12 Lakh Crore Written Off by PSBs in a Decade: Wilful Defaults Soar, Banks Bleed.

What Next? Funds Recovery and Accountability

The ED’s action is seen as a rare move toward accountability in the cooperative banking space. However, legal experts believe the ₹500 crore recovery process is still uncertain, as market conditions and property disputes may delay full fund realization.

Financial regulators, meanwhile, are expected to strengthen audits and bring more cooperative banks under the Reserve Bank of India’s direct supervision.

Key Facts:

•Key Accused: Vivek Patil, ex-MLA, and Chairman of Karnala Bank

•Amount Involved: ₹500 Crore

•Assets to be Auctioned: 102 acres in Posari village and Karnala Sports Academy in Panvel

•Legal Provisions: Prevention of Money Laundering Act (PMLA)

•Current Status: Vivek Patil jailed since 2019 in Taloja Central Prison.