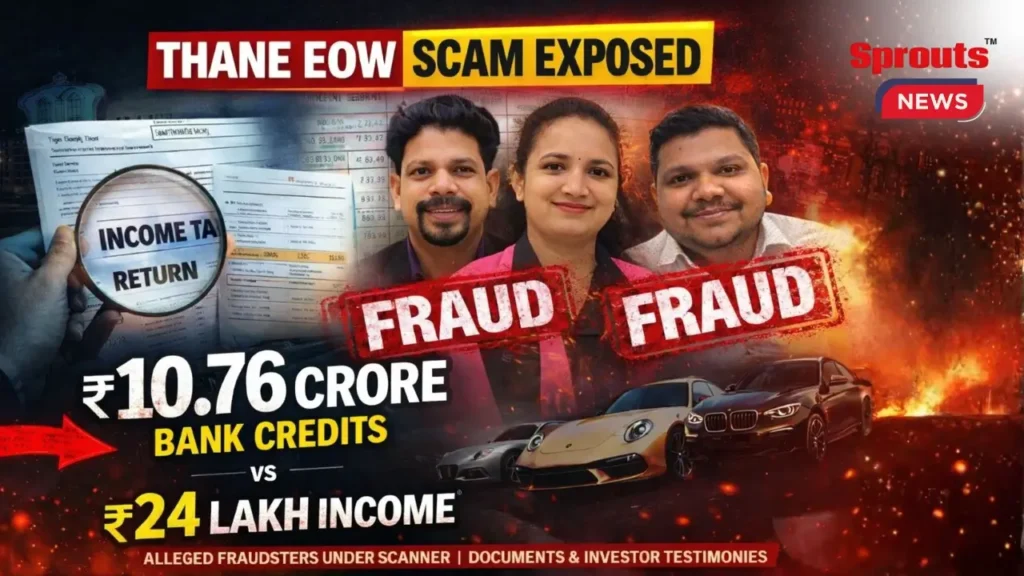

Thane EOW Investment Scam Probe Exposes Income Tax Gaps Linked to Alleged Fraudster Priti Rane Network

Exclusive: Thane EOW is probing an alleged investment and tax evasion scam involving alleged fraudsters Priti Rane and Sachin Rane, after documents revealed major gaps between declared income and bank credits, triggering serious concerns over investor protection and regulatory oversight.

- Thane EOW Investment Scam Probe Exposes Income Tax Gaps Linked to Alleged Fraudster Priti Rane Network

- Declared Income Versus Bank Credits Raise Serious Tax Compliance Questions

- Investment Model, Training Classes, and Alleged Ponzi Structure

- Luxury Assets, Investor Pressure, and Broader Regulatory Implications

The Thane EOW investment scam probe has intensified after documents revealed significant gaps between declared income and bank credits linked to alleged fraudster Priti Rane and alleged fraudster Sachin Rane, raising wider concerns around investor protection and tax compliance.

Financial records reviewed show patterns that investigators say could indicate deliberate understatement of income, routing of funds across multiple accounts, and possible misrepresentation of professional credentials to gain investor confidence.

The case has drawn attention because it combines elements of unregulated financial advice, high return investment promises, and potential misuse of the formal banking system to obscure the true scale of transactions.

Declared Income Versus Bank Credits Raise Serious Tax Compliance Questions

Documents accessed during the investigation show that alleged fraudster Priti Rane declared a total income of ₹24.07 lakh across assessment years 2020–21 to 2022–23 in her income tax filings.

However, bank statements for the same period reflect credits amounting to approximately ₹10.76 crore.

Investigators examined statements from three accounts held with HDFC Bank, G S Mahanagar Bank, and Saraswat Bank, covering transactions between 2019 and 2024.

The HDFC account lists alleged fraudster Sachin Rane as a joint holder, while the remaining two accounts are reportedly held individually by Priti Rane.

For assessment year 2020–21 alone, total credits across these accounts reached ₹8.74 crore, while declared income for that year stood at ₹7 lakh.

In 2021–22, bank credits amounted to ₹1.84 crore against a declared income of ₹11.90 lakh, followed by ₹18.24 lakh in credits during 2022–23, with income declared at ₹5.17 lakh.

Tax experts note that such mismatches typically trigger scrutiny under provisions of the Income Tax Act relating to undisclosed income and unexplained cash credits.

When questioned earlier, Priti Rane reportedly cited GST compliance, a response investigators say does not address income tax obligations, which are assessed independently.

Investment Model, Training Classes, and Alleged Ponzi Structure

According to investor statements recorded by investigators, Priti Rane allegedly enrolled more than 12,000 individuals into online and offline stock market training programmes during the Covid-19 lockdown period.

These programmes were widely promoted through online advertisements, positioning Rane as a market expert and educator, with claims that investors say later proved misleading.

Participants were reportedly encouraged to invest additional funds, lured by assurances of monthly returns ranging between four and five percent.

Funds were allegedly routed through Sagar Karivdekar, a resident of Sindhudurg, who investors say acted as the operational conduit for managing pooled investments.

Money was collected through memorandums of understanding executed on stamp paper, with alleged fraudster Sachin Rane introduced as a mentor guaranteeing fixed monthly returns.

Several investors told investigators they received payouts for only a short period before payments abruptly stopped, a pattern commonly associated with Ponzi style schemes.

By May 2025, most investors had reportedly stopped receiving returns, triggering widespread demands for refunds and formal complaints to law enforcement authorities.

Also Read: Ebiotorium faces consumer scrutiny as complaints mount.

Related News: ₹180 Cr Stock Market Scam: Thane Couple Under EOW Probe.

Luxury Assets, Investor Pressure, and Broader Regulatory Implications

As investor pressure mounted, Priti Rane allegedly informed investors that Karivdekar had absconded with the funds, shifting responsibility away from the core promoters.

One investor later traced Karivdekar’s bungalow in Sindhudurg, where luxury vehicles including a Porsche and a Mercedes Maybach were allegedly parked despite his absence.

Further allegations suggest ownership of a BMW X7 and two Lamborghini Urus vehicles, details now under verification as part of the asset tracing exercise.

On December 2, 2025, alleged fraudster Sachin Rane signed an undertaking with a group of investors acknowledging repayment obligations, reflecting the scale of outstanding claims.

Financial crime experts say the case highlights regulatory gaps in unregistered market education platforms that double as investment collection channels without oversight.

Sprouts News notes that allegations are based on documents, investor testimonies, and preliminary investigative findings, while the accused retain the right to respond before competent authorities.

The outcome of the Thane EOW investigation could influence stricter scrutiny of unregulated stock market training businesses and reinforce coordination between tax authorities and financial crime units nationwide.

Unmesh Gujarathi and the Sprouts News Special Investigation Team have consistently exposed major scams, frauds, and financial irregularities. If you have information related to any scam, you can confidentially contact our team at 9322755098.