Thane Police have arrested three people for allegedly running a ₹500 crore investment scam that affected more than 11,000 investors. The accused reportedly promised high monthly returns and collected funds from small and middle-income families. Investigators say the scheme worked like a Ponzi model, using new investments to pay earlier investors. The Economic Offences Wing is now tracing money trails and expects more arrests.

- Three Held in Thane for Alleged ₹500 Crore Investment Scam, Over 11,000 Investors Affected

- How the Thane Investment Scam Operated and Why It Raised Red Flags

- Legal Action, Charges Filed, and Ongoing Economic Offences Wing Probe

- Why This ₹500 Crore Scam Matters for Investors and Regulators

- Whistleblower Exposure and Call for Public Support

Three Held in Thane for Alleged ₹500 Crore Investment Scam, Over 11,000 Investors Affected

Thane Police arrested three people for allegedly running a ₹500 crore investment scam that cheated over 11,000 investors. Investigators say the scheme promised high monthly returns, operated like a Ponzi model, and has triggered a probe with more arrests likely.

The ₹500 crore investment scam in Thane has triggered serious concerns across Maharashtra, after police arrested three individuals accused of cheating thousands through a high return investment scheme.

In a major breakthrough, the Thane Police Economic Offences Wing arrested a husband wife duo and their associate for allegedly defrauding more than 11,000 investors over several years.

The accused have been identified as Sameer Subhash Narvekar, his wife Neha Narvekar, and close associate Amit Palaw, according to official police statements released on Friday.

A special EOW team led by Inspector Madhuri Rajekumbhar traced the suspects to Gujarat, where they were arrested and placed on transit remand to Thane.

Investigators believe the arrests mark only the first phase of a wider probe into what appears to be a sophisticated and well coordinated financial fraud network.

Police officials confirmed the alleged scam involved collecting funds from small and middle income families under the promise of assured monthly investment returns.

How the Thane Investment Scam Operated and Why It Raised Red Flags

According to investigators, the accused promoted an investment model promising monthly returns of up to four percent, significantly higher than most regulated financial products.

The firm claimed investor funds were deployed in stock market trading, commodity ventures, and allied financial activities, projecting itself as a professional wealth management operation.

Marketing material allegedly assured investors that the company generated nearly ten percent monthly profits, a claim experts say is unrealistic and unsustainable in regulated markets.

Such assurances, combined with regular early payouts, helped build trust and encouraged investors to reinvest or bring in friends and family members.

Police suspect the scheme followed a classic Ponzi structure, where returns to early investors were funded using fresh deposits from new participants.

Warning signs emerged when company offices across Maharashtra abruptly shut down, phone lines went silent, and senior executives became unreachable.

Thousands of investors reportedly realised the deception only after promised monthly payouts stopped without explanation, leaving families facing sudden financial distress.

Legal Action, Charges Filed, and Ongoing Economic Offences Wing Probe

The Srinagar Police Station in Thane registered a detailed First Information Report following multiple investor complaints and preliminary financial scrutiny by authorities.

Charges have been filed under the Maharashtra Protection of Interest of Depositors Act, 1999, a stringent law designed to protect public savings from fraudulent entities.

Additional sections invoked include 61(2) and 316(5) of the Bharatiya Nyaya Sanhita, 2023, covering criminal breach of trust and large scale financial cheating.

The Economic Offences Wing is currently analysing bank statements, digital payment trails, and shell accounts to trace the complete flow of misappropriated funds.

Officials believe the actual amount siphoned could increase as more victims come forward and undisclosed accounts are uncovered during forensic audits.

Police sources told Sprouts News that further arrests are likely, particularly of agents, promoters, and financial intermediaries who helped expand the scheme’s reach.

Also Read: Megha Engineering Faces Financial Stress as Projects Stall.

Why This ₹500 Crore Scam Matters for Investors and Regulators

Financial experts say this case exposes ongoing gaps in investor awareness, especially among middle class households seeking stable income alternatives.

Unregulated investment schemes continue to exploit trust, financial insecurity, and limited understanding of market risks, particularly during periods of economic uncertainty.

Despite repeated warnings from regulators like SEBI and the Reserve Bank of India, illegal deposit taking entities often operate under misleading corporate structures.

Authorities stress that guaranteed high monthly returns are a major red flag, as legitimate market linked investments cannot promise fixed profits.

The Thane case also underscores the need for stronger local level monitoring, faster complaint redressal, and real time tracking of suspicious fundraising activities.

The Sprouts News Special Investigation Team notes that timely reporting by investors can significantly reduce losses and help authorities intervene before schemes collapse.

Police have urged citizens to verify registration details, regulatory approvals, and audited financial records before investing in any high return offering.

As the investigation deepens, this case is expected to influence stricter enforcement and renewed policy discussions around protecting small investors in Maharashtra.

The unfolding probe serves as a cautionary reminder that financial literacy and due diligence remain the strongest safeguards against investment fraud.

Whistleblower Exposure and Call for Public Support

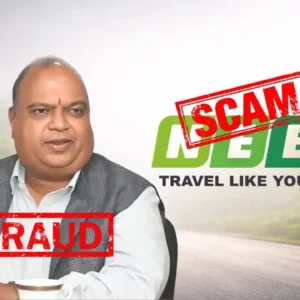

Renowned investigative journalist Unmesh Gujarathi first exposed the alleged scam, bringing it to public attention. He urges citizens to share information on similar frauds, reaffirming that investigations will continue relentlessly until every victim receives justice.