UFIOE Strikes Against IDBI Privatization

• IDBI Workers Rise Against Sell-Off

• Strike Erupts Over IDBI Ownership Battle

• Save IDBI: Unions Take a Stand

Unmesh Gujarathi

Sprouts News Exclusive

Contact: +91 9322755098

Sprouts News Exclusive

Contact: +91 9322755098

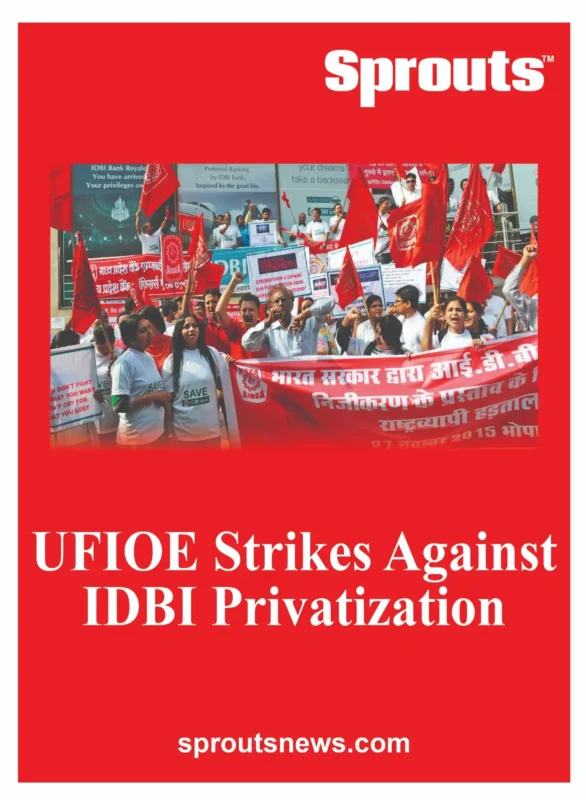

On August 11, 2025, a nationwide strike led by UFIOE opposed IDBI Bank’s privatization. Demands include retaining government and LIC ownership, increasing recruitment, and improving work culture. Union leaders warned that privatization would endanger the interests of farmers, small entrepreneurs, depositors, and employees.

Save IDBI: Unions Take a Stand

Under the banner of the United Forum of IDBI Officers and Employees (UFIOE), members of the All India IDBI Officers’ Association (AIIDBIOA) and All India Industrial Development Bank Employees Association (AIIDBEA) staged a one-day nationwide strike today. The action comes in protest against the proposed privatization of IDBI Bank and other critical demands affecting employees, depositors, and the broader public sector banking ecosystem.

The strike follows a series of demonstrations, including a dharna at Jantar Mantar, Delhi on July 26, 2025, and another at Azad Maidan, Mumbai on August 9, 2025. Support has poured in from across the banking industry under the United Forum of Bank Unions (UFBU), along with solidarity from unions in the insurance and railway sectors.

Click Here To Download the News Attachment

Contents

- UFIOE Strikes Against IDBI Privatization

- • IDBI Workers Rise Against Sell-Off

- • Strike Erupts Over IDBI Ownership Battle

- • Save IDBI: Unions Take a Stand

- Save IDBI: Unions Take a Stand

- Click Here To Download the News Attachment

- Key Demands: Protecting Public Sector Character of IDBI Bank

- Historical Role and Public Sector Legacy

- Financial Performance and Stakeholder Concerns

- Call to Government: Honor Parliamentary Assurances

- Also Read: Murbad’s, Mumbai maternal crisis exposes deadly delays in childbirth.

- Customer Disputes & Operational Complaints

- Cyber Fraud Refund Case

Key Demands: Protecting Public Sector Character of IDBI Bank

The UFIOE, backed by its constituent unions, has outlined nine major demands. The foremost is halting the sale of IDBI Bank to private or foreign investors. Other demands include the recruitment of 5,000 clerks and 2,000 sub-staff, addressing a toxic work culture, introducing a bilateral transfer policy for officers, and reinstating medical and welfare schemes for staff.

Union leaders emphasize that the proposed disinvestment—which would reduce government and LIC holdings in IDBI Bank to minority stakes—threatens the bank’s public sector role. As per the Sprouts News Investigation Team (SIT) review of past parliamentary assurances, the 2003 commitment to maintain a minimum 51% government stake was central to passing the IDBI (Transfer of Undertaking & Repeal) Bill, 2002. Breaking this promise, they argue, could undermine depositor confidence and destabilize the institution’s development-oriented mandate.

Historical Role and Public Sector Legacy

Established in 1964 as a subsidiary of the Reserve Bank of India, IDBI Bank played a pivotal role in financing industrial development, supporting institutions such as SEBI, NSE, NSDL, and SIDBI. The bank has also contributed significantly to government social schemes, with over 18.7 lakh accounts under Pradhan Mantri Jan Dhan Yojana and strong participation in insurance and pension programs.

Following its reclassification as a private sector bank in 2019, some rural and agricultural lending programs were curtailed. UFIOE warns that full privatization would further limit credit access for farmers, small businesses, and students—sectors that rely heavily on public sector banking.

Financial Performance and Stakeholder Concerns

Despite challenges, IDBI Bank has reported profits for five consecutive years, reaching ₹7,515 crore in FY 2024-25. With over 2,100 branches and more than 20,000 employees—including significant representation from SC, ST, OBC, EWS, women, and differently-abled staff—the bank remains a key player in India’s financial inclusion strategy.

However, union leaders highlight risks to depositor safety if government and LIC control is relinquished. As the SIT fact-check notes, deposit insurance caps at ₹5 lakh in the event of a moratorium—far less than the unlimited implicit protection under government ownership. Historical precedents like the PMC Bank and Yes Bank crises underscore these fears.

Call to Government: Honor Parliamentary Assurances

The UFIOE urges the Government of India to immediately halt the strategic sale and restore majority public ownership by acquiring an additional 6% equity. They also call on the RBI to classify IDBI Bank as a public sector bank for regulatory purposes and to reinstate its original development banking role.

As Sprouts News Investigation Team (SIT) concludes in its independent assessment, the proposed privatization could have far-reaching consequences—not only for the bank’s 20,000+ employees but also for millions of depositors and small borrowers across India.

Recent Fraud Investigations and Loan Defaults:

•CID Loan Fraud (₹2.86 Crore): Telangana’s CID arrested a Mumbai-based IDBI bank manager for forging documents under the Kisan Credit Scheme, marking the seventh arrest since the case began in 2021.

•CRB vs. Supertech Real Estate Firm: The CBI filed charges against Supertech Limited and its promoters for allegedly forging documents and colluding with unidentified bank officials to misuse loan funds sanctioned by IDBI Bank.

•Wilful Defaults Pattern: Over 370 accounts defaulted deliberately, with outstanding dues exceeding ₹26,000 crore. Notably, high-profile defaulters (owing ₹250 crore+ each) account for over ₹15,000 crore. Critics argue the failure in recovering these dues has significantly weakened the bank’s financial health.

Also Read: Murbad’s, Mumbai maternal crisis exposes deadly delays in childbirth.

Customer Disputes & Operational Complaints

From discussions on Reddit, several widespread customer grievances have surfaced:

Net banking and mobile app issues:

“Their two apps don’t work… Netbanking doesn’t work… Wall? Stone?”

KYC and account access delays:

“Disabled my internet access… saga has been going on for 3 months now”

Fixed deposit (FD) auto-renewal concerns:

Customers reported FDs renewing automatically despite selecting a different option, creating financial inconvenience and frustration.

Unauthorized Fastag issuance:

A user discovered IDBI issued a Fastag for their car without consent—raising serious privacy and procedural concerns.

Bond redemption delay affecting nominee:

Chandigarh’s Consumer Commission partly ruled in favor of a complainant whose nominee faced delays in redeeming a deep discount bond, ordering a refund with interest plus compensation.

Cash counting dispute:

A customer was contacted after supposedly receiving ₹800 more than issued, despite clear personal verification—prompting accusations of negligence and harassment.

Cyber Fraud Refund Case

In a notable legal development, the Rajasthan High Court directed IDBI Bank to refund ₹58.9 lakh plus 6% interest to a customer defrauded via a cyber attack. The ruling affirmed zero liability for the victim and emphasized the need for stronger mechanisms to protect customers from unauthorized transactions